IRS 2555 Fill and Sign Printable TemplateAbout Form 2555, Foreign Earned IncomeInternal RevenueInstructions for Form 2555 Intern 2022

What is Form 2555?

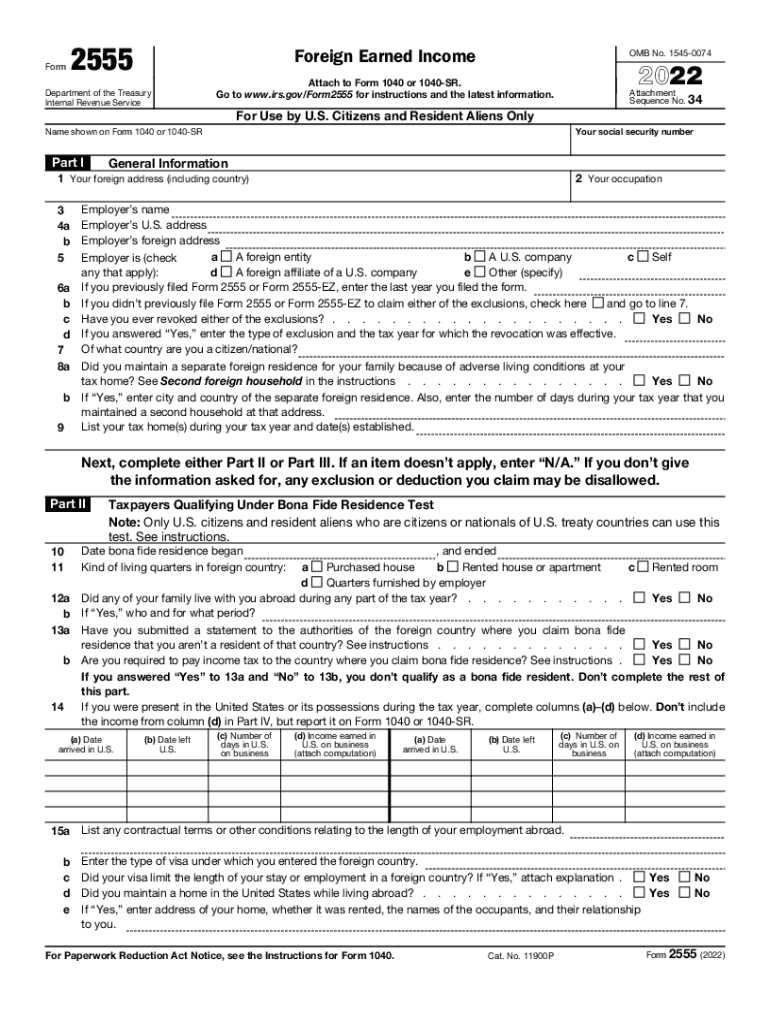

Form 2555, officially known as the Foreign Earned Income form, is a crucial document used by U.S. taxpayers who earn income while living abroad. This form allows eligible individuals to exclude a portion of their foreign earned income from U.S. taxation, which can significantly reduce their overall tax liability. The IRS provides specific guidelines on who qualifies for this exclusion, typically based on residency or physical presence tests. Understanding the purpose and requirements of Form 2555 is essential for expatriates to ensure compliance with U.S. tax laws.

Steps to Complete Form 2555

Completing Form 2555 involves several key steps to ensure accuracy and compliance. First, gather necessary documentation, including proof of foreign residency and income statements. Next, determine eligibility by reviewing the residency and physical presence tests outlined by the IRS. Then, accurately fill out the form, detailing your foreign earned income and any applicable deductions. Finally, review the completed form for errors before submission. Ensuring all information is correct is vital, as inaccuracies can lead to delays or penalties.

Legal Use of Form 2555

Form 2555 is legally recognized by the IRS as a valid means for U.S. citizens and residents to claim the foreign earned income exclusion. To be legally binding, the form must be filled out accurately and submitted on time. Compliance with IRS regulations is essential to avoid potential penalties for non-compliance. Additionally, using a reliable electronic signature tool can enhance the legal standing of the document, ensuring that it meets all necessary requirements for electronic submission.

Filing Deadlines for Form 2555

Filing deadlines for Form 2555 align with the general tax filing deadlines for U.S. taxpayers. Typically, the form must be submitted by April 15 each year, with extensions available under certain circumstances. Taxpayers residing abroad may qualify for an automatic two-month extension, allowing them to file by June 15. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties. Staying informed about these deadlines is crucial for timely submissions.

Required Documents for Form 2555

To successfully complete Form 2555, several documents are required. Taxpayers should have their foreign income statements, proof of residency, and any relevant tax documents from the foreign country. Additionally, records of days spent in and out of the U.S. may be necessary to establish eligibility for the foreign earned income exclusion. Keeping organized records can streamline the process and help ensure that all necessary information is included.

Eligibility Criteria for Form 2555

Eligibility for Form 2555 hinges on specific criteria set by the IRS. Taxpayers must either meet the bona fide residence test or the physical presence test. The bona fide residence test requires individuals to reside in a foreign country for an uninterrupted period that includes an entire tax year. The physical presence test mandates that individuals be physically present in a foreign country for at least 330 full days during a 12-month period. Meeting these criteria is essential for claiming the foreign earned income exclusion.

Quick guide on how to complete irs 2555 2021 2022 fill and sign printable templateabout form 2555 foreign earned incomeinternal revenueinstructions for form

Effortlessly prepare IRS 2555 Fill And Sign Printable TemplateAbout Form 2555, Foreign Earned IncomeInternal RevenueInstructions For Form 2555 Intern on any device

Managing documents online has increasingly become favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed agreements, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle IRS 2555 Fill And Sign Printable TemplateAbout Form 2555, Foreign Earned IncomeInternal RevenueInstructions For Form 2555 Intern on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to modify and electronically sign IRS 2555 Fill And Sign Printable TemplateAbout Form 2555, Foreign Earned IncomeInternal RevenueInstructions For Form 2555 Intern with ease

- Locate IRS 2555 Fill And Sign Printable TemplateAbout Form 2555, Foreign Earned IncomeInternal RevenueInstructions For Form 2555 Intern and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact private information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IRS 2555 Fill And Sign Printable TemplateAbout Form 2555, Foreign Earned IncomeInternal RevenueInstructions For Form 2555 Intern to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 2555 2021 2022 fill and sign printable templateabout form 2555 foreign earned incomeinternal revenueinstructions for form

Create this form in 5 minutes!

People also ask

-

What is form 2555 and who needs it?

Form 2555 is a tax form used by U.S. citizens and resident aliens living abroad to claim the Foreign Earned Income Exclusion. If you have income earned outside the United States, you may need to fill out form 2555 to potentially reduce your taxable income.

-

How can airSlate SignNow help me with filling out form 2555?

airSlate SignNow provides an easy-to-use platform where you can securely prepare, send, and eSign documents, including form 2555. Our solution simplifies the document workflow, making it efficient for users to complete tax forms with confidence.

-

Is there a cost associated with using airSlate SignNow for form 2555?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Each plan provides features designed to streamline the document signing process, ensuring you can complete forms like form 2555 efficiently at a reasonable cost.

-

What features does airSlate SignNow offer for managing form 2555?

airSlate SignNow includes features such as document templates, in-app guidance for form completion, and advanced tracking options. These tools help users manage their form 2555 efficiently, ensuring they are filled out correctly and submitted on time.

-

Can I integrate airSlate SignNow with other software for my form 2555 workflow?

Absolutely! airSlate SignNow offers seamless integrations with popular software solutions, enhancing your workflow for form 2555. Whether you use accounting software or customer relationship management tools, our integrations help optimize your document processes.

-

What are the benefits of using airSlate SignNow for my tax-related documents like form 2555?

Using airSlate SignNow for your tax-related documents, including form 2555, streamlines the signing process. You benefit from enhanced security, easy collaboration, and the ability to access your forms from anywhere, ensuring a hassle-free experience.

-

Is airSlate SignNow compliant with legal requirements for form 2555?

Yes, airSlate SignNow complies with all legal requirements for electronic signatures, ensuring that documents like form 2555 are valid and legally binding. Our platform prioritizes security and compliance, so you can confidently submit your forms.

Get more for IRS 2555 Fill And Sign Printable TemplateAbout Form 2555, Foreign Earned IncomeInternal RevenueInstructions For Form 2555 Intern

- Quitclaim deed by two individuals to llc new hampshire form

- Warranty deed from two individuals to llc new hampshire form

- Notice to financial institution of furnishing of labor or materials corporation or llc new hampshire form

- Notice to financial institution of furnishing of labor or materials railroad individual new hampshire form

- Quitclaim deed by two individuals to corporation new hampshire form

- New hampshire deed 497318599 form

- Notice to financial institution of furnishing of labor or materials railroad corporation new hampshire form

- New hampshire release form

Find out other IRS 2555 Fill And Sign Printable TemplateAbout Form 2555, Foreign Earned IncomeInternal RevenueInstructions For Form 2555 Intern

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast