Form 8863 2014

What is the Form 8863

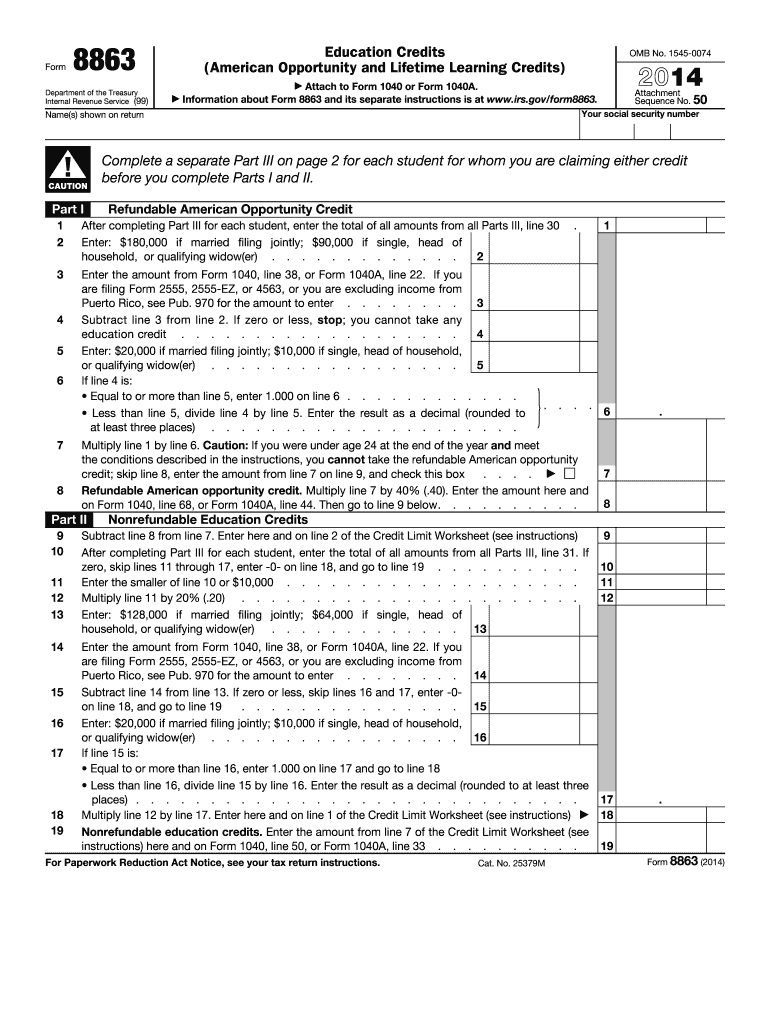

The Form 8863, also known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is utilized by taxpayers in the United States to claim education-related tax credits. These credits can significantly reduce the amount of tax owed, making higher education more affordable. The American Opportunity Credit allows eligible students to receive a credit for qualified education expenses for the first four years of higher education, while the Lifetime Learning Credit is available for any post-secondary education and can be claimed for an unlimited number of years. Understanding the details and requirements of Form 8863 is essential for maximizing tax benefits related to education.

How to use the Form 8863

To effectively use Form 8863, taxpayers must first determine their eligibility for either the American Opportunity Credit or the Lifetime Learning Credit. This involves gathering necessary information about the student, such as enrollment status, qualified expenses, and the institution attended. After confirming eligibility, taxpayers should accurately complete the form by providing the required details and calculating the credits based on the instructions provided by the IRS. It is important to attach Form 8863 to the taxpayer's federal income tax return to ensure the credits are claimed correctly.

Steps to complete the Form 8863

Completing Form 8863 involves several steps:

- Gather necessary documents, including Form 1098-T, which reports tuition payments, and receipts for qualified expenses.

- Determine eligibility for the American Opportunity or Lifetime Learning Credit based on the student's enrollment status and expenses.

- Fill out the personal information section, including the taxpayer's name, Social Security number, and details about the student.

- Calculate the credits by following the worksheet provided in the form's instructions, ensuring all figures are accurate.

- Sign and date the form before submitting it with the federal income tax return.

Legal use of the Form 8863

Form 8863 is legally binding when completed accurately and submitted according to IRS guidelines. To ensure its legal standing, taxpayers must provide truthful information and retain supporting documentation, such as receipts and tax forms, in case of an audit. The form must be filed in conjunction with the taxpayer's federal income tax return, and any discrepancies or fraudulent claims can lead to penalties, including fines or disqualification from future credits.

Eligibility Criteria

Eligibility for the education credits claimed on Form 8863 depends on several factors:

- The student must be enrolled at least half-time in a qualified educational institution.

- The taxpayer must have a modified adjusted gross income (MAGI) below specified limits.

- Qualified education expenses must be incurred for tuition, fees, and course materials.

- Students must not have felony drug convictions that affect eligibility for federal student aid.

Filing Deadlines / Important Dates

Form 8863 must be filed by the tax return deadline, which is typically April 15 of each year. If taxpayers require additional time, they can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is important to keep track of any changes in deadlines, especially for tax years that may have unique circumstances or extensions announced by the IRS.

Quick guide on how to complete form 8863 2014

Effortlessly prepare Form 8863 on any gadget

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Form 8863 on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form 8863 effortlessly

- Locate Form 8863 and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to secure your modifications.

- Choose your preferred method of delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from your device of choice. Alter and eSign Form 8863 to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8863 2014

Create this form in 5 minutes!

How to create an eSignature for the form 8863 2014

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is Form 8863 and why is it important?

Form 8863 is a tax form used to claim education credits, specifically the American Opportunity and Lifetime Learning credits. It is important for taxpayers who qualify for these credits as it can signNowly reduce their tax liability. Completing Form 8863 accurately ensures you maximize your potential tax refunds.

-

How can airSlate SignNow help with completing Form 8863?

airSlate SignNow offers an easy-to-use platform for eSigning and sending documents, including Form 8863. With its user-friendly interface, you can conveniently fill out, sign, and share the form electronically, streamlining the process. Plus, our integration capabilities mean you can connect to other software for enhanced productivity.

-

What are the pricing options for airSlate SignNow when using it for Form 8863?

airSlate SignNow offers competitive pricing plans, which cater to various needs whether you're an individual taxpayer or a business. The plans include features like unlimited document signing and secure storage, making it cost-effective for anyone needing to submit Form 8863. You can choose a plan that fits your usage frequency and budget.

-

Is airSlate SignNow secure for sending sensitive documents like Form 8863?

Yes, airSlate SignNow prioritizes security with advanced encryption protocols to protect all sensitive documents, including Form 8863. Our platform is compliant with industry standards to ensure your data and signatures remain confidential and secure. You can trust us to handle your financial documents safely.

-

What features does airSlate SignNow offer that are beneficial for handling Form 8863?

airSlate SignNow provides a range of features including document templates, automated reminders, and secure eSigning specifically designed to facilitate forms like Form 8863. These features can help streamline your tax filing process, ensuring you never miss an important deadline. User-friendly interfaces assist in reducing the time spent on paperwork.

-

Can I integrate airSlate SignNow with other applications when managing Form 8863?

Absolutely, airSlate SignNow supports seamless integrations with various applications, including popular tax software. This integration allows for efficient transfer of data required for Form 8863, making the whole process faster and reducing the likelihood of errors. Streamlining your workflow has never been easier!

-

What benefits does using airSlate SignNow provide for small businesses handling Form 8863?

Using airSlate SignNow can greatly benefit small businesses handling Form 8863 by minimizing paperwork and enhancing efficiency. The platform allows for easy document sharing and collaboration, making it easier to manage tax documents with clients. This not only saves time but also helps in maintaining accurate records throughout the tax filing process.

Get more for Form 8863

- Lc general filing instructions form

- Iht404 jointly owned assets use this form with form iht400 to give details of all uk assets the deceased owned jointly with

- There you can also stay up to date on your form

- Account representative lottery free related pdf documents form

- Application for certificate of eligiblilty form

- Change of resident agent name form

- License application requirements information city of chicago

- If the name does not contain the required words or abbreviation pursuant to section 204 of the form

Find out other Form 8863

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself