PDF Form 8863, Education Credits American Opportunity and IRS Gov 2020

What is the IRS Form 8863?

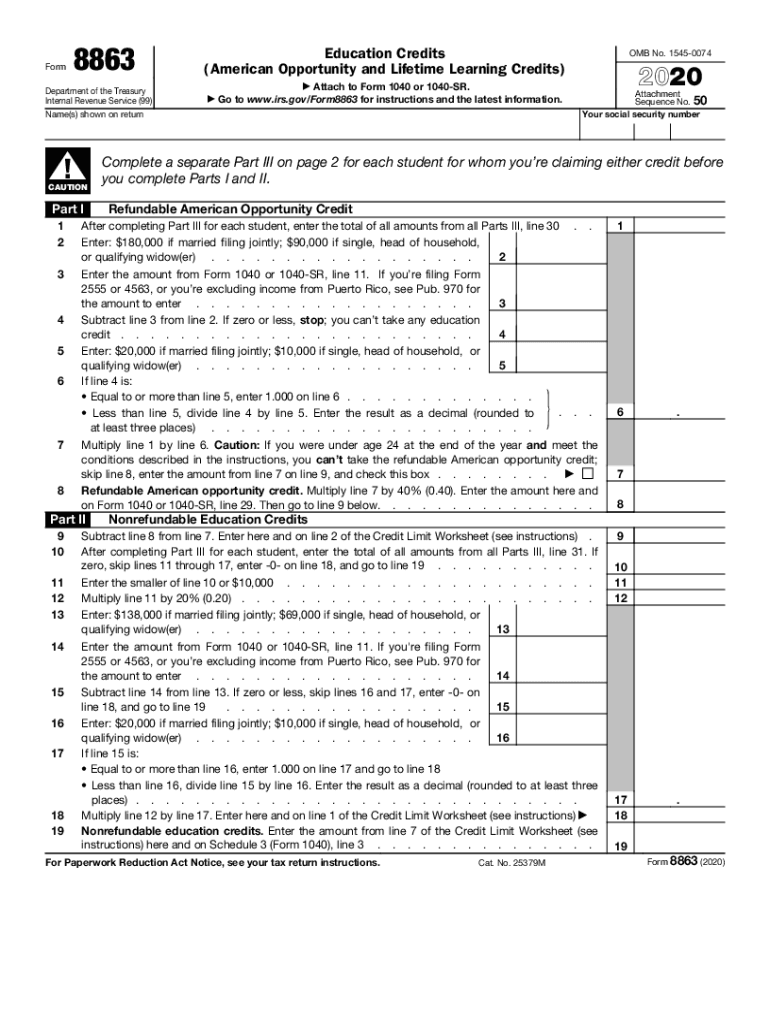

The IRS Form 8863 is used to claim education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit. These credits can help offset the costs of higher education by reducing the amount of tax owed. The American Opportunity Credit is available for eligible students for the first four years of higher education, while the Lifetime Learning Credit can be claimed for any post-secondary education and courses to acquire or improve job skills.

How to Use the IRS Form 8863

To use the IRS Form 8863, taxpayers must first determine their eligibility for the education credits. This involves gathering information about qualified education expenses, such as tuition and fees paid for higher education. Once eligibility is established, the form can be filled out, detailing the amounts spent on education and the credits being claimed. It is essential to attach this form to the federal tax return when filing, whether online or via mail.

Steps to Complete the IRS Form 8863

Completing the IRS Form 8863 involves several key steps:

- Gather necessary documentation, including Form 1098-T, which reports tuition payments.

- Fill out Part I for the American Opportunity Credit or Part II for the Lifetime Learning Credit.

- Calculate the credits based on qualified expenses and enter the amounts on the form.

- Ensure all information is accurate and complete before submitting the form with your tax return.

Eligibility Criteria for IRS Form 8863

To qualify for the education credits claimed on IRS Form 8863, taxpayers must meet specific eligibility criteria. For the American Opportunity Credit, the student must be enrolled at least half-time in a degree or certificate program and not have completed four years of post-secondary education before the tax year. The Lifetime Learning Credit is available for any post-secondary education course but does not have the same enrollment requirements. Additionally, income limits apply, which may reduce or eliminate the credits for higher-income taxpayers.

Legal Use of the IRS Form 8863

The IRS Form 8863 is legally recognized when filled out correctly and submitted according to IRS guidelines. It is essential to maintain accurate records of all education expenses and ensure that the information reported on the form is truthful and complete. Misrepresenting information on this form can lead to penalties and interest on unpaid taxes, making compliance with IRS regulations critical.

Form Submission Methods

Taxpayers can submit the IRS Form 8863 in several ways. The form can be filed electronically along with the federal tax return using tax preparation software, which often simplifies the process. Alternatively, it can be printed, completed, and mailed to the appropriate IRS address. Filing electronically is generally faster and may provide quicker processing times for refunds.

Quick guide on how to complete pdf form 8863 education credits american opportunity and irsgov

Prepare PDF Form 8863, Education Credits American Opportunity And IRS gov effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle PDF Form 8863, Education Credits American Opportunity And IRS gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign PDF Form 8863, Education Credits American Opportunity And IRS gov with ease

- Obtain PDF Form 8863, Education Credits American Opportunity And IRS gov and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that functionality.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow accommodates all your needs in document management within just a few clicks from any device of your choice. Alter and electronically sign PDF Form 8863, Education Credits American Opportunity And IRS gov to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form 8863 education credits american opportunity and irsgov

Create this form in 5 minutes!

How to create an eSignature for the pdf form 8863 education credits american opportunity and irsgov

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What are IRS gov tax forms, and how can airSlate SignNow help with them?

IRS gov tax forms are official documents required by the Internal Revenue Service for tax reporting purposes. airSlate SignNow simplifies the process of signing and sending these forms electronically, making it easier for businesses to stay compliant with tax regulations.

-

How does airSlate SignNow ensure the security of my IRS gov tax forms?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your IRS gov tax forms and sensitive information, ensuring that your documents are safe from unauthorized access.

-

Is airSlate SignNow suitable for small businesses needing to file IRS gov tax forms?

Absolutely! airSlate SignNow offers an affordable solution perfect for small businesses. With features tailored to streamline the management of IRS gov tax forms, small businesses can manage their tax documentation efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other software tools for IRS gov tax forms?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow when handling IRS gov tax forms. Popular integrations include CRM systems, accounting software, and more, enhancing productivity and collaboration.

-

What features does airSlate SignNow offer for managing IRS gov tax forms?

airSlate SignNow provides features such as customizable templates, automated reminders, and tracking capabilities specifically for IRS gov tax forms. These features help ensure timely submissions and reduce the risk of errors in your tax documentation.

-

How can I get started with airSlate SignNow for my IRS gov tax forms?

Getting started is easy! Simply visit our website, choose a plan that suits your needs, and create an account. Within minutes, you can begin managing your IRS gov tax forms electronically with our user-friendly platform.

-

What are the benefits of using airSlate SignNow for IRS gov tax forms compared to traditional methods?

Using airSlate SignNow to manage IRS gov tax forms offers signNow benefits over traditional methods, such as reduced paperwork, faster processing times, and increased accuracy. Electronic signature capabilities also streamline approval processes, saving you valuable time.

Get more for PDF Form 8863, Education Credits American Opportunity And IRS gov

- Printable photo booth contract form

- North carolina service animal verification form

- Westside regional center intake application form

- Af oc 01pdf form

- Accuro forms

- Equine surgery consent form warwick vet clinic

- Letterman jacket order form

- Pdf cpd 31509pdf chicago police department directives system form

Find out other PDF Form 8863, Education Credits American Opportunity And IRS gov

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document