Form 2555 2007

What is the Form 2555

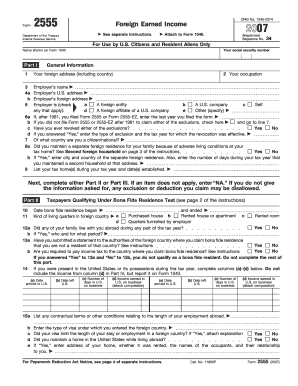

The Form 2555 is a tax form used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion and the Foreign Housing Exclusion or Deduction. This form allows eligible individuals to exclude a certain amount of their foreign earnings from U.S. taxation, thereby reducing their taxable income. It is particularly relevant for those who live and work abroad, as it helps prevent double taxation on income earned outside the United States.

How to use the Form 2555

To effectively use the Form 2555, individuals must first determine their eligibility based on their foreign residency status and the nature of their income. The form requires detailed information regarding the taxpayer's foreign earned income, the period of residence abroad, and any housing expenses incurred. It is essential to accurately complete all sections to ensure compliance with IRS regulations and to maximize potential exclusions.

Steps to complete the Form 2555

Completing the Form 2555 involves several key steps:

- Gather necessary documentation, including proof of foreign residency and income statements.

- Fill out Part I to establish eligibility by providing details about your foreign residence and employment.

- Complete Part II to report your foreign earned income and calculate the exclusion amount.

- Fill out Part III if claiming the Foreign Housing Exclusion or Deduction, detailing your housing costs.

- Review the completed form for accuracy before submission.

Legal use of the Form 2555

The Form 2555 is legally binding when filled out correctly and submitted to the IRS. To ensure its legal validity, all information must be truthful and supported by appropriate documentation. Additionally, the form must be filed within the designated timeframe to avoid penalties. Utilizing a reliable digital platform for e-signatures can further enhance the form's legitimacy, ensuring compliance with eSignature regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2555 align with the annual tax return due date, typically April 15. However, taxpayers residing abroad may qualify for an automatic two-month extension, allowing them to file until June 15. It is crucial to stay informed about any changes to these deadlines, especially if filing for extensions or if additional forms are required.

Required Documents

When completing the Form 2555, several documents are necessary to support your claims:

- Proof of foreign residency, such as a lease agreement or utility bills.

- Income statements from foreign employers, including W-2 equivalents.

- Documentation of housing expenses if claiming the Foreign Housing Exclusion.

Eligibility Criteria

To qualify for the benefits of the Form 2555, taxpayers must meet specific eligibility criteria. These include being a U.S. citizen or resident alien, having foreign earned income, and meeting the physical presence test or the bona fide residence test. Understanding these criteria is vital for determining whether to file the form and how to maximize potential tax benefits.

Quick guide on how to complete 2007 form 2555

Complete Form 2555 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without complications. Handle Form 2555 on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 2555 without hassle

- Obtain Form 2555 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form: via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 2555 to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2007 form 2555

Create this form in 5 minutes!

How to create an eSignature for the 2007 form 2555

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is Form 2555 and how does it relate to airSlate SignNow?

Form 2555 is used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion, eliminating the need to pay taxes on income earned abroad. airSlate SignNow simplifies the process of filling and signing Form 2555, making it easier to manage your tax obligations while overseas.

-

Can I use airSlate SignNow to fill out Form 2555 electronically?

Yes, airSlate SignNow allows you to fill out Form 2555 electronically with a user-friendly interface. You can sign and send the form securely online, ensuring that your financial details are safely transmitted and easily organized.

-

What features of airSlate SignNow make it ideal for managing Form 2555?

airSlate SignNow offers features such as eSignature, templates for Form 2555, and document tracking. These features streamline the whole process of filing your taxes and help ensure compliance with the IRS, saving you time and reducing stress.

-

Is airSlate SignNow a cost-effective solution for handling Form 2555?

Absolutely! airSlate SignNow is a cost-effective solution tailored for businesses and individuals preparing Form 2555. With flexible pricing plans, you can choose a package that fits your needs without breaking the bank.

-

How can I securely store my Form 2555 documents using airSlate SignNow?

airSlate SignNow provides secure cloud storage for all your documents, including Form 2555. This means you can easily access and retrieve your forms anytime, while also ensuring that sensitive information is protected with advanced security protocols.

-

What integrations does airSlate SignNow support for tax management and Form 2555?

airSlate SignNow integrates seamlessly with a variety of accounting and tax software, allowing you to manage Form 2555 efficiently. Popular integrations include QuickBooks and Xero, which facilitate streamlined financial management alongside your tax filing.

-

Can I send Form 2555 directly to tax authorities through airSlate SignNow?

Yes, once you complete Form 2555 using airSlate SignNow, you can easily send it directly to the tax authorities. The platform supports secure document delivery options, ensuring that your Form 2555 signNowes the right destination safely and efficiently.

Get more for Form 2555

Find out other Form 2555

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent