Choosing the Foreign Earned Income Exclusion 2024

What is the foreign earned income exclusion?

The foreign earned income exclusion allows U.S. citizens and resident aliens to exclude a certain amount of their foreign earned income from U.S. taxation. This exclusion is particularly beneficial for individuals working abroad, as it helps to mitigate the double taxation that can occur when earning income in a foreign country while also being subject to U.S. taxes. For the tax year 2022, the maximum exclusion amount is $112,000. This figure is adjusted annually for inflation.

Eligibility criteria for the foreign earned income exclusion

To qualify for the foreign earned income exclusion, individuals must meet specific criteria set by the IRS. These include:

- Having foreign earned income, which is income received for services performed in a foreign country.

- Having a tax home in a foreign country, meaning that the individual’s main place of business is located outside the United States.

- Meeting either the bona fide residence test or the physical presence test. The bona fide residence test requires individuals to be a resident of a foreign country for an uninterrupted period that includes an entire tax year. The physical presence test requires individuals to be physically present in a foreign country for at least 330 full days during a 12-month period.

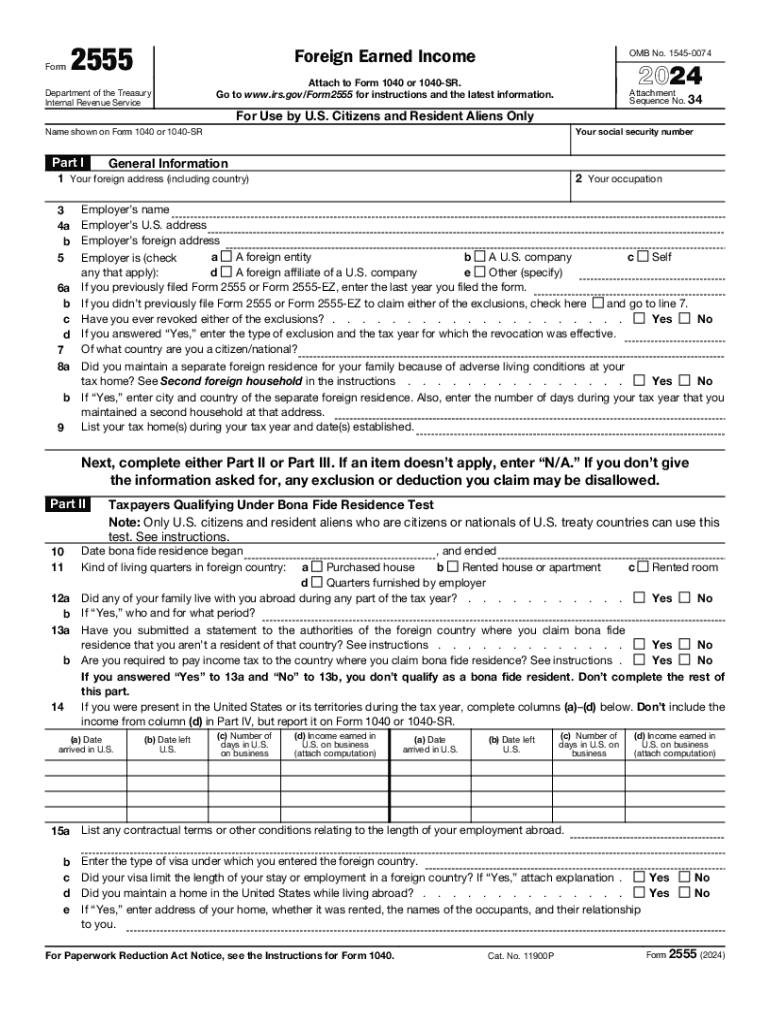

Steps to complete IRS Form 2555

Filling out IRS Form 2555 involves several key steps:

- Gather necessary documentation, including proof of foreign earned income and details about your tax home.

- Determine eligibility by reviewing the bona fide residence or physical presence tests.

- Complete the form, ensuring to include all relevant income and deductions.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return, either electronically or by mail.

Filing deadlines for Form 2555

IRS Form 2555 must be filed along with your annual tax return. The standard deadline for filing individual tax returns is April 15. However, if you are living abroad, you may qualify for an automatic extension, allowing you to file as late as June 15. It's important to note that any taxes owed are still due by April 15 to avoid penalties and interest.

Required documents for Form 2555

When completing IRS Form 2555, you will need to provide specific documentation to support your claims. This includes:

- Proof of foreign earned income, such as pay stubs or tax returns from the foreign country.

- Documentation of your tax home, which may include rental agreements or utility bills.

- Records verifying your physical presence or residency in the foreign country.

IRS guidelines for Form 2555

The IRS provides detailed guidelines for completing Form 2555. It is essential to follow these instructions closely to ensure compliance and to maximize your exclusion. Key points include understanding what constitutes foreign earned income, how to calculate the exclusion, and the implications of any foreign taxes paid. Familiarizing yourself with these guidelines can help prevent errors and potential audits.

Handy tips for filling out Choosing The Foreign Earned Income Exclusion online

Quick steps to complete and e-sign Choosing The Foreign Earned Income Exclusion online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant service for optimum efficiency. Use signNow to electronically sign and send Choosing The Foreign Earned Income Exclusion for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct choosing the foreign earned income exclusion

Create this form in 5 minutes!

How to create an eSignature for the choosing the foreign earned income exclusion

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 2555 and who needs it?

IRS Form 2555 is used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. If you earn income while living abroad, this form allows you to exclude a certain amount of your foreign earnings from U.S. taxation. Understanding how to properly fill out IRS Form 2555 is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with IRS Form 2555?

airSlate SignNow simplifies the process of sending and eSigning IRS Form 2555. With our user-friendly platform, you can easily prepare, send, and securely sign your tax documents online. This ensures that your IRS Form 2555 is completed accurately and submitted on time.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including customizable templates, real-time tracking, and secure cloud storage. These features make it easy to manage your IRS Form 2555 and other important documents efficiently. Additionally, our platform supports multiple file formats for added convenience.

-

Is airSlate SignNow cost-effective for small businesses handling IRS Form 2555?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to manage IRS Form 2555 and other documents. Our pricing plans are designed to fit various budgets, ensuring that even small enterprises can access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for IRS Form 2555?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for IRS Form 2555. Whether you use accounting software or CRM systems, our integrations help streamline the document management process, making it easier to handle your tax forms.

-

What are the benefits of using airSlate SignNow for IRS Form 2555?

Using airSlate SignNow for IRS Form 2555 offers numerous benefits, including increased efficiency and reduced turnaround time. Our platform allows you to eSign documents from anywhere, ensuring that you can complete your tax filings promptly. Additionally, the security features protect your sensitive information.

-

How secure is airSlate SignNow when handling IRS Form 2555?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your IRS Form 2555 and other documents. Our compliance with industry standards ensures that your data remains confidential and secure throughout the signing process.

Get more for Choosing The Foreign Earned Income Exclusion

Find out other Choosing The Foreign Earned Income Exclusion

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple