Form 2555 2023

What is the Form 2555

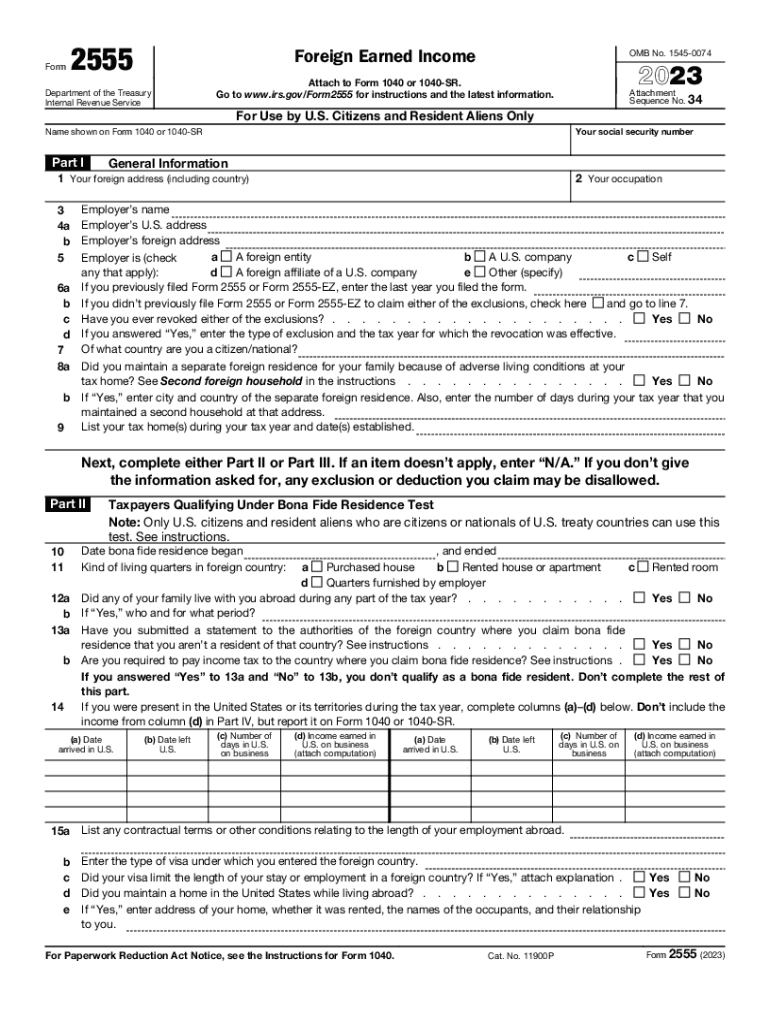

The Form 2555 is an IRS document used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion and the Foreign Housing Exclusion or Deduction. This form allows eligible taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation, thereby reducing their overall tax liability. Understanding the purpose and function of this form is crucial for individuals working abroad who wish to take advantage of these tax benefits.

How to use the Form 2555

To effectively use the Form 2555, taxpayers must first determine their eligibility based on their foreign residency status and the nature of their income. The form requires detailed information about the taxpayer's foreign earned income, the foreign address, and the dates of residence abroad. By filling out the form accurately, individuals can claim the exclusions they are entitled to, which can significantly impact their tax obligations. It is advisable to consult IRS guidelines or a tax professional to ensure compliance and maximize benefits.

Steps to complete the Form 2555

Completing the Form 2555 involves several key steps:

- Gather necessary documentation, including proof of foreign earned income and residency.

- Fill out the identification section, providing personal details such as name, address, and Social Security number.

- Report foreign earned income in the designated sections, ensuring all amounts are accurate and supported by documentation.

- Complete the Foreign Housing Exclusion section if applicable, detailing housing expenses incurred while living abroad.

- Review the form for accuracy and completeness before submission.

IRS Guidelines

The IRS provides specific guidelines for filling out the Form 2555, including eligibility criteria and instructions for reporting income. Taxpayers must meet the bona fide residence test or the physical presence test to qualify for the exclusions. Additionally, the IRS outlines the maximum exclusion amounts and any changes from previous tax years. Familiarizing oneself with these guidelines is essential for proper compliance and to avoid potential penalties.

Filing Deadlines / Important Dates

The deadline for filing the Form 2555 typically aligns with the standard tax filing deadline for U.S. citizens, which is usually April fifteenth. However, taxpayers living abroad may qualify for an automatic extension until June fifteenth. It is important to stay informed about any changes to deadlines or requirements, as these can vary from year to year. Filing the form on time is crucial to ensure eligibility for the exclusions claimed.

Eligibility Criteria

To qualify for the benefits of the Form 2555, taxpayers must meet specific eligibility criteria. This includes being a U.S. citizen or resident alien, having foreign earned income, and meeting either the bona fide residence test or the physical presence test. The bona fide residence test requires individuals to reside in a foreign country for an uninterrupted period that includes an entire tax year, while the physical presence test requires being physically present in a foreign country for at least three hundred sixty-five days during a consecutive twelve-month period. Understanding these criteria is essential for successful filing.

Quick guide on how to complete form 2555 702425835

Effortlessly complete Form 2555 on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Form 2555 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Form 2555 with ease

- Obtain Form 2555 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a physical ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 2555 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2555 702425835

Create this form in 5 minutes!

How to create an eSignature for the form 2555 702425835

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2555 and why is it important?

Form 2555 is a tax form used by U.S. citizens and resident aliens to claim the foreign earned income exclusion. This form is essential for individuals working overseas, as it helps minimize their U.S. tax obligations. Utilizing form 2555 correctly ensures compliance with IRS regulations and can lead to signNow tax savings.

-

How does airSlate SignNow help with form 2555?

airSlate SignNow simplifies the process of submitting form 2555 by allowing users to electronically sign and send documents securely. With its user-friendly interface, you can efficiently manage and prepare form 2555 without the hassle of paper documents. This enhances the accuracy and speed of your tax filing process.

-

Is there a cost associated with eSigning form 2555 using airSlate SignNow?

Yes, there is a cost for using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing is tiered to accommodate different needs and budgets, ensuring you have access to features that help with form 2555 management. You can easily choose a plan that fits your requirements.

-

What features does airSlate SignNow offer for form 2555 preparation?

airSlate SignNow offers several features to assist with form 2555 preparation, including customizable templates, cloud storage, and integration with other tax software. The platform also provides real-time tracking of document status and allows for collaboration with other parties involved in your tax filings. These features streamline the process and reduce the risk of errors.

-

Can form 2555 be integrated with other applications through airSlate SignNow?

Absolutely! airSlate SignNow supports integration with various applications, making it easy to work alongside your existing tax and accounting tools when processing form 2555. This seamless integration allows for better workflow management and enhances productivity by keeping all your documents organized.

-

Are there benefits of using airSlate SignNow for form 2555 compared to traditional methods?

Using airSlate SignNow for form 2555 offers numerous benefits over traditional methods, including increased efficiency and reduced turnaround times. The electronic signature process eliminates the need for printing and mailing, saving both time and resources. Furthermore, the secure nature of the platform helps safeguard your sensitive tax information.

-

How secure is my information when using airSlate SignNow for form 2555?

Security is a priority at airSlate SignNow. When using the platform for form 2555, your information is protected through advanced encryption and compliance with industry standards. You can confidently manage your documents, knowing that sensitive data is kept safe from unauthorized access.

Get more for Form 2555

- Badmasti form

- Short form general photography contract

- Personal financial statement firstcaribbean international bank form

- Pour over will 20750 form

- Durham council tax number form

- Interconnection applicationagreement level 1 atlantic city electric form

- Egg drop experiment report form

- Tenant notice of termination of lease agreement template form

Find out other Form 2555

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer