Form 8863 Education Credits American Opportunity and Lifetime Learning Credits 2023

Understanding Form 8863: Education Credits

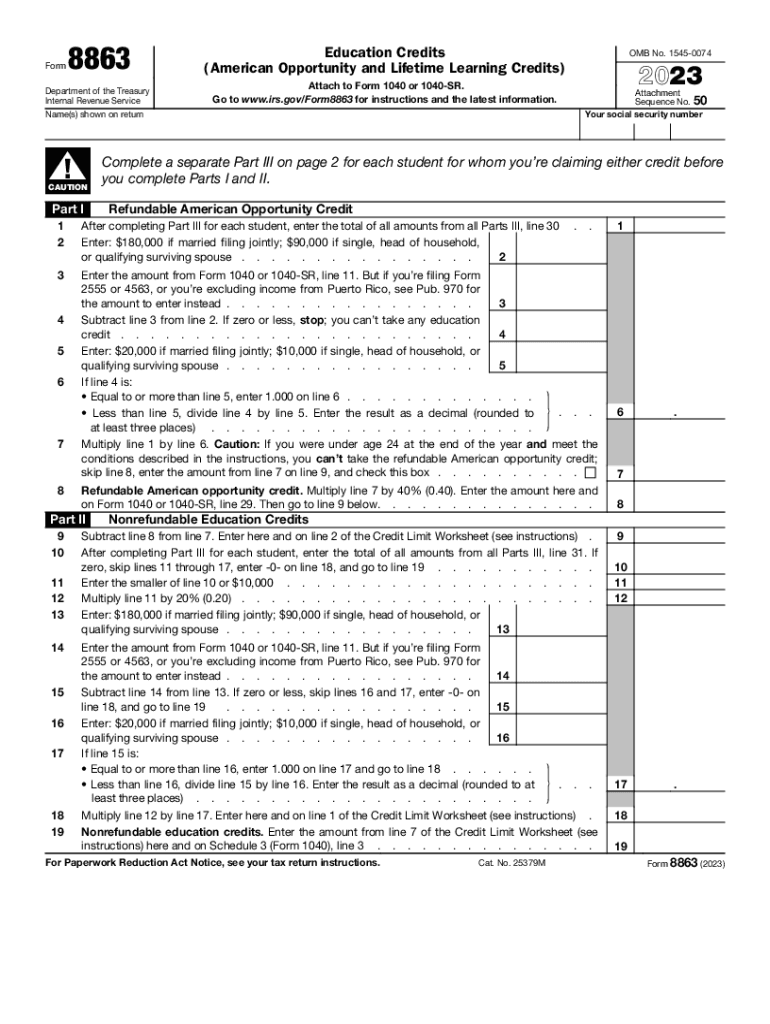

The Form 8863 is essential for claiming education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit. These credits help offset the costs of higher education by reducing the amount of tax owed. The American Opportunity Credit can provide up to two thousand five hundred dollars per eligible student for the first four years of higher education. The Lifetime Learning Credit offers a credit of up to two thousand dollars per tax return for qualified tuition and related expenses for students enrolled in eligible educational institutions.

Steps to Complete Form 8863

Completing Form 8863 involves several steps to ensure accuracy and compliance with IRS regulations. Begin by gathering necessary information, including the student’s name, Social Security number, and the educational institution's details. Next, determine eligibility for the credits by reviewing the requirements for both the American Opportunity and Lifetime Learning Credits. Fill out the form by following the instructions provided, ensuring all calculations are correct. Finally, attach the completed form to your tax return when filing.

Eligibility Criteria for Education Credits

Eligibility for the education credits on Form 8863 is based on several factors. To qualify for the American Opportunity Credit, the student must be enrolled at least half-time in a degree or certificate program and must not have completed four years of post-secondary education before the tax year. For the Lifetime Learning Credit, the student must be enrolled in an eligible institution and can claim the credit for any number of years. Additionally, income limits apply, which may reduce the credits or eliminate eligibility altogether.

Filing Deadlines for Tax Year 2022

For tax filing 2022, the deadline to submit Form 8863 is typically April 15 of the following year, unless an extension is filed. It is important to be aware of any changes in deadlines or specific state requirements that may affect the filing process. Keeping track of these dates ensures that taxpayers can claim their credits without facing penalties or missing out on potential savings.

Obtaining Form 8863

Form 8863 can be obtained directly from the IRS website or through tax preparation software. It is also available at various tax assistance centers. Taxpayers should ensure they are using the correct version of the form for the tax year in question, as forms may change from year to year. Accessing the most current version helps avoid errors during the filing process.

IRS Guidelines for Form 8863

The IRS provides specific guidelines for completing and submitting Form 8863. Taxpayers should refer to IRS Publication 970, which covers tax benefits for education, including detailed instructions for filling out Form 8863. Following these guidelines is crucial for ensuring compliance and maximizing eligible credits. Additionally, taxpayers should keep records of all educational expenses in case of an audit.

Quick guide on how to complete form 8863 education credits american opportunity and lifetime learning credits

Manage Form 8863 Education Credits American Opportunity And Lifetime Learning Credits seamlessly on any device

Online document organization has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form 8863 Education Credits American Opportunity And Lifetime Learning Credits on any device with airSlate SignNow Android or iOS applications and simplify any document-driven task today.

How to modify and eSign Form 8863 Education Credits American Opportunity And Lifetime Learning Credits effortlessly

- Locate Form 8863 Education Credits American Opportunity And Lifetime Learning Credits and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Form 8863 Education Credits American Opportunity And Lifetime Learning Credits to ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8863 education credits american opportunity and lifetime learning credits

Create this form in 5 minutes!

How to create an eSignature for the form 8863 education credits american opportunity and lifetime learning credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for tax filing 2022?

airSlate SignNow provides features like eSignature, document templates, and form automation that streamline the tax filing 2022 process. These tools help ensure that your documents are completed correctly and submitted on time, minimizing the stress associated with tax preparation.

-

How can airSlate SignNow help me with my tax filing 2022?

Using airSlate SignNow for tax filing 2022 can simplify the way you manage documents. The platform allows you to send, sign, and store necessary tax documents securely, ensuring that your information is always accessible and organized for timely filing.

-

Is airSlate SignNow affordable for small businesses handling tax filing 2022?

Yes, airSlate SignNow is designed to be cost-effective, making it an excellent choice for small businesses tackling tax filing 2022. With a range of pricing plans available, you can select one that fits your budget while still accessing essential features to assist with tax preparation.

-

What integrations does airSlate SignNow have for tax filing 2022?

airSlate SignNow seamlessly integrates with popular software solutions like Google Drive, Dropbox, and QuickBooks. These integrations enhance your efficiency and organization when managing documents related to tax filing 2022, allowing you to streamline your workflow.

-

Can I use airSlate SignNow for remote tax filing 2022?

Absolutely! airSlate SignNow is cloud-based, allowing you to manage your tax filing 2022 from anywhere, at any time. This flexibility is perfect for remote teams or individuals who need to collaborate on documents regardless of their physical location.

-

Are there any security features with airSlate SignNow for tax filing 2022?

Yes, airSlate SignNow prioritizes your security with industry-standard encryption and secure data storage. This means your sensitive information related to tax filing 2022 is well-protected against unauthorized access, giving you peace of mind while managing your documents.

-

What types of documents can I electronically sign for tax filing 2022?

You can electronically sign a variety of documents with airSlate SignNow for tax filing 2022, including tax returns, W-2s, and other IRS forms. The platform allows you to easily prepare, send, and track these documents, ensuring nothing is overlooked during the filing process.

Get more for Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

- Last will and testament for other persons maine form

- Notice to beneficiaries of being named in will maine form

- Estate planning questionnaire and worksheets maine form

- Document locator and personal information package including burial information form maine

- Demand to produce copy of will from heir to executor or person in possession of will maine form

- Michigan complaint divorce form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497311187 form

- Bill of sale of automobile and odometer statement michigan form

Find out other Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer