Form 2555 2014

What is the Form 2555

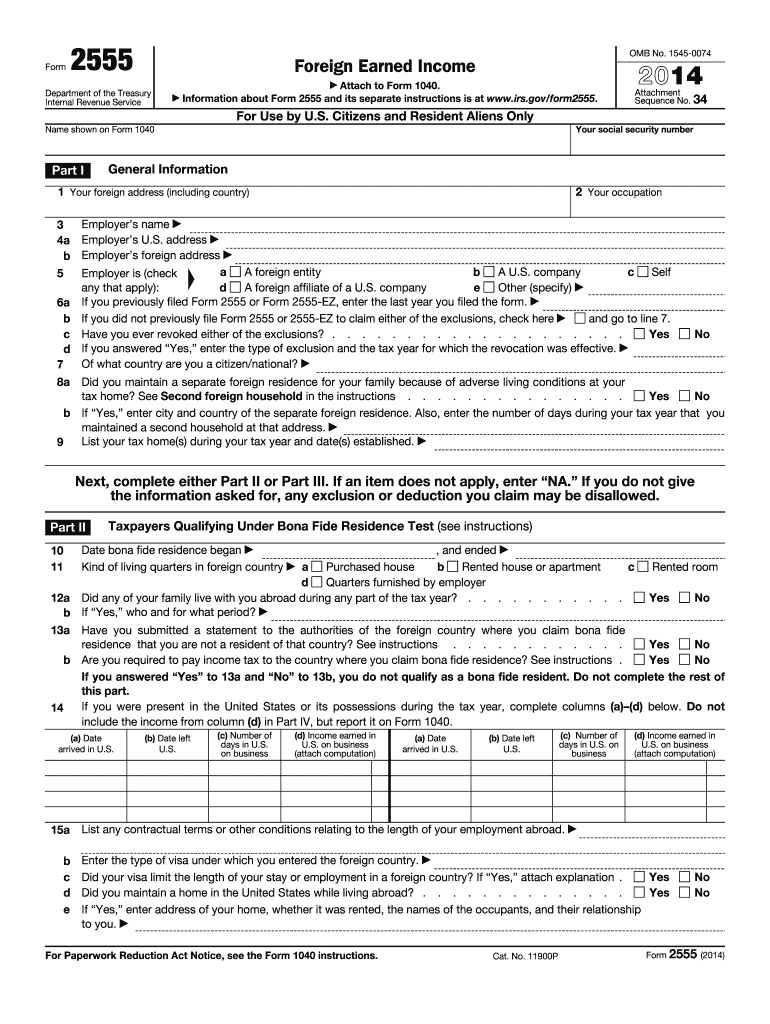

The Form 2555 is a tax form used by U.S. citizens and resident aliens who earn income abroad. It allows individuals to claim the Foreign Earned Income Exclusion, which can help reduce their taxable income. This form is essential for those who qualify, as it provides a means to avoid double taxation on income earned outside the United States. The form requires detailed information about the taxpayer's foreign employment and residency status, ensuring compliance with U.S. tax laws.

How to use the Form 2555

To use the Form 2555 effectively, taxpayers must first determine their eligibility for the Foreign Earned Income Exclusion. This involves meeting specific criteria, such as the physical presence test or the bona fide residence test. Once eligibility is established, individuals can fill out the form by providing necessary details about their foreign income, residency, and any applicable deductions. It is crucial to ensure all information is accurate and complete to avoid delays or issues with the IRS.

Steps to complete the Form 2555

Completing the Form 2555 involves several key steps:

- Gather necessary documentation, including proof of foreign income and residency.

- Determine eligibility by reviewing the physical presence or bona fide residence tests.

- Fill out the form, providing accurate information about income, residency, and any deductions.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return to the IRS by the applicable deadline.

Legal use of the Form 2555

The legal use of the Form 2555 is governed by IRS regulations, which stipulate that only eligible taxpayers can claim the Foreign Earned Income Exclusion. To ensure compliance, individuals must accurately report their foreign income and meet the residency requirements. Failure to adhere to these regulations may result in penalties or the disallowance of the exclusion. It is advisable to consult with a tax professional if there are uncertainties regarding eligibility or the completion of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2555 align with the general tax return deadlines. Typically, U.S. citizens must file their tax returns by April 15. However, taxpayers living abroad may qualify for an automatic extension until June 15. It is important to note that any taxes owed must still be paid by April 15 to avoid penalties and interest. Additional extensions may be available, but they require specific requests and justifications.

Required Documents

When completing the Form 2555, several documents are necessary to support the information provided. These may include:

- Proof of foreign earned income, such as pay stubs or contracts.

- Documentation of foreign residency, like rental agreements or utility bills.

- Tax returns filed in the foreign country, if applicable.

- Any additional forms that may be relevant to the taxpayer’s situation.

Eligibility Criteria

Eligibility for the Foreign Earned Income Exclusion on the Form 2555 is based on specific criteria. Taxpayers must meet one of the following tests:

- The physical presence test, which requires being outside the U.S. for at least 330 full days during a 12-month period.

- The bona fide residence test, which involves establishing a permanent residence in a foreign country for an entire tax year.

Meeting these criteria is essential to qualify for the exclusion and reduce taxable income effectively.

Quick guide on how to complete 2014 form 2555

Accomplish Form 2555 effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the appropriate form and store it securely online. airSlate SignNow provides you with all the necessary tools to generate, adjust, and eSign your documents swiftly without delays. Manage Form 2555 on any device with airSlate SignNow applications for Android or iOS and enhance any document-related task today.

Steps to modify and eSign Form 2555 with ease

- Locate Form 2555 and then select Get Form to begin.

- Employ the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information carefully and then hit the Done button to save your updates.

- Choose how you wish to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 2555 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 2555

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 2555

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form 2555 and why is it important?

Form 2555 is a tax form used by U.S. citizens and residents living abroad to claim the Foreign Earned Income Exclusion. It's important because it helps expatriates reduce their taxable income, allowing them to save on taxes. By using airSlate SignNow, you can easily eSign and submit your Form 2555 securely.

-

How does airSlate SignNow simplify the process of completing Form 2555?

airSlate SignNow streamlines the process of filling out Form 2555 By enabling users to edit, sign, and send the document electronically. Our intuitive interface allows you to quickly input your information, minimizing errors and ensuring compliance. Plus, you can access your forms from anywhere.

-

Are there any costs associated with using airSlate SignNow for Form 2555?

Yes, airSlate SignNow offers different pricing plans to suit various needs, including individual and business options. You can choose a plan that allows you to eSign and manage documents, including Form 2555 at a cost-effective price. Check our website for specific pricing details and features.

-

Can I integrate airSlate SignNow with other applications to manage my Form 2555?

Absolutely! airSlate SignNow offers a range of integrations with popular applications like Google Drive, Dropbox, and more. This means you can easily import and manage your Form 2555 alongside your other important documents, enhancing your workflow and saving you time.

-

What security features does airSlate SignNow provide for Form 2555?

airSlate SignNow ensures that your Form 2555 and other documents are secured with bank-level encryption and compliance with standards like GDPR. You can confidently eSign documents knowing that your sensitive data is protected. Additionally, we provide secure audit trails for all signed documents.

-

Is there customer support available for users of Form 2555 in airSlate SignNow?

Yes, airSlate SignNow provides comprehensive customer support for all users. If you have questions about completing or eSigning Form 2555, our support team is available through various channels, including live chat, email, and phone. We’re here to help you navigate your document needs.

-

What are the benefits of using airSlate SignNow for Form 2555 versus traditional methods?

Using airSlate SignNow for Form 2555 offers numerous benefits over traditional methods, such as speed, convenience, and cost savings. You can eSign and send your form in just a few clicks, eliminating the need for printing and mailing. This modern solution helps you manage your time efficiently and stay organized.

Get more for Form 2555

- Employment separation certificate form

- Victoria verification identity form

- Griffith university os help loan application form griffith edu

- Statement environmental effects lake macquarie template form

- Pontificium opus a propagatione fidei form

- New employee welcome pack checklist form

- Clever slusd form

- Parent forms packet new ampamp alumni childs play

Find out other Form 2555

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast