Form 2290 Rev July Heavy Highway Vehicle Use Tax Return 2022

What is the Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

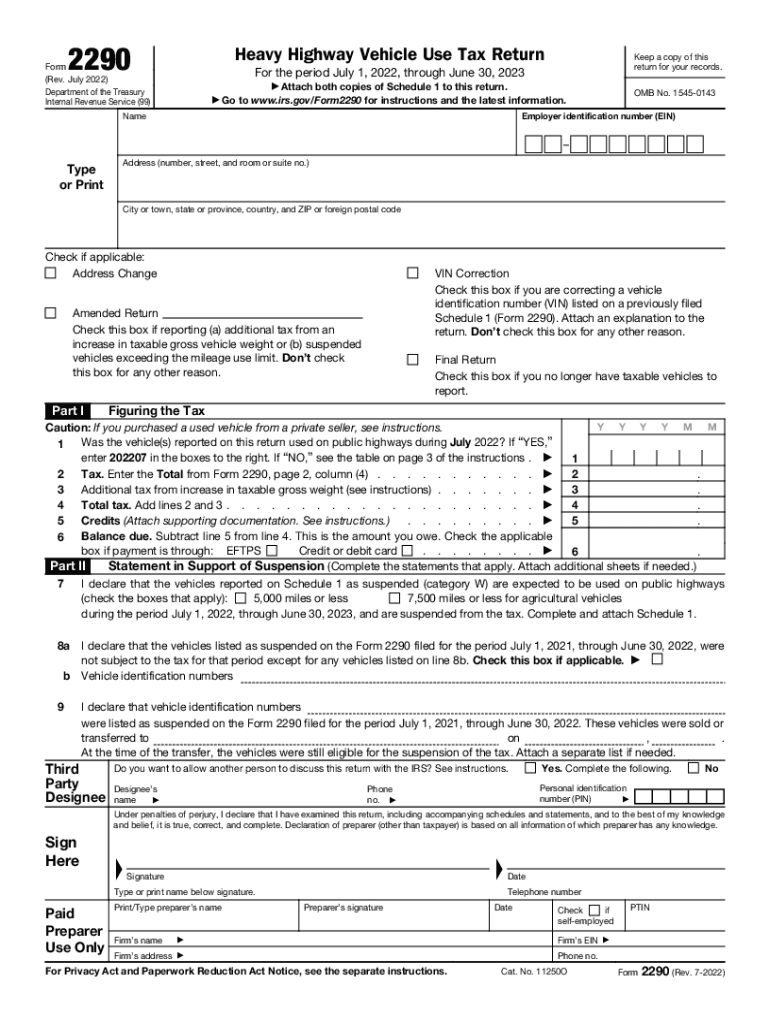

The Form 2290, officially known as the Heavy Highway Vehicle Use Tax Return, is a tax form used by vehicle owners to report and pay the federal highway use tax. This form is specifically designed for vehicles that have a gross weight of 55,000 pounds or more and are used on public highways. The tax is imposed on heavy vehicles to fund the maintenance and construction of highways, ensuring that the infrastructure is maintained for all users. Understanding this form is crucial for compliance with IRS regulations and for avoiding potential penalties.

Steps to complete the Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

Completing the Form 2290 involves several key steps to ensure accurate reporting and payment of the highway use tax. First, gather all necessary information, including the vehicle identification number (VIN), gross weight, and the date the vehicle was first used on the highway during the tax period. Next, calculate the tax owed based on the vehicle's weight and the applicable tax rates. Fill out the form accurately, ensuring all details are correct. Finally, submit the form electronically or via mail to the IRS, along with the payment for the tax due. Keeping a copy of the completed form for your records is also advisable.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2290 are critical to avoid penalties. The form must be submitted by the last day of the month following the month of first use of the vehicle. For example, if a vehicle is first used in July, the form must be filed by August 31. Additionally, if you are filing for the first time or if there are changes in your vehicle status, it is essential to be aware of the annual deadline, which typically falls on August 31 for the upcoming tax year. Marking these dates on your calendar helps ensure timely compliance.

Legal use of the Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

The legal use of the Form 2290 is governed by IRS regulations, which stipulate that it must be filed by all owners of heavy vehicles that meet the weight threshold. This form serves as proof of payment of the highway use tax, which is required for vehicles operating on public highways. Failure to file the form or pay the associated tax can result in penalties and interest charges. It is important to ensure that the information provided is accurate and complete to maintain compliance with federal tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Form 2290 can be submitted through various methods, providing flexibility for taxpayers. The most efficient method is electronic filing, which allows for quicker processing and immediate confirmation of submission. Alternatively, taxpayers may choose to mail the completed form to the IRS, though this may result in longer processing times. In-person submission is generally not available, as the IRS encourages electronic filing for efficiency. Regardless of the method chosen, ensure that all required information and payment are included to avoid delays.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 2290 can lead to significant penalties. If the form is not filed by the deadline, the IRS may impose a penalty based on the amount of tax owed. Additionally, interest may accrue on any unpaid taxes. It is essential to file the form accurately and on time to avoid these consequences. Understanding the implications of non-compliance can help vehicle owners take proactive steps to ensure they meet their tax obligations.

Quick guide on how to complete form 2290 rev july 2022 heavy highway vehicle use tax return

Effortlessly Prepare Form 2290 Rev July Heavy Highway Vehicle Use Tax Return on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the required format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your files swiftly without delays. Manage Form 2290 Rev July Heavy Highway Vehicle Use Tax Return across any platform using the airSlate SignNow Android or iOS apps and simplify any document-related task today.

How to Edit and eSign Form 2290 Rev July Heavy Highway Vehicle Use Tax Return with Ease

- Obtain Form 2290 Rev July Heavy Highway Vehicle Use Tax Return and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finish button to save your changes.

- Select how you wish to send your form, via email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 2290 Rev July Heavy Highway Vehicle Use Tax Return and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2290 rev july 2022 heavy highway vehicle use tax return

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to gov irs?

airSlate SignNow is an electronic signature platform that allows users to create, send, and eSign documents securely. It is particularly useful for businesses handling forms related to gov irs, ensuring that all signed documents are compliant with IRS regulations.

-

Is airSlate SignNow suitable for small businesses dealing with gov irs requirements?

Yes, airSlate SignNow is an ideal solution for small businesses that need to manage documents related to gov irs efficiently. Its user-friendly features allow small teams to streamline their document workflows, even when dealing with complex regulatory requirements.

-

What pricing plans does airSlate SignNow offer for gov irs users?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for teams frequently handling gov irs documentation. With competitive pricing, businesses can choose a plan that best fits their budget while benefiting from a comprehensive eSigning solution.

-

What features does airSlate SignNow include that are beneficial for gov irs documentation?

Key features of airSlate SignNow beneficial for gov irs documentation include customizable templates, secure storage, and detailed audit trails. These tools help businesses ensure compliance with IRS standards and maintain proper records for all eSigned documents.

-

How does airSlate SignNow integrate with other tools relevant to gov irs?

airSlate SignNow seamlessly integrates with popular software such as Google Drive, Dropbox, and various CRM systems. This capability is particularly useful for businesses that need to manage documents efficiently while complying with gov irs requirements.

-

Can airSlate SignNow help with tax-related documents for gov irs?

Absolutely! airSlate SignNow is effective for managing tax-related documents that require eSignatures, ensuring compliance with gov irs regulations. By using this platform, businesses can expedite their filing processes while keeping everything organized and secure.

-

What are the security measures in place for gov irs documents in airSlate SignNow?

airSlate SignNow prioritizes security with features such as encryption, secure cloud storage, and user authentication. These measures are essential for businesses handling sensitive gov irs documents, ensuring that all data remains protected throughout the eSigning process.

Get more for Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

- New hampshire landlord 497318647 form

- New hampshire lease form

- Nh tenant in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497318650 form

- New hampshire letter 497318651 form

- Nh tenant form

- New hampshire letter 497318653 form

- New hampshire letter 497318654 form

Find out other Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online