Department of the Treasury Attachment G Attach to Form 2021

What is the Department of the Treasury Attachment G?

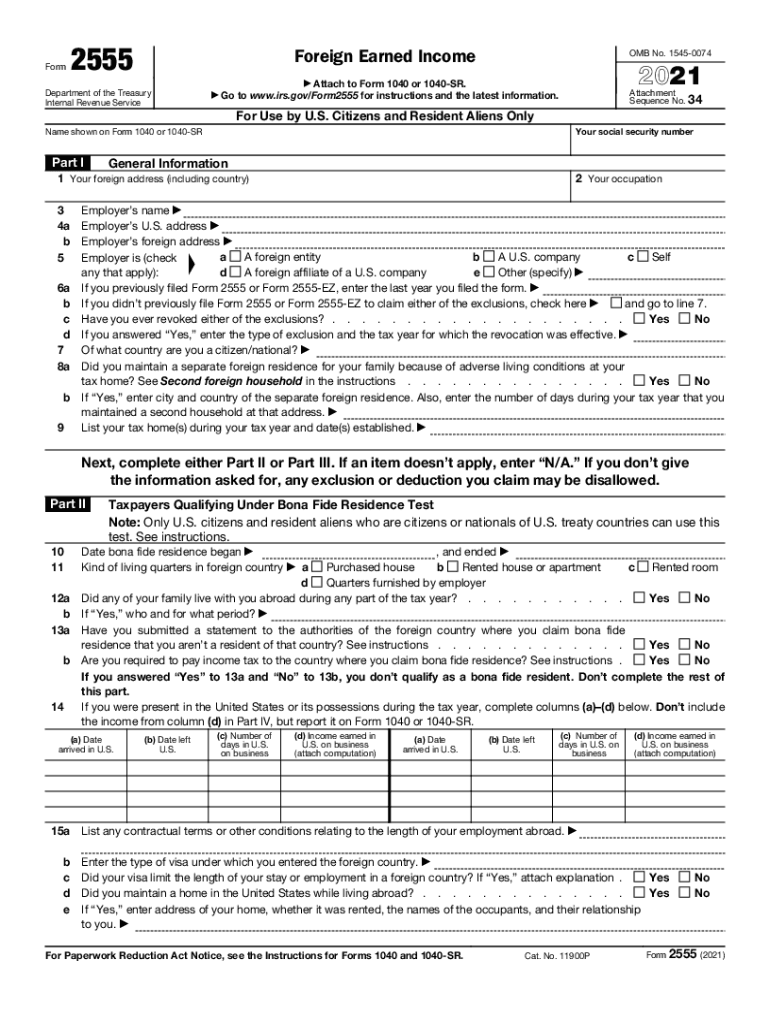

The Department of the Treasury Attachment G is a supplementary document that must be attached to IRS Form 2555 when claiming the foreign earned income exclusion. This attachment provides additional information about the taxpayer's foreign income and residency status, which is essential for the IRS to evaluate eligibility for the exclusion. Understanding the specific requirements and details of this attachment is crucial for ensuring compliance with U.S. tax laws.

How to Use the Department of the Treasury Attachment G

To effectively use the Department of the Treasury Attachment G, taxpayers should first ensure they have completed IRS Form 2555 accurately. The attachment should be filled out with precise details regarding foreign income and residency. It is important to include all relevant financial information and documentation that supports the claims made on the 2555 form. After completing Attachment G, it should be securely attached to Form 2555 before submission to the IRS.

Steps to Complete the Department of the Treasury Attachment G

Completing the Department of the Treasury Attachment G involves several key steps:

- Gather all necessary documents, including proof of foreign income and residency.

- Fill out the attachment with accurate information regarding your foreign earnings.

- Ensure that all figures are consistent with those reported on Form 2555.

- Review the completed attachment for accuracy and completeness.

- Attach the completed Attachment G to your Form 2555 before filing.

IRS Guidelines for the Department of the Treasury Attachment G

The IRS provides specific guidelines for completing the Department of the Treasury Attachment G. Taxpayers should refer to the instructions for Form 2555 to ensure compliance. Key guidelines include providing accurate income figures, maintaining documentation to support claims, and adhering to deadlines for submission. Following these guidelines helps prevent delays or issues with the processing of tax returns.

Filing Deadlines for the Department of the Treasury Attachment G

Filing deadlines for the Department of the Treasury Attachment G align with those for IRS Form 2555. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. However, extensions may be available, and it is essential to check for any changes in deadlines or specific requirements for expatriates or those living abroad.

Required Documents for the Department of the Treasury Attachment G

When completing the Department of the Treasury Attachment G, taxpayers must provide several required documents, including:

- Proof of foreign earned income, such as pay stubs or tax returns from foreign employers.

- Documentation of residency status, which may include visas, residency permits, or other relevant records.

- Any additional forms or schedules that support the claims made on Form 2555.

Eligibility Criteria for the Department of the Treasury Attachment G

To be eligible to use the Department of the Treasury Attachment G, taxpayers must meet specific criteria, including:

- Having foreign earned income that qualifies for exclusion under IRS guidelines.

- Meeting the physical presence test or the bona fide residence test as defined by the IRS.

- Filing a complete and accurate Form 2555 along with the attachment.

Quick guide on how to complete department of the treasury attachment g attach to form

Effortlessly prepare Department Of The Treasury Attachment G Attach To Form on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Department Of The Treasury Attachment G Attach To Form on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Department Of The Treasury Attachment G Attach To Form without hassle

- Obtain Department Of The Treasury Attachment G Attach To Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Department Of The Treasury Attachment G Attach To Form and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of the treasury attachment g attach to form

Create this form in 5 minutes!

How to create an eSignature for the department of the treasury attachment g attach to form

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

How to create an e-signature from your mobile device

How to create an e-signature for a PDF document on iOS devices

How to create an e-signature for a PDF file on Android devices

People also ask

-

What is the form 2555 and why do I need it?

The form 2555 is an essential tax form used by U.S. citizens and residents living abroad to claim the Foreign Earned Income Exclusion. It allows taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation. Understanding its purpose can help you maximize your tax benefits while complying with IRS regulations.

-

How can airSlate SignNow assist me with form 2555?

AirSlate SignNow streamlines the process of completing and eSigning your form 2555. With our easy-to-use interface, you can fill out your tax documents quickly, ensuring that every detail is captured accurately. Our platform allows for secure storage and sharing, making tax season hassle-free.

-

Is there a cost associated with using airSlate SignNow for form 2555?

AirSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly subscriptions or annual plans, all designed to provide value while using our form 2555 features. We also offer a free trial, allowing you to evaluate our services without any commitment.

-

What features does airSlate SignNow provide for completing tax forms like form 2555?

Our platform includes features such as customizable templates, the ability to add signature fields, and cloud storage for easy document management. With airSlate SignNow, you can also track the progress of your form 2555, ensuring all necessary signatures are collected in a timely manner. These features enhance your efficiency and reduce the risk of errors.

-

Can I integrate airSlate SignNow with other software for form 2555 management?

Yes, airSlate SignNow offers seamless integrations with popular software such as Google Drive, Dropbox, and Office 365. This allows you to import and export your form 2555 easily across platforms, enhancing your workflow. Our integrations ensure that you can manage your tax documents effectively and keep everything in one place.

-

How secure is my information when using airSlate SignNow for form 2555?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to ensure that your personal and financial information related to form 2555 is always protected. You can confidently eSign and share your documents, knowing that we adhere to strict security standards.

-

What are the benefits of using airSlate SignNow for my form 2555 filings?

Using airSlate SignNow for filing your form 2555 provides numerous benefits, including signNow time savings and increased accuracy. Our platform simplifies the eSignature process, reducing delays and allowing you to file your taxes efficiently. Additionally, cloud access means you can complete your form 2555 from anywhere in the world.

Get more for Department Of The Treasury Attachment G Attach To Form

- Quitclaim deed from corporation to husband and wife hawaii form

- Warranty deed from corporation to husband and wife hawaii form

- Quitclaim deed from corporation to individual hawaii form

- Warranty deed from corporation to individual hawaii form

- Transfer death to form

- Quitclaim deed from corporation to llc hawaii form

- Quitclaim deed from corporation to corporation hawaii form

- Warranty deed from corporation to corporation hawaii form

Find out other Department Of The Treasury Attachment G Attach To Form

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy