2555 Form 2011

What is the 2555 Form

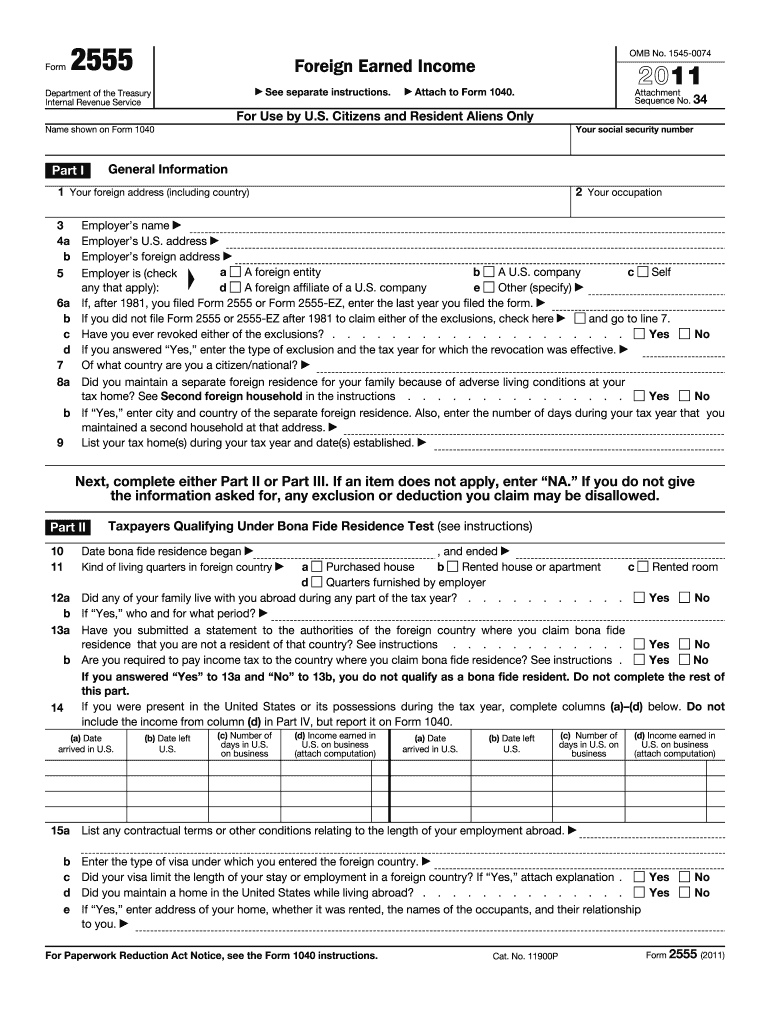

The 2555 Form, officially known as the Foreign Earned Income Exclusion, is a tax form used by U.S. citizens and resident aliens who earn income abroad. This form allows eligible taxpayers to exclude a portion of their foreign earnings from U.S. taxation. The purpose of the form is to alleviate double taxation for individuals working outside the United States, recognizing the unique financial challenges they face. By completing the 2555 Form, taxpayers can potentially reduce their taxable income significantly, depending on their earnings and living situation abroad.

How to use the 2555 Form

Using the 2555 Form involves several steps to ensure accurate completion and submission. Taxpayers must first determine their eligibility based on residency and income criteria. The form requires detailed information about foreign earnings, including the amount earned, the country of residence, and the duration of stay. Taxpayers should also gather supporting documentation, such as pay stubs and tax returns from the foreign country. Once the form is completed, it should be filed along with the individual's annual tax return to the IRS. Understanding the nuances of the form is crucial for maximizing potential tax benefits.

Steps to complete the 2555 Form

Completing the 2555 Form involves a systematic approach to ensure all necessary information is accurately reported. Here are the essential steps:

- Determine eligibility for the Foreign Earned Income Exclusion by meeting the physical presence test or the bona fide residence test.

- Gather relevant financial documents, including proof of foreign income and residency.

- Fill out the form by providing personal information, foreign income details, and any applicable deductions.

- Calculate the exclusion amount based on current IRS limits for foreign earned income.

- Review the completed form for accuracy before submission.

Legal use of the 2555 Form

The legal use of the 2555 Form is governed by IRS regulations, which stipulate the requirements for claiming the Foreign Earned Income Exclusion. To be valid, the form must be completed accurately and submitted within the appropriate tax filing deadlines. Taxpayers must ensure compliance with all IRS guidelines, including maintaining proper documentation to support their claims. Failure to adhere to these regulations may result in penalties or denial of the exclusion. Understanding the legal framework surrounding the form is vital for safeguarding against potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 2555 Form align with the standard tax return deadlines set by the IRS. Typically, individual taxpayers must file their returns by April 15 of the year following the tax year. However, those living abroad may qualify for an automatic extension, allowing them to file by June 15. It is essential to be aware of these dates to ensure timely submission and avoid penalties. Additionally, any taxes owed should be paid by the original due date to prevent interest and late fees.

Eligibility Criteria

Eligibility for using the 2555 Form hinges on specific criteria set by the IRS. Taxpayers must be U.S. citizens or resident aliens who have foreign earned income and meet either the physical presence test or the bona fide residence test. The physical presence test requires individuals to be outside the United States for at least 330 full days during a 12-month period. The bona fide residence test necessitates that individuals establish a permanent residence in a foreign country. Meeting these criteria is essential for qualifying for the Foreign Earned Income Exclusion.

Quick guide on how to complete 2011 2555 form

Complete 2555 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage 2555 Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign 2555 Form without any hassle

- Find 2555 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow has specially designed for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and press the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 2555 Form and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 2555 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 2555 form

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the 2555 Form and why is it important?

The 2555 Form is essential for U.S. citizens and resident aliens who earn income abroad and want to claim the Foreign Earned Income Exclusion. Filling out the 2555 Form allows taxpayers to exclude a portion of their income from U.S. taxation, thereby potentially reducing their tax liability signNowly.

-

How can airSlate SignNow help in filling out the 2555 Form?

airSlate SignNow streamlines the process of completing the 2555 Form by offering easy-to-use electronic signing and document management features. With our platform, you can fill out, eSign, and securely send the form to relevant parties without the hassle of printing or mailing.

-

Is there a cost associated with using airSlate SignNow for the 2555 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, ensuring a cost-effective solution for handling the 2555 Form. We provide a free trial, so you can explore our features before committing to a subscription.

-

What are the key features of airSlate SignNow for managing the 2555 Form?

Key features of airSlate SignNow include intuitive document editing, secure eSigning, and real-time tracking of document status. These functionalities simplify the completion of the 2555 Form, making it easier to manage important tax documents efficiently.

-

Can I integrate airSlate SignNow with my existing tax software when using the 2555 Form?

Absolutely! airSlate SignNow offers seamless integrations with popular tax software, allowing users to streamline their workflows while completing the 2555 Form. This integration capability ensures that your documents are easily accessible and manageable.

-

What benefits does airSlate SignNow provide for businesses filing the 2555 Form?

Using airSlate SignNow for the 2555 Form offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved security for sensitive information. These advantages enable businesses to focus on their core activities while ensuring compliance with tax regulations.

-

How do I get started with airSlate SignNow for the 2555 Form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose the appropriate plan, and you can begin managing your documents, including the 2555 Form, right away. Our user-friendly interface guides you through the entire process.

Get more for 2555 Form

- Nhif outpatient registration online form

- Pre departure foreign travel form

- Saudi arabia application form

- Passport correction form bd

- Use this power of attorney if you are going to move to someone work study or visit sweden and you want someone form

- Nigerian passport application form pdf

- Nigeria embassy new york form

- Acte de mariage ambassade du cameroun en tunisie form

Find out other 2555 Form

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast