Form 941 2019

What is the Form 941

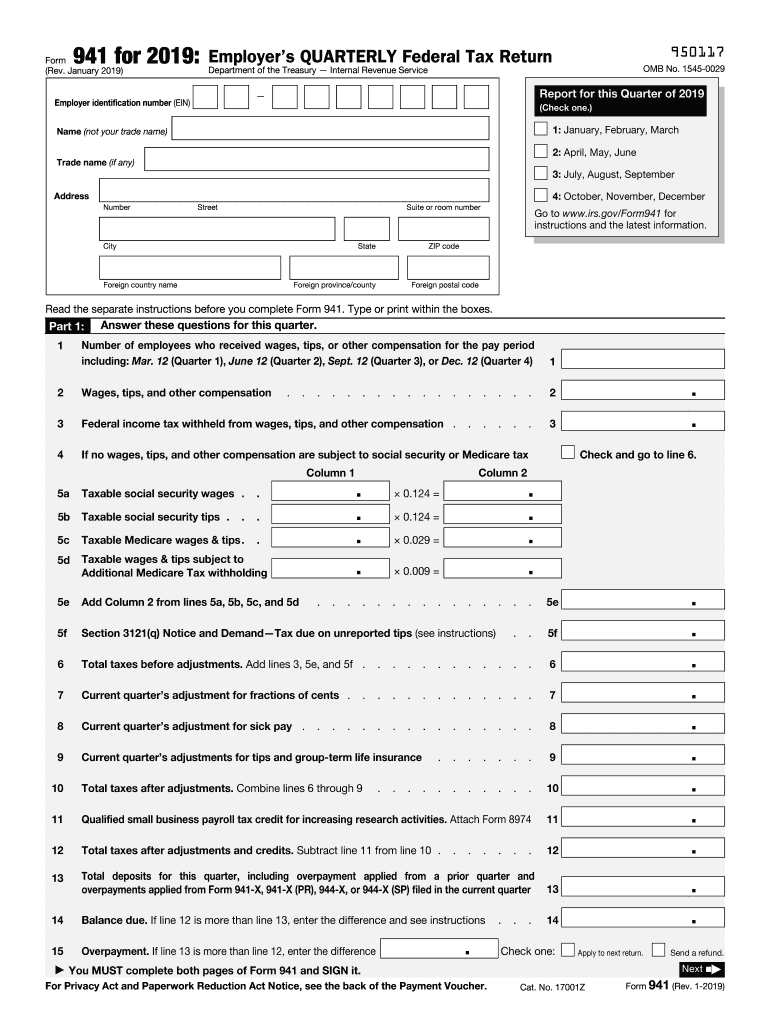

The Form 941 is a quarterly payroll tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is essential for businesses to accurately report these figures to the Internal Revenue Service (IRS). This form is required for most employers, including corporations, partnerships, and sole proprietorships, who pay wages to employees. The 941 for 2018 specifically pertains to the tax year 2018, and it must be filed for each quarter of that year.

Steps to complete the Form 941

Completing the Form 941 involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records, including total wages paid, tips reported, and federal income tax withheld. Next, enter the total number of employees and the amount of wages subject to Social Security and Medicare taxes. Calculate the total taxes owed and any adjustments for the quarter. Finally, review the form for accuracy before signing and dating it. It is crucial to ensure that all calculations are correct to avoid penalties or interest from the IRS.

Filing Deadlines / Important Dates

For the year 2018, the IRS set specific deadlines for filing Form 941. Employers must file the form by the last day of the month following the end of each quarter. The deadlines for 2018 are as follows:

- First quarter (January to March): April 30, 2018

- Second quarter (April to June): July 31, 2018

- Third quarter (July to September): October 31, 2018

- Fourth quarter (October to December): January 31, 2019

Employers should be aware that failure to file on time may result in penalties, so it is important to adhere to these deadlines.

How to obtain the Form 941

The Form 941 can be easily obtained from the IRS website. It is available as a printable PDF that can be filled out by hand or electronically. Employers may also access the form through various tax software programs that support payroll tax reporting. Additionally, some accounting firms and tax professionals can provide the form and assist with its completion. It is important to ensure that the correct version of the form is used for the appropriate tax year.

Legal use of the Form 941

The Form 941 must be filed in accordance with IRS regulations to maintain its legal validity. Employers are required to report accurate figures for wages paid and taxes withheld. Misreporting or failing to file can lead to legal repercussions, including fines and penalties. It is crucial for employers to maintain proper records and documentation to support the information reported on the form. Compliance with all IRS guidelines ensures that the form serves its intended purpose without legal complications.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form 941 to the IRS. The form can be filed electronically through the IRS e-file system, which is a secure and efficient method. Alternatively, employers may choose to mail a paper version of the form to the appropriate IRS address based on their location. In-person submission is generally not an option for Form 941, as the IRS does not accept walk-in filings for this form. It is advisable to keep a copy of the submitted form and any confirmation received for future reference.

Quick guide on how to complete file 941 online 2019 form

Uncover the easiest method to complete and endorse your Form 941

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and endorse your Form 941 and similar forms for public services. Our intelligent electronic signature solution provides everything necessary to handle documents swiftly and in accordance with regulatory standards - powerful PDF editing, managing, securing, signing, and sharing features all available within a user-friendly interface.

Only a few steps are required to finalize filling out and signing your Form 941:

- Insert the fillable template into the editor using the Get Form button.

- Review the information you need to enter in your Form 941.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the sections with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is particularly signNow or Obscure fields that are no longer relevant.

- Hit Sign to produce a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and finalize your task with the Done button.

Store your finished Form 941 in the Documents folder within your account, download it, or transfer it to your choice of cloud storage. Our service also offers versatile file sharing options. There’s no need to print your templates when you need to submit them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct file 941 online 2019 form

FAQs

-

Is there software that allows a customer to fill out an online form and receive a large file?

There are a couple of ways to achieve this:1. Create a form using an online form builder like EmailmeForm.2. Give your users access to the document via 3 ways:- Redirect them to the download link url upon completing the form (fastest approach)- Insert the file download link in the form’s Success Message- Automatically send a confirmation email with the document link to users who have successfully completed your form.Whichever of these 3 methods you use, you are still sure that you only give the link the people who have completely answered your form.As for your document, you can just upload it on Google Drive or Dropbox and get the shareable url.Disclaimer: I work for EmailMeForm

-

What do you put on Schedule B when filling out Form 941?

Form 941 Schedule B can be filled out in 5 steps:1. Enter business info (Name and EIN)2. Choose tax year/quarter3. Select the quarter you’re filing for4. Enter your tax liability by semi-weekly & total liability for the quarter5. Attach to Form 941 & transmit to the IRS(these instructions work best when paired with TaxBandits e-filing)

-

How I fill GATE 2019 Application form online?

Here is a lot of information on GATE from where you can find out how to fill the application form, too. Moreover, there are articles, videos, discussions, etc. that can help you to prepare for the examination.You can get a lot of valuable information from here.

-

Where can I file multiple 941 forms with one account online?

Once you make a free account with TaxBandits–an IRS-authorized e-filer–your credentials enable you to file any/ as many forms as you need, whether that’s just the 941 Forms for every quarter or multiple 941s for all your clients.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

Create this form in 5 minutes!

How to create an eSignature for the file 941 online 2019 form

How to make an eSignature for the File 941 Online 2019 Form online

How to generate an electronic signature for the File 941 Online 2019 Form in Google Chrome

How to generate an eSignature for putting it on the File 941 Online 2019 Form in Gmail

How to create an electronic signature for the File 941 Online 2019 Form from your mobile device

How to create an electronic signature for the File 941 Online 2019 Form on iOS devices

How to generate an electronic signature for the File 941 Online 2019 Form on Android OS

People also ask

-

What is Form 941 and why is it important for businesses?

Form 941 is a quarterly tax return used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Understanding how to correctly fill out Form 941 is crucial for compliance with IRS regulations and avoiding penalties. airSlate SignNow can streamline the process of signing and sending Form 941, ensuring you stay compliant and organized.

-

How can airSlate SignNow help with the completion of Form 941?

airSlate SignNow provides an intuitive platform for electronically signing and sending Form 941. With our user-friendly interface, you can easily fill out the necessary fields, add signatures, and share the document securely with your team or accountant. This simplifies the process, allowing for quicker submissions and reducing the chances of errors.

-

What features does airSlate SignNow offer for managing Form 941?

airSlate SignNow offers features like document templates, bulk sending, and real-time tracking that make managing Form 941 efficient. You can create a reusable template for Form 941, ensuring all necessary information is consistently filled out. Additionally, tracking allows you to see when the form is opened, signed, and completed.

-

Is airSlate SignNow cost-effective for small businesses needing to file Form 941?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to file Form 941. With flexible pricing plans, you can choose a package that fits your budget while still gaining access to powerful document management tools. This makes it easier for small businesses to handle their tax forms efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for Form 941?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage Form 941 alongside your financial records. This integration ensures that your data flows smoothly between systems, reducing the risk of errors and saving you time during tax season.

-

What are the benefits of using airSlate SignNow for electronic signatures on Form 941?

Using airSlate SignNow for electronic signatures on Form 941 provides several benefits, including faster processing times and enhanced security. Electronic signatures are legally binding and can be completed from anywhere, making it easier to get the necessary approvals without delays. Additionally, our platform offers secure storage for your signed documents, ensuring compliance with legal standards.

-

How does airSlate SignNow ensure the security of Form 941 documents?

airSlate SignNow prioritizes the security of your documents, including Form 941, with advanced encryption and compliance with industry standards. We utilize secure servers and maintain strict access controls to protect your data from unauthorized access. This commitment to security ensures that your sensitive tax information is safe throughout the signing and sending process.

Get more for Form 941

- See bformb aoc cv 663 motion to contest validity of a b nccourts

- Pediatric intake form east valley naturopathic

- Civ 531 alaska form

- Motion to stay final judgment amp objection to sale foreclosure pro form

- Maid2clean worker attendance payment form maid2clean co

- Office of home energy programs form

- Subscription us agreement template form

- Subsidiary agreement template form

Find out other Form 941

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure