Form 2555 2013

What is the Form 2555

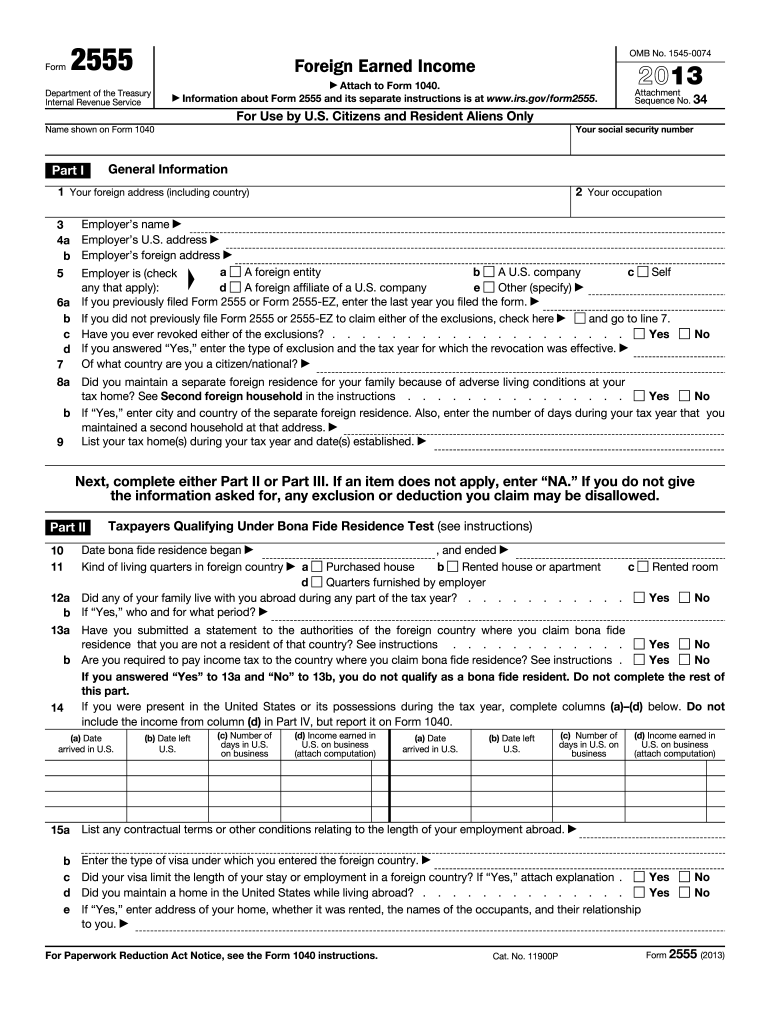

The Form 2555 is a tax document used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible taxpayers to exclude a certain amount of their foreign earnings from U.S. taxation, thus reducing their overall tax liability. It is primarily designed for individuals who live and work outside the United States and meet specific criteria regarding their foreign residence and employment.

How to use the Form 2555

To effectively use the Form 2555, taxpayers must first determine their eligibility based on the criteria set by the IRS. This includes meeting the physical presence test or the bona fide residence test. Once eligibility is confirmed, individuals should accurately fill out the form, providing necessary details such as foreign income, housing expenses, and residency information. After completing the form, it should be attached to the taxpayer's annual income tax return when filed with the IRS.

Steps to complete the Form 2555

Completing the Form 2555 involves several key steps:

- Determine eligibility by reviewing the physical presence test or bona fide residence test.

- Gather necessary documentation, including proof of foreign income and residency.

- Fill out the form, ensuring all sections are completed accurately, including income details and housing costs.

- Review the completed form for accuracy and completeness.

- Attach the Form 2555 to your tax return and submit it to the IRS.

Legal use of the Form 2555

The legal use of the Form 2555 is governed by IRS regulations, which outline the requirements for claiming the Foreign Earned Income Exclusion. To ensure compliance, taxpayers must adhere to the guidelines set forth by the IRS, including maintaining proper documentation and meeting the eligibility criteria. Failure to comply with these regulations may result in penalties or the disallowance of the exclusion.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 2555. Generally, the form must be submitted by the tax return due date, which is typically April fifteenth for most individuals. However, those living abroad may qualify for an automatic extension until June fifteenth. It is essential to file the form on time to avoid potential penalties and interest on unpaid taxes.

Required Documents

When completing the Form 2555, taxpayers should gather several key documents to support their claims. These may include:

- Proof of foreign earned income, such as pay stubs or tax documents from the foreign country.

- Documentation of foreign residency, like lease agreements or utility bills.

- Records of any housing expenses that may be claimed.

Eligibility Criteria

To qualify for the Foreign Earned Income Exclusion using the Form 2555, individuals must meet specific eligibility criteria. This includes being a U.S. citizen or resident alien, having foreign earned income, and passing either the physical presence test or the bona fide residence test. Understanding these criteria is crucial for ensuring that the exclusion is properly claimed and that the taxpayer remains compliant with IRS regulations.

Quick guide on how to complete 2013 form 2555

Effortlessly Prepare Form 2555 on Any Device

Digital document management has gained prominence among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right template and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 2555 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

The Easiest Way to Modify and eSign Form 2555 Effortlessly

- Obtain Form 2555 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize crucial sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Form 2555 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 2555

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 2555

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 2555 and why do I need it?

Form 2555 is a tax form that helps U.S. citizens and resident aliens report foreign earned income and claim the foreign earned income exclusion. Completing Form 2555 is essential for minimizing your tax liabilities when working overseas, allowing you to exclude portions of your income from U.S. taxation.

-

How can airSlate SignNow support my Form 2555 submissions?

With airSlate SignNow, you can easily prepare and eSign your Form 2555 digitally, making the submission process convenient and secure. Our platform allows you to streamline document workflows, customize forms, and ensure compliance with tax regulations.

-

What features does airSlate SignNow offer for Form 2555 preparation?

airSlate SignNow offers robust features such as eSignature capabilities, document templates, and real-time collaboration tools, all designed to simplify the preparation of Form 2555. Our intuitive interface helps you manage and complete your forms efficiently, ensuring you submit them accurately.

-

Is there a cost associated with using airSlate SignNow for Form 2555?

Yes, while airSlate SignNow provides various pricing plans, the cost is competitive and tailored to meet the needs of different users preparing Form 2555. Our plans include features that make document signing and management affordable for both individuals and businesses.

-

Can I integrate airSlate SignNow with other software for Form 2555 filing?

Absolutely! airSlate SignNow seamlessly integrates with a range of popular software applications, enhancing the efficiency of your Form 2555 filing process. This integration allows you to sync data and manage documents across different platforms without needing to switch between apps.

-

What are the benefits of using airSlate SignNow for my tax documents, including Form 2555?

Using airSlate SignNow for your tax documents, such as Form 2555, provides multiple benefits, including enhanced security, easy access, and time-saving features. Our platform helps ensure that your documents are signed, stored, and shared safely, which is crucial for sensitive tax information.

-

How does airSlate SignNow ensure the security of my Form 2555 documents?

AirSlate SignNow employs advanced security measures, including encryption, secure cloud storage, and compliance with industry regulations, to protect your Form 2555 and other documents. You can confidently manage sensitive information knowing that your data is safeguarded throughout the signing process.

Get more for Form 2555

- Publication 1494 form

- Where to fax form 433 d 2005

- Form 8926 example 2008

- Form 8850 rev 2009 pre screening notice and certification request for the work opportunity credit irs

- 2011 943 fillable form pdf

- 990 pf instruction 2011 form

- 886 form

- Form 14157 a rev 5 2012 tax return preparer fraud or misconduct affidavit

Find out other Form 2555

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer