1120 S Form 2016

What is the 1120 S Form

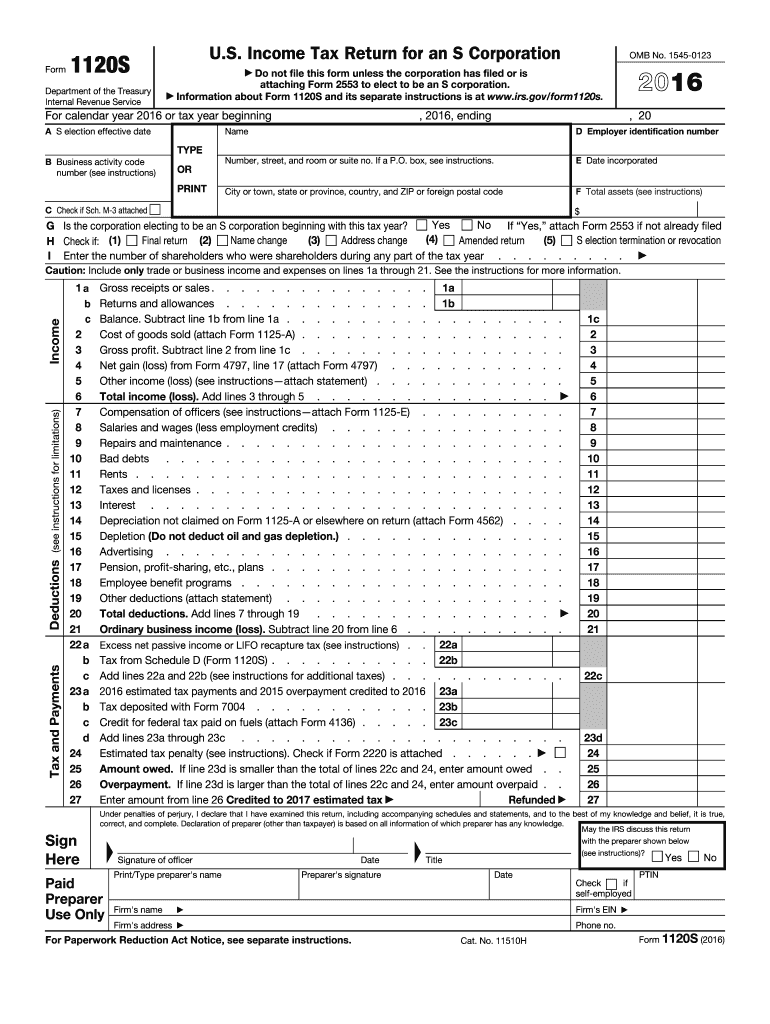

The 1120 S Form is a tax document used by S corporations in the United States to report income, deductions, and credits. This form is essential for S corporations as it allows them to pass income directly to shareholders, avoiding double taxation at the corporate level. The form includes various sections that detail the corporation's financial activities, ensuring compliance with IRS regulations. Understanding the 1120 S Form is crucial for accurate tax reporting and maintaining the benefits associated with S corporation status.

How to use the 1120 S Form

Using the 1120 S Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including income statements, balance sheets, and any relevant deductions. Next, fill out the form by entering the corporation's financial data in the appropriate sections. It's important to review the instructions provided by the IRS to ensure that all information is accurately reported. Once completed, the form can be submitted electronically or by mail, depending on the preference of the corporation and compliance with IRS guidelines.

Steps to complete the 1120 S Form

Completing the 1120 S Form requires attention to detail and adherence to IRS guidelines. Follow these steps for a successful submission:

- Gather all financial documents, including income and expense records.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income in the appropriate section, including gross receipts and any other income sources.

- Detail deductions, including salaries, rent, and other business expenses.

- Calculate the total income and deductions to determine the taxable income.

- Complete the shareholder information section to report each shareholder's share of income.

- Review the form for accuracy and completeness before submission.

Legal use of the 1120 S Form

The 1120 S Form must be used in accordance with IRS regulations to ensure it is legally binding. This includes accurately reporting all income and deductions, as well as ensuring that the form is signed by an authorized officer of the corporation. Compliance with federal tax laws is essential to avoid penalties and maintain the corporation's S status. Utilizing a reliable e-signature solution can enhance the legal validity of the document by ensuring secure and compliant signing processes.

Filing Deadlines / Important Dates

Filing deadlines for the 1120 S Form are crucial for compliance with IRS regulations. Generally, the form must be filed by the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It's important for corporations to be aware of these deadlines to avoid late filing penalties and ensure timely processing of their tax returns.

Form Submission Methods (Online / Mail / In-Person)

The 1120 S Form can be submitted through various methods, providing flexibility for corporations. Electronic filing is encouraged by the IRS, allowing for quicker processing and confirmation of receipt. Corporations can use tax software or authorized e-file providers to submit the form online. Alternatively, the form can be mailed to the appropriate IRS address, which varies based on the corporation's location and whether a payment is included. In-person submission is generally not an option for this form, making electronic and mail submissions the primary methods.

Quick guide on how to complete 1120 s 2016 form

Complete 1120 S Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow offers you all the tools needed to create, modify, and eSign your documents efficiently without delays. Manage 1120 S Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The most efficient way to modify and eSign 1120 S Form effortlessly

- Obtain 1120 S Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign 1120 S Form and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 s 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1120 s 2016 form

How to create an eSignature for the 1120 S 2016 Form in the online mode

How to create an electronic signature for your 1120 S 2016 Form in Chrome

How to make an electronic signature for putting it on the 1120 S 2016 Form in Gmail

How to generate an electronic signature for the 1120 S 2016 Form right from your smart phone

How to generate an eSignature for the 1120 S 2016 Form on iOS devices

How to make an eSignature for the 1120 S 2016 Form on Android

People also ask

-

What is the 1120 S Form used for?

The 1120 S Form is used by S corporations to report income, deductions, and credits to the IRS. This form allows S corporations to pass corporate income, losses, and deductions to shareholders for tax purposes. Understanding how to properly fill out and file the 1120 S Form is crucial for compliance and minimizing tax liabilities.

-

How can airSlate SignNow help with the 1120 S Form?

airSlate SignNow simplifies the process of preparing and signing the 1120 S Form by providing an intuitive platform for eSigning and document management. With features like reusable templates and automated workflows, users can efficiently gather signatures and ensure that the 1120 S Form is completed accurately and on time. This streamlines the filing process, saving you valuable time and resources.

-

What are the pricing options for using airSlate SignNow for the 1120 S Form?

airSlate SignNow offers competitive pricing plans tailored to different business needs, starting with a free trial to explore features. For users specifically dealing with the 1120 S Form, choosing a plan that includes advanced features like bulk sending and team management can enhance efficiency. Detailed pricing information can be found on our website, allowing you to select a plan that fits your budget.

-

Is it secure to eSign the 1120 S Form with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your eSignatures for the 1120 S Form are legally binding and protected. We implement advanced security measures, including encryption and secure cloud storage, to safeguard your documents. Trust us to keep your sensitive information safe while you focus on your business.

-

Can I integrate airSlate SignNow with accounting software for the 1120 S Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to handle the 1120 S Form and related documentation. These integrations allow for smooth data transfer and management, ensuring your tax documents are always up to date and accessible. Check our integrations page for a complete list of compatible software.

-

What features does airSlate SignNow offer for managing the 1120 S Form?

airSlate SignNow provides features like customizable templates, automated reminders, and in-app chat support to enhance the management of the 1120 S Form. These tools help ensure that all parties are kept informed and that signatures are collected promptly. With our user-friendly interface, you can easily track the status of your documents at any time.

-

How long does it take to eSign the 1120 S Form using airSlate SignNow?

Using airSlate SignNow, eSigning the 1120 S Form can take just a few minutes. Our platform streamlines the process, allowing you to send the form for signatures and receive completed documents quickly. This efficiency helps ensure that you meet filing deadlines without unnecessary delays.

Get more for 1120 S Form

- Hud 9548 form

- Temporary guardianship 45a 622 pc 504 form

- Nycha employment application pdf form

- Durable medical equipment and medical supplies general prescription and medical necessity review form durable medical equipment

- Form 900 2011

- Swp application form reliance mutual fund

- Sample certification for importation in the dominican republic form

- Va hospital discharge papers form

Find out other 1120 S Form

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple