Form 2555 2016

What is the Form 2555

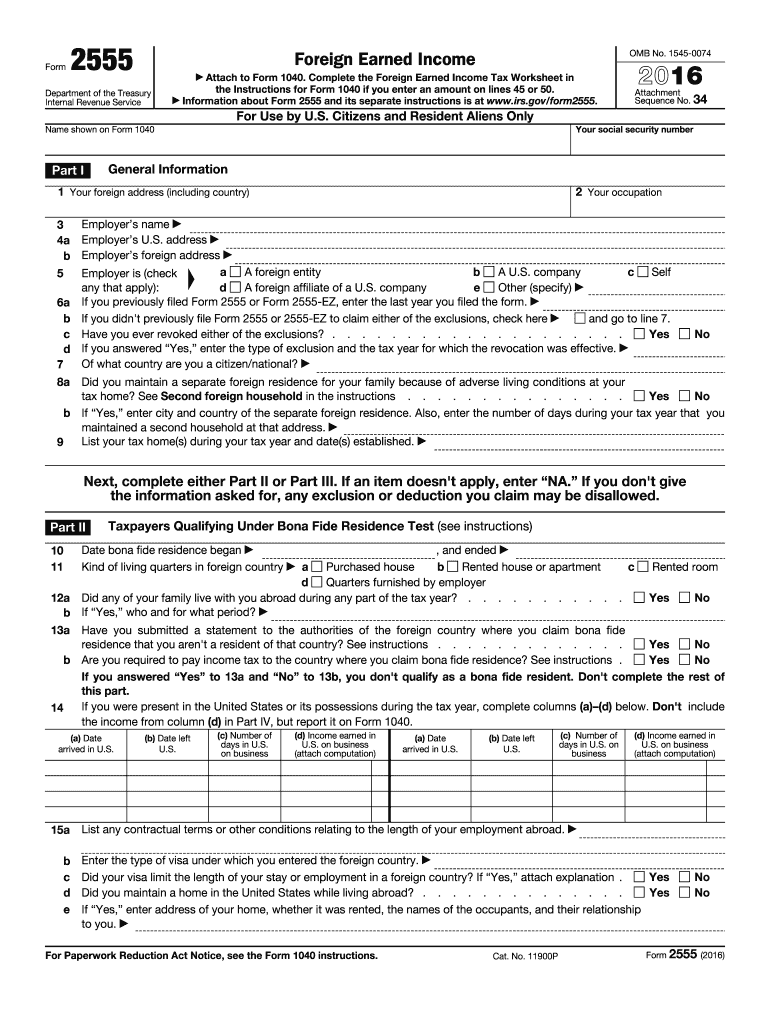

The Form 2555 is a tax document used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible taxpayers to exclude a portion of their foreign earnings from U.S. taxation, thereby reducing their overall tax liability. This form is particularly relevant for individuals who live and work abroad, as it helps prevent double taxation on income earned outside the United States.

How to use the Form 2555

To effectively use the Form 2555, taxpayers must first determine their eligibility based on specific criteria, such as their foreign residency status and the nature of their income. Once eligibility is established, individuals can fill out the form by providing necessary personal information, including their foreign address and details about their employment. It is crucial to accurately report all foreign income and any applicable deductions to ensure compliance with IRS regulations.

Steps to complete the Form 2555

Completing the Form 2555 involves several key steps:

- Gather necessary documents, including proof of foreign income and residency.

- Fill out personal information in the designated sections of the form.

- Report your foreign earned income and any housing expenses, if applicable.

- Calculate the exclusion amount based on the IRS guidelines.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Foreign Earned Income Exclusion using Form 2555, taxpayers must meet specific eligibility criteria. These include:

- Being a U.S. citizen or resident alien.

- Having foreign earned income that meets the minimum threshold set by the IRS.

- Meeting either the bona fide residence test or the physical presence test, which assesses the duration of time spent living or working abroad.

Form Submission Methods

The Form 2555 can be submitted to the IRS through various methods. Taxpayers have the option to file electronically using tax preparation software that supports e-filing, or they can complete a paper version of the form and mail it to the appropriate IRS address. It is essential to check the latest IRS guidelines for submission methods and ensure that the form is filed by the specified deadlines.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of Form 2555. Taxpayers should refer to the IRS instructions for the form, which detail the eligibility requirements, necessary documentation, and the calculation of the exclusion amount. Adhering to these guidelines is vital to avoid penalties and ensure that the form is processed correctly.

Penalties for Non-Compliance

Failing to comply with the requirements associated with Form 2555 can result in significant penalties. Taxpayers who do not file the form when required may face fines, and they could also be responsible for paying back taxes on the income that was excluded. It is important to understand the implications of non-compliance and to ensure that all necessary forms are filed accurately and on time.

Quick guide on how to complete form 2555 2016

Complete Form 2555 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 2555 on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Form 2555 with ease

- Obtain Form 2555 and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, and errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 2555 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2555 2016

Create this form in 5 minutes!

How to create an eSignature for the form 2555 2016

How to generate an eSignature for your Form 2555 2016 in the online mode

How to make an eSignature for the Form 2555 2016 in Google Chrome

How to make an electronic signature for putting it on the Form 2555 2016 in Gmail

How to generate an eSignature for the Form 2555 2016 right from your smart phone

How to make an electronic signature for the Form 2555 2016 on iOS devices

How to generate an eSignature for the Form 2555 2016 on Android OS

People also ask

-

What is Form 2555 and how does it relate to airSlate SignNow?

Form 2555 is a tax form used by U.S. citizens and residents living abroad to claim the Foreign Earned Income Exclusion. With airSlate SignNow, you can easily manage and sign documents related to Form 2555, streamlining your tax filing process.

-

How can airSlate SignNow help with the completion of Form 2555?

airSlate SignNow provides tools to electronically sign and manage documents, including Form 2555. Our platform simplifies the process, allowing you to gather necessary signatures and securely share your completed forms without hassle.

-

What are the pricing plans for airSlate SignNow when using Form 2555?

Our pricing plans for airSlate SignNow are designed to accommodate various business needs while efficiently handling documents like Form 2555. Competitive monthly and annual subscriptions are available, offering features that support your document management at an affordable rate.

-

Can I integrate airSlate SignNow with accounting software when filing Form 2555?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your financial documentation related to Form 2555. This integration streamlines workflows, ensuring that your forms and documents are organized and accessible.

-

What features does airSlate SignNow offer for handling Form 2555?

airSlate SignNow includes features specifically designed for managing Form 2555, such as customizable templates, secure document storage, and tracking capabilities. These features help you keep everything organized and ensure that the process runs smoothly and efficiently.

-

Is airSlate SignNow secure for handling sensitive information on Form 2555?

Absolutely. airSlate SignNow employs top-notch security measures to ensure that all documents, including Form 2555, are protected. Data encryption, secure storage, and access controls comply with industry standards to keep your personal information safe.

-

What customer support options are available for users working with Form 2555?

At airSlate SignNow, we offer comprehensive customer support for users dealing with Form 2555. You can access resources like FAQs, live chat, and email support to assist you with any questions or issues you may encounter.

Get more for Form 2555

Find out other Form 2555

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU