Schedule K 1 Form 2016

What is the Schedule K-1 Form

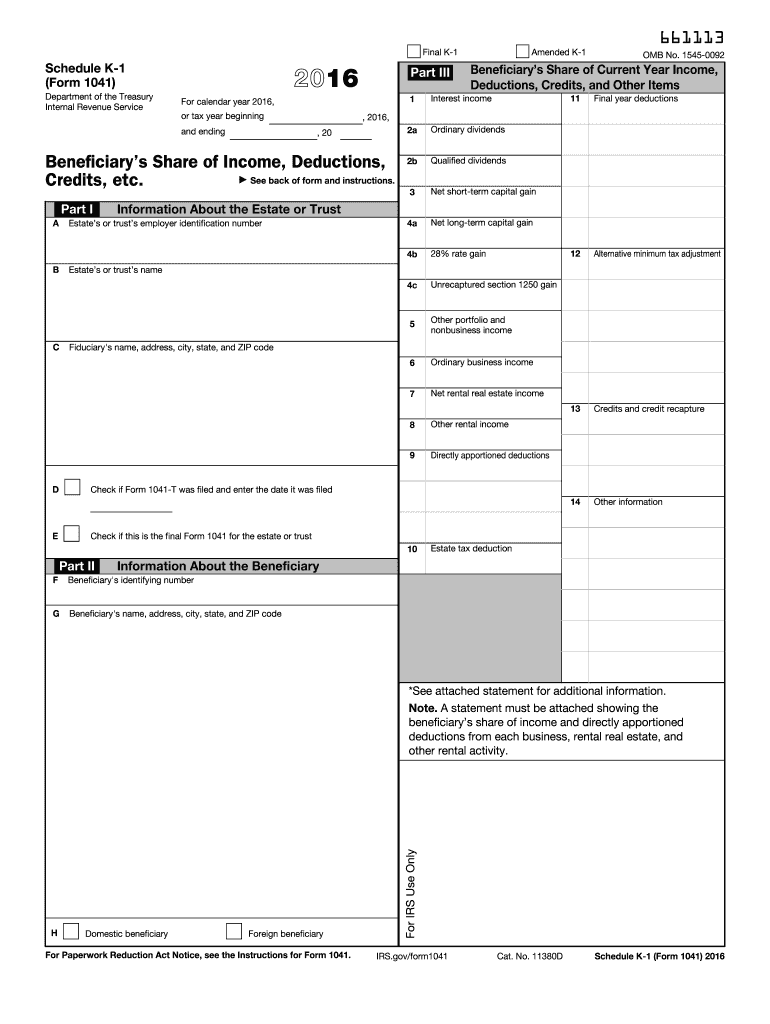

The Schedule K-1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of the entity's income, which is essential for accurate tax reporting. The form is typically issued to each partner or shareholder by the entity, allowing them to report their share of the income on their individual tax returns.

How to use the Schedule K-1 Form

To use the Schedule K-1 Form effectively, recipients should first review the information provided on the form. This includes understanding the types of income reported, such as ordinary business income, rental income, and capital gains. Recipients must then incorporate this information into their personal tax returns, specifically on Form 1040. It is crucial to ensure that all amounts are reported accurately to avoid discrepancies with the IRS.

Steps to complete the Schedule K-1 Form

Completing the Schedule K-1 Form involves several key steps:

- Gather necessary financial information from the partnership or corporation.

- Fill out the identifying information, including the entity's name, address, and tax identification number.

- Report each partner's or shareholder's share of income, deductions, and credits in the appropriate sections of the form.

- Review the form for accuracy and completeness before submission.

Legal use of the Schedule K-1 Form

The Schedule K-1 Form is legally binding when used correctly. It must be filled out accurately and submitted to the IRS along with the entity's tax return. Recipients should retain a copy for their records, as it serves as proof of income and deductions that must be reported on their personal tax returns. Compliance with IRS regulations is essential to avoid penalties and ensure that the form is accepted during audits.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 Form vary based on the type of entity. Typically, partnerships and S corporations must provide K-1s to their partners and shareholders by March 15. This allows recipients adequate time to incorporate the information into their tax returns, which are generally due by April 15. It is important to stay informed about these deadlines to ensure timely compliance with tax obligations.

Who Issues the Form

The Schedule K-1 Form is issued by partnerships, S corporations, estates, and trusts. Each entity is responsible for preparing and distributing the form to its partners or shareholders. This ensures that all income and deductions are reported accurately to the IRS and to the individual taxpayers who need to include this information on their tax returns.

Quick guide on how to complete 2016 schedule k 1 form

Easily Prepare Schedule K 1 Form on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools essential for quickly creating, editing, and electronically signing your documents without delays. Manage Schedule K 1 Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

Effortlessly Modify and eSign Schedule K 1 Form

- Obtain Schedule K 1 Form and click on Get Form to initiate the process.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which is completed in seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information carefully and then press the Done button to save your modifications.

- Choose your delivery method for the form—via email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule K 1 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 schedule k 1 form

Create this form in 5 minutes!

How to create an eSignature for the 2016 schedule k 1 form

How to generate an electronic signature for the 2016 Schedule K 1 Form in the online mode

How to generate an eSignature for your 2016 Schedule K 1 Form in Chrome

How to generate an electronic signature for signing the 2016 Schedule K 1 Form in Gmail

How to generate an electronic signature for the 2016 Schedule K 1 Form right from your smart phone

How to create an electronic signature for the 2016 Schedule K 1 Form on iOS devices

How to make an eSignature for the 2016 Schedule K 1 Form on Android devices

People also ask

-

What is a Schedule K 1 Form?

The Schedule K 1 Form is a tax document used to report income, deductions, and credits for partners in a partnership or shareholders in an S corporation. It is crucial for ensuring accurate tax reporting and compliance. Understanding this form can help you streamline your tax preparation process.

-

How can airSlate SignNow help with the Schedule K 1 Form?

airSlate SignNow allows users to easily create, send, and eSign Schedule K 1 Forms digitally. Our platform simplifies the document workflow, making it faster and more efficient. By using airSlate SignNow, you can ensure that your Schedule K 1 Form is signed and securely stored, enhancing your document management.

-

Is there a cost associated with using airSlate SignNow for Schedule K 1 Forms?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Each plan provides access to features that facilitate the smooth handling of Schedule K 1 Forms. Explore our pricing page to find the best option for your unique requirements.

-

What features does airSlate SignNow offer for managing Schedule K 1 Forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking for Schedule K 1 Forms. These features simplify the entire document management process, ensuring that your forms are completed accurately and efficiently. Additionally, our user-friendly interface enhances your experience.

-

Can I integrate airSlate SignNow with other software for Schedule K 1 Forms?

Yes, airSlate SignNow offers seamless integrations with a variety of software, including CRM and accounting platforms. This capability allows you to manage your Schedule K 1 Forms alongside other business processes. Integrating our solution can signNowly enhance your productivity and data accuracy.

-

How secure is my data when using airSlate SignNow for Schedule K 1 Forms?

Data security is a top priority at airSlate SignNow. We implement advanced encryption and authentication protocols to protect your Schedule K 1 Forms and other documents. You can trust that your sensitive information will remain secure while being shared and stored.

-

What are the benefits of electronic signatures for Schedule K 1 Forms?

Using electronic signatures for your Schedule K 1 Forms streamlines the signing process, saving you time and eliminating the need for physical paperwork. It enhances convenience for all parties involved and improves compliance with regulatory standards. Moreover, it contributes to a greener, paperless workflow.

Get more for Schedule K 1 Form

Find out other Schedule K 1 Form

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast