Form 8863 2013

What is the Form 8863

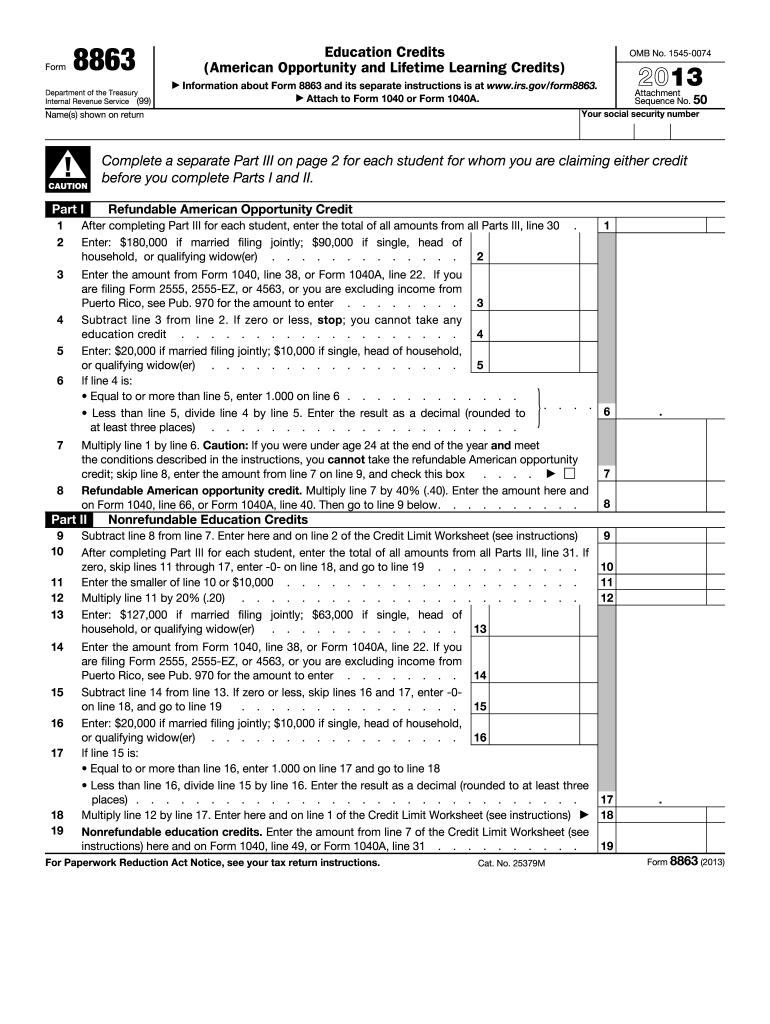

The Form 8863 is a tax form used by eligible taxpayers in the United States to claim education credits. Specifically, it is designed for the American Opportunity Credit and the Lifetime Learning Credit. These credits can help offset the costs of higher education by reducing the amount of tax owed. Understanding this form is crucial for students and their families looking to benefit from available educational tax incentives.

How to use the Form 8863

Using the Form 8863 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your educational expenses, the number of qualifying students, and their respective Social Security numbers. Next, fill out the form by providing details regarding the credits you are claiming. Finally, attach the completed form to your tax return, whether you are filing electronically or via mail.

Steps to complete the Form 8863

Completing the Form 8863 requires careful attention to detail. Start by entering your personal information, including your name and taxpayer identification number. Then, specify the educational institution attended and the qualified expenses incurred. Calculate the amount of credit you are eligible for based on the provided instructions. After verifying all entries for accuracy, sign and date the form before filing it with your tax return.

Legal use of the Form 8863

The legal use of the Form 8863 is governed by IRS regulations. To ensure compliance, taxpayers must meet specific eligibility criteria, such as income limits and enrollment status. Additionally, it is essential to maintain documentation of all educational expenses claimed, as the IRS may request proof during audits. Proper use of the form helps avoid penalties and ensures that taxpayers receive the credits they are entitled to.

Eligibility Criteria

To qualify for the education credits claimed on Form 8863, taxpayers must meet certain eligibility criteria. The student must be enrolled at least half-time in a degree or certificate program at an eligible institution. Additionally, the taxpayer’s modified adjusted gross income must fall below specified thresholds. It is also important to note that the credits are available for a limited number of years, so understanding these criteria is vital for maximizing benefits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8863 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines that may occur due to legislative updates or IRS announcements, ensuring timely submission to avoid penalties.

Required Documents

When completing the Form 8863, certain documents are required to support the claims made. Taxpayers should have records of tuition payments, receipts for educational expenses, and Form 1098-T, which is issued by educational institutions. Additionally, it is advisable to keep any correspondence related to the credits, as this documentation may be necessary for verification purposes during an audit.

Quick guide on how to complete form 8863 2013

Effortlessly prepare Form 8863 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 8863 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to edit and eSign Form 8863 with ease

- Find Form 8863 and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8863 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8863 2013

Create this form in 5 minutes!

How to create an eSignature for the form 8863 2013

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 8863 and why do I need it?

Form 8863 is used to claim education credits for eligible students, allowing you to reduce your tax liability. By utilizing Form 8863, you can access signNow financial benefits that can alleviate the cost of education. It's essential for taxpayers seeking to maximize their education-related tax credits.

-

How can airSlate SignNow help me complete Form 8863?

airSlate SignNow offers an intuitive platform that allows you to easily fill out and eSign Form 8863. With its user-friendly interface, you can ensure that all information is accurately entered and securely submitted. This streamlines the process of claiming your education credits without the hassle of traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8863?

Yes, airSlate SignNow provides various pricing plans that cater to different needs, including options for individuals and businesses. The cost is typically affordable, especially considering the time and hassle saved when completing Form 8863. You can choose a plan that offers the best value based on your frequency of use and required features.

-

What features does airSlate SignNow offer for completing Form 8863?

airSlate SignNow offers features like document templates, electronic signatures, and secure cloud storage, all of which simplify the process of managing Form 8863. You can easily create, edit, and send your tax forms from any device. This ensures that your Form 8863 is completed accurately and efficiently.

-

Does airSlate SignNow integrate with tax software for Form 8863?

Yes, airSlate SignNow can integrate with various tax software solutions, making it easier to manage Form 8863 alongside your other tax documents. This integration helps you maintain all your financial records in one place, simplifying your tax filing process. You can seamlessly transfer data between platforms, ensuring accuracy and efficiency.

-

Can I track the status of my Form 8863 using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your documents, including Form 8863. You’ll receive notifications when your form is viewed, signed, or completed, giving you peace of mind knowing where your document stands in the process.

-

What are the benefits of using airSlate SignNow for Form 8863?

Using airSlate SignNow for Form 8863 offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. You can complete your form from anywhere, at any time, which saves you valuable time during tax season. Additionally, electronic signatures ensure that your form is legally binding and secure.

Get more for Form 8863

- Pdf aor 102 xavier university form

- The lincoln national life insurance company at one of the following form

- Please forward this cover sheet with your completed evidence form

- Pdf proceedings of the 13th hokkaido indonesian student form

- Uncw university housing agreement residence halls and form

- Bi mart online form

- 2018 form 941

- Client affidavit for self employed examinees d17 american concrete form

Find out other Form 8863

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple