Form 8863 2015

What is Form 8863

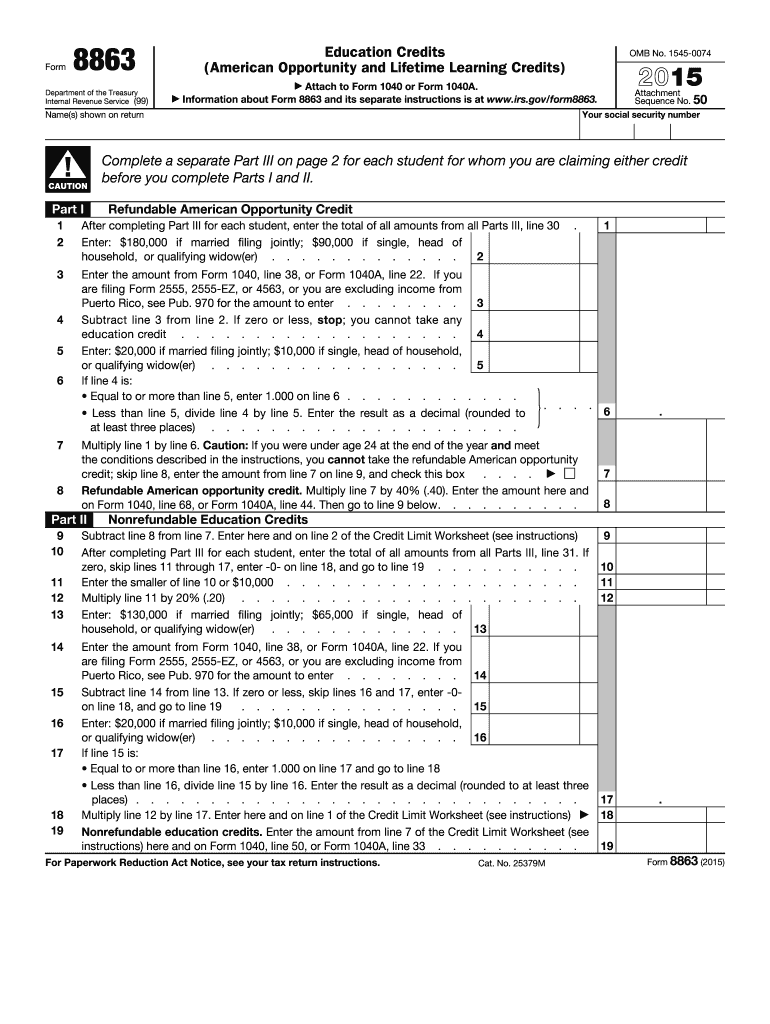

Form 8863 is a tax form used by eligible taxpayers in the United States to claim education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit. These credits can significantly reduce the amount of tax owed, making education more affordable for students and their families. The form requires detailed information about qualified education expenses, the student’s enrollment status, and the taxpayer's income level to determine eligibility for these credits.

How to use Form 8863

To use Form 8863, taxpayers must first determine their eligibility for the education credits. This involves reviewing the requirements for both the American Opportunity Credit and the Lifetime Learning Credit. Once eligibility is established, taxpayers should gather all necessary documentation, including Form 1098-T, which reports tuition payments. The completed form is then included with the taxpayer's federal income tax return, either electronically or via mail.

Steps to complete Form 8863

Completing Form 8863 involves several key steps:

- Gather required documents, such as Form 1098-T and records of qualified expenses.

- Fill out the personal information section, including the taxpayer's name, Social Security number, and filing status.

- Complete Part I for the American Opportunity Credit or Part II for the Lifetime Learning Credit, providing details about the student and qualified expenses.

- Calculate the credit amount based on the information provided.

- Transfer the credit amount to the appropriate line on the federal tax return.

Legal use of Form 8863

Form 8863 is legally binding when completed accurately and submitted according to IRS guidelines. To ensure compliance, taxpayers must adhere to the eligibility criteria for the education credits and maintain proper documentation. The form must be signed and dated, and any electronic submissions must comply with eSignature regulations. Using a reliable eSigning solution can enhance the legal validity of the submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for Form 8863 to avoid penalties. Typically, the deadline for submitting federal tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should consider any extensions they may need to file their returns, which can provide extra time for completing Form 8863.

Eligibility Criteria

To qualify for the credits claimed on Form 8863, taxpayers must meet specific eligibility criteria. For the American Opportunity Credit, the student must be enrolled at least half-time in a degree or certificate program and have not completed four years of post-secondary education. The Lifetime Learning Credit is available for any post-secondary education course and does not have a limit on the number of years it can be claimed. Income limits also apply, affecting the credit amount available.

Quick guide on how to complete 2015 form 8863

Effortlessly Prepare Form 8863 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Form 8863 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form 8863 with Ease

- Find Form 8863 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and then click the Done button to save your revisions.

- Decide how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Form 8863 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 8863

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 8863

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 8863 and why do I need it?

Form 8863 is used to claim education credits for eligible students, allowing you to reduce your tax liability. By utilizing Form 8863, you can access signNow financial benefits that can alleviate the cost of education. It's essential for taxpayers seeking to maximize their education-related tax credits.

-

How can airSlate SignNow help me complete Form 8863?

airSlate SignNow offers an intuitive platform that allows you to easily fill out and eSign Form 8863. With its user-friendly interface, you can ensure that all information is accurately entered and securely submitted. This streamlines the process of claiming your education credits without the hassle of traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8863?

Yes, airSlate SignNow provides various pricing plans that cater to different needs, including options for individuals and businesses. The cost is typically affordable, especially considering the time and hassle saved when completing Form 8863. You can choose a plan that offers the best value based on your frequency of use and required features.

-

What features does airSlate SignNow offer for completing Form 8863?

airSlate SignNow offers features like document templates, electronic signatures, and secure cloud storage, all of which simplify the process of managing Form 8863. You can easily create, edit, and send your tax forms from any device. This ensures that your Form 8863 is completed accurately and efficiently.

-

Does airSlate SignNow integrate with tax software for Form 8863?

Yes, airSlate SignNow can integrate with various tax software solutions, making it easier to manage Form 8863 alongside your other tax documents. This integration helps you maintain all your financial records in one place, simplifying your tax filing process. You can seamlessly transfer data between platforms, ensuring accuracy and efficiency.

-

Can I track the status of my Form 8863 using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your documents, including Form 8863. You’ll receive notifications when your form is viewed, signed, or completed, giving you peace of mind knowing where your document stands in the process.

-

What are the benefits of using airSlate SignNow for Form 8863?

Using airSlate SignNow for Form 8863 offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. You can complete your form from anywhere, at any time, which saves you valuable time during tax season. Additionally, electronic signatures ensure that your form is legally binding and secure.

Get more for Form 8863

Find out other Form 8863

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors