Form 2555 1998

What is the Form 2555

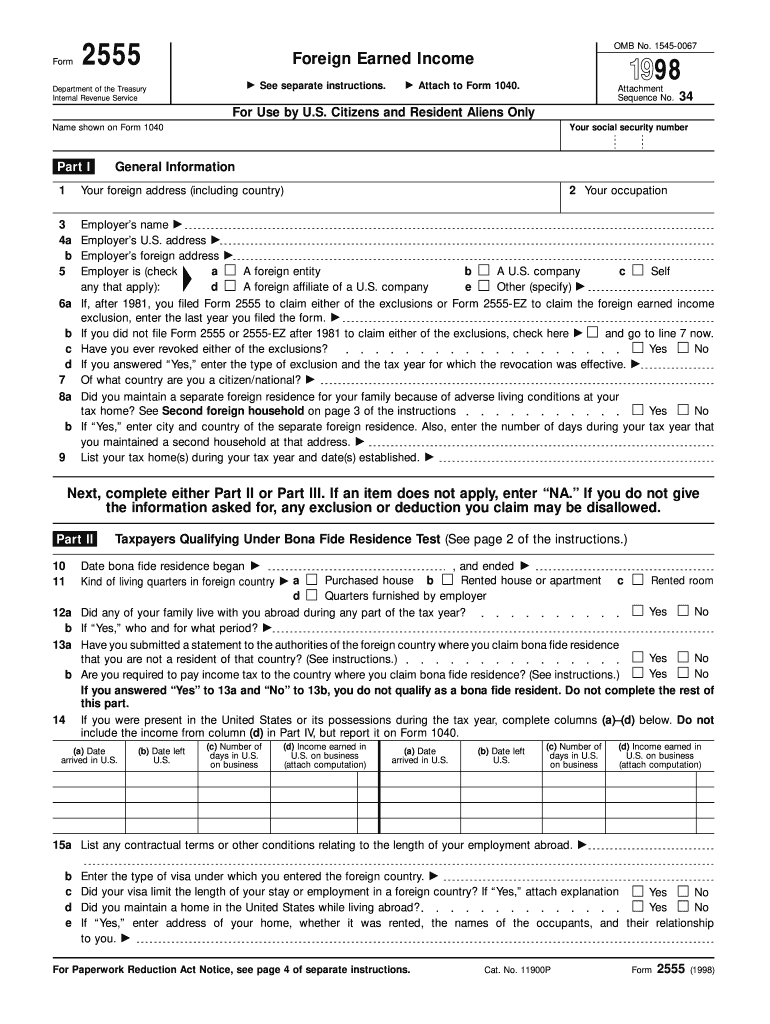

The Form 2555 is a tax form used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible taxpayers to exclude a portion of their foreign earnings from U.S. taxation, thereby reducing their taxable income. The primary purpose of the form is to help individuals who live and work abroad avoid double taxation on their income. To qualify, taxpayers must meet specific criteria regarding their residency and the nature of their foreign employment.

How to use the Form 2555

Using the Form 2555 involves several steps to ensure accurate completion and compliance with IRS regulations. Taxpayers must first determine their eligibility based on the foreign earned income and their physical presence in a foreign country. Once eligibility is established, individuals can fill out the form by providing necessary details such as foreign income, housing expenses, and the duration of their stay abroad. After completing the form, it must be submitted with the taxpayer's annual income tax return to the IRS.

Steps to complete the Form 2555

Completing the Form 2555 requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial documents, including proof of foreign income and residency.

- Determine your eligibility by reviewing the physical presence test or the bona fide residence test.

- Fill out the form, ensuring all income and expenses are accurately reported.

- Calculate the exclusion amount based on the IRS guidelines.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return by the designated deadline.

Legal use of the Form 2555

The Form 2555 is legally binding when completed and submitted according to IRS guidelines. To ensure its legality, taxpayers must provide truthful information and maintain proper documentation of their foreign income and residency status. The form must be filed in conjunction with the taxpayer's annual return, and failure to comply with IRS regulations may result in penalties or disqualification from the exclusion.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 2555. Taxpayers should refer to the IRS instructions for the form, which outline eligibility requirements, necessary documentation, and filing procedures. Adhering to these guidelines is crucial for successfully claiming the Foreign Earned Income Exclusion and avoiding potential issues with the IRS.

Required Documents

To complete the Form 2555, taxpayers need to gather several key documents, including:

- Proof of foreign earned income, such as pay stubs or tax returns from the foreign country.

- Documentation of residency in a foreign country, such as a lease agreement or utility bills.

- Any additional forms or schedules that may be required to support the claims made on the Form 2555.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the Form 2555 to ensure compliance with IRS regulations. Generally, the form must be submitted by the same deadline as the taxpayer's annual income tax return, which is typically April fifteenth. However, taxpayers living abroad may qualify for an automatic extension, allowing them to file up to June fifteenth without penalties. It is essential to check for any updates or changes to these deadlines each tax year.

Quick guide on how to complete 1998 2014 form 2555

Prepare Form 2555 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, alter, and electronically sign your documents swiftly without holdups. Manage Form 2555 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Form 2555 with ease

- Locate Form 2555 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 2555 to ensure outstanding communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1998 2014 form 2555

Create this form in 5 minutes!

How to create an eSignature for the 1998 2014 form 2555

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the Form 2555 and who needs it?

The Form 2555 is used by U.S. citizens and resident aliens living abroad to claim the Foreign Earned Income Exclusion. If you earn income outside the U.S. and wish to avoid double taxation, completing Form 2555 is essential for beneficial tax treatment.

-

How can airSlate SignNow assist with the Form 2555 process?

airSlate SignNow streamlines the process of preparing and submitting Form 2555 by allowing you to easily send, eSign, and manage your documents securely online. This simplifies the paperwork associated with tax filings for individuals residing abroad.

-

Is there a cost associated with using airSlate SignNow for Form 2555?

Yes, airSlate SignNow offers various pricing plans tailored to individuals and businesses. For users needing to manage Form 2555 documentation efficiently, the plans are designed to be cost-effective while providing robust features for eSigning and document management.

-

What features make airSlate SignNow ideal for handling Form 2555?

airSlate SignNow features a user-friendly interface, customizable templates, and electronic signature capabilities that make managing Form 2555 more efficient. Additionally, real-time tracking and notifications ensure you stay updated throughout the process.

-

Can I integrate airSlate SignNow with other applications for Form 2555 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it easier to manage your Form 2555 workflow. This integration helps enhance productivity and maintain organized records of important tax documents.

-

What are the benefits of using airSlate SignNow for Form 2555 eSignatures?

Using airSlate SignNow for Form 2555 eSignatures offers the advantage of speed and security. You can expedite your tax filing process while ensuring that your documents are safeguarded and compliant with eSignature laws.

-

Is airSlate SignNow secure for handling sensitive documents like Form 2555?

Yes, airSlate SignNow prioritizes security and uses encryption protocols to protect sensitive documents like Form 2555. Your data remains safe and confidential while ensuring compliance with industry standards.

Get more for Form 2555

- Subcontractors package georgia form

- Georgia identity form

- Georgia identity 497304135 form

- Georgia deceased form

- Identity theft by known imposter package georgia form

- Ga assets form

- Essential documents for the organized traveler package georgia form

- Essential documents for the organized traveler package with personal organizer georgia form

Find out other Form 2555

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now