Form 2555 2015

What is the Form 2555

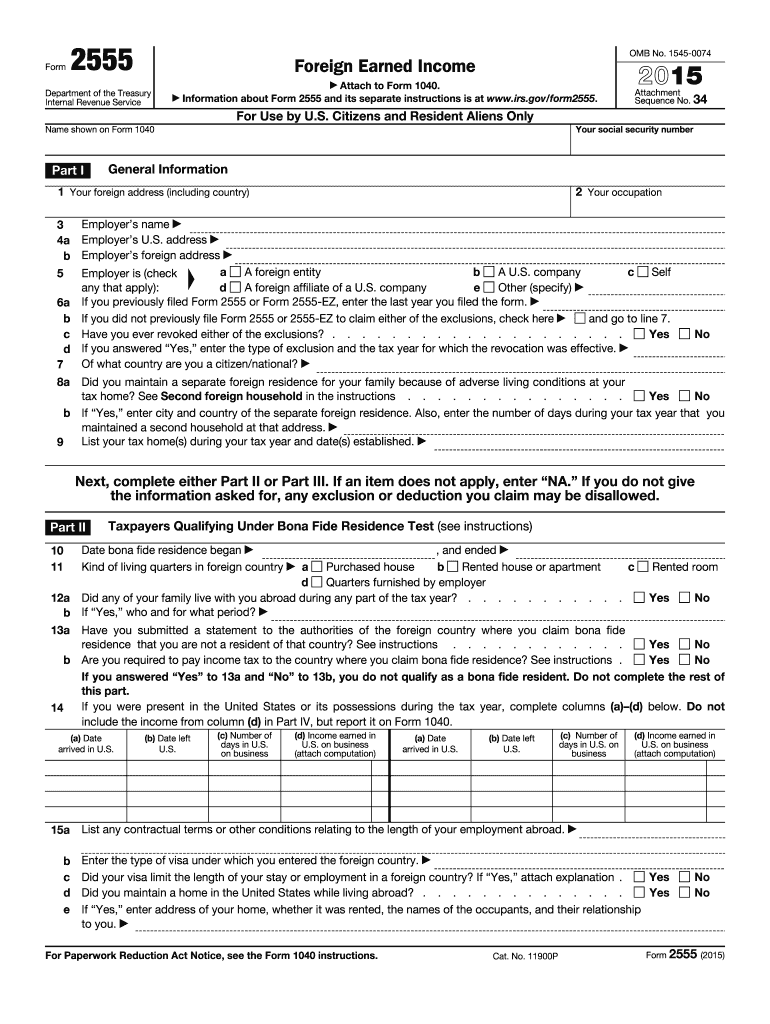

The Form 2555 is a tax form used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible individuals to exclude a certain amount of their foreign earnings from U.S. taxation. By filing this form, taxpayers can reduce their taxable income, potentially lowering their overall tax liability. The form is particularly relevant for those who live and work outside the United States, as it helps to prevent double taxation on income earned abroad.

How to use the Form 2555

To use the Form 2555 effectively, taxpayers must first determine their eligibility for the Foreign Earned Income Exclusion. This involves meeting specific criteria, such as the physical presence test or the bona fide residence test. Once eligibility is established, individuals can fill out the form by providing necessary information, including details about their foreign income and the countries where they reside. After completing the form, it should be attached to the taxpayer's annual income tax return, typically Form 1040.

Steps to complete the Form 2555

Completing the Form 2555 involves several key steps:

- Determine eligibility by reviewing the physical presence test or bona fide residence test.

- Gather necessary documentation, including proof of foreign earnings and residency.

- Fill out the form, providing accurate information about income and residency.

- Calculate the exclusion amount based on the current limits set by the IRS.

- Attach the completed Form 2555 to your Form 1040 when filing your taxes.

Legal use of the Form 2555

The legal use of the Form 2555 is governed by IRS regulations, which stipulate that taxpayers must meet specific criteria to qualify for the Foreign Earned Income Exclusion. Filing this form accurately and in compliance with IRS guidelines is essential to ensure that the exclusion is valid. Failure to adhere to these regulations can result in penalties or the denial of the exclusion, making it crucial for taxpayers to understand their obligations when using this form.

Eligibility Criteria

To qualify for the Foreign Earned Income Exclusion using the Form 2555, taxpayers must meet certain eligibility criteria:

- Be a U.S. citizen or resident alien.

- Have foreign earned income.

- Meet either the physical presence test, which requires being outside the U.S. for at least 330 full days during a 12-month period, or the bona fide residence test, which involves being a resident of a foreign country for an uninterrupted period.

Filing Deadlines / Important Dates

The deadline for filing the Form 2555 typically aligns with the tax return deadline, which is April 15 for most taxpayers. However, individuals living abroad may qualify for an automatic extension, allowing them to file until June 15. It is important to note that any taxes owed are still due by April 15 to avoid interest and penalties. Taxpayers should keep track of these dates to ensure compliance and avoid potential issues with their tax filings.

Quick guide on how to complete form 2555 2015

Prepare Form 2555 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delay. Manage Form 2555 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Form 2555 without hassle

- Obtain Form 2555 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form 2555 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2555 2015

Create this form in 5 minutes!

How to create an eSignature for the form 2555 2015

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is Form 2555 and why is it important?

Form 2555 is a critical IRS document used by U.S. citizens and residents living abroad to claim the Foreign Earned Income Exclusion. This form helps you minimize your taxable income by excluding a portion of your earnings from U.S. taxation. Understanding how to effectively use Form 2555 can signNowly reduce your tax liabilities.

-

How does airSlate SignNow facilitate the signing process for Form 2555?

airSlate SignNow streamlines the signing process for Form 2555 by allowing users to send, eSign, and manage documents securely online. With its user-friendly interface, you can prepare your Form 2555, add signers, and track the signing status effortlessly. This ensures a quick and efficient way to handle important tax documents.

-

What features does airSlate SignNow offer for completing Form 2555?

airSlate SignNow provides various features tailored for completing Form 2555, including customizable templates, automated reminders, and secure cloud storage. These features allow users to easily fill out and store their tax forms while keeping sensitive information safe. The platform’s capabilities help ensure that your Form 2555 is completed accurately and efficiently.

-

Is there a cost involved with using airSlate SignNow for Form 2555?

Yes, there are pricing plans for using airSlate SignNow’s services, which cater to different business sizes and needs. The platform offers a cost-effective solution that can help you save time and money when handling documents like Form 2555. You can choose from various subscription options depending on the volume of documents you need to manage.

-

Can airSlate SignNow integrate with accounting software for Form 2555 preparation?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to prepare your Form 2555. By connecting your accounting tools, you can import necessary data directly into your tax forms, reducing manual entry and minimizing errors. This integration simplifies your workflow and enhances productivity.

-

Does airSlate SignNow comply with legal standards for Form 2555 signing?

Yes, airSlate SignNow complies with legal standards for electronic signatures, ensuring that your Form 2555 is signed and processed according to U.S. laws. The platform follows stringent security measures to protect your information, giving users confidence in the validity of their submitted documents. This makes it a reliable choice for handling tax forms.

-

What are the benefits of using airSlate SignNow for Form 2555?

Using airSlate SignNow for Form 2555 offers numerous benefits, including ease of use, reduced turnaround time, and enhanced security for sensitive information. The platform’s automation features help you stay organized and compliant with tax regulations. Overall, it ensures that the process of managing your Form 2555 is smooth and stress-free.

Get more for Form 2555

- Secure electronic filing of w 2 and 1099 forms connecticut

- Pdf form ct 1065ct 1120si ext this return must be filed ctgov

- Connecticut state tax informationsupport

- Connecticut form ct 1040 connecticut resident income tax

- Welcome to the connecticut department of revenue services form

- Visit our website see need form

- Form ct 247 application for exemption from corporation franchise taxes by a not for profit organization revised 1220

- Environmental compliance certificate form

Find out other Form 2555

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later