Form 2290 Rev July Heavy Highway Vehicle Use Tax Return 2024-2026

What is the Form 2290 Heavy Highway Vehicle Use Tax Return

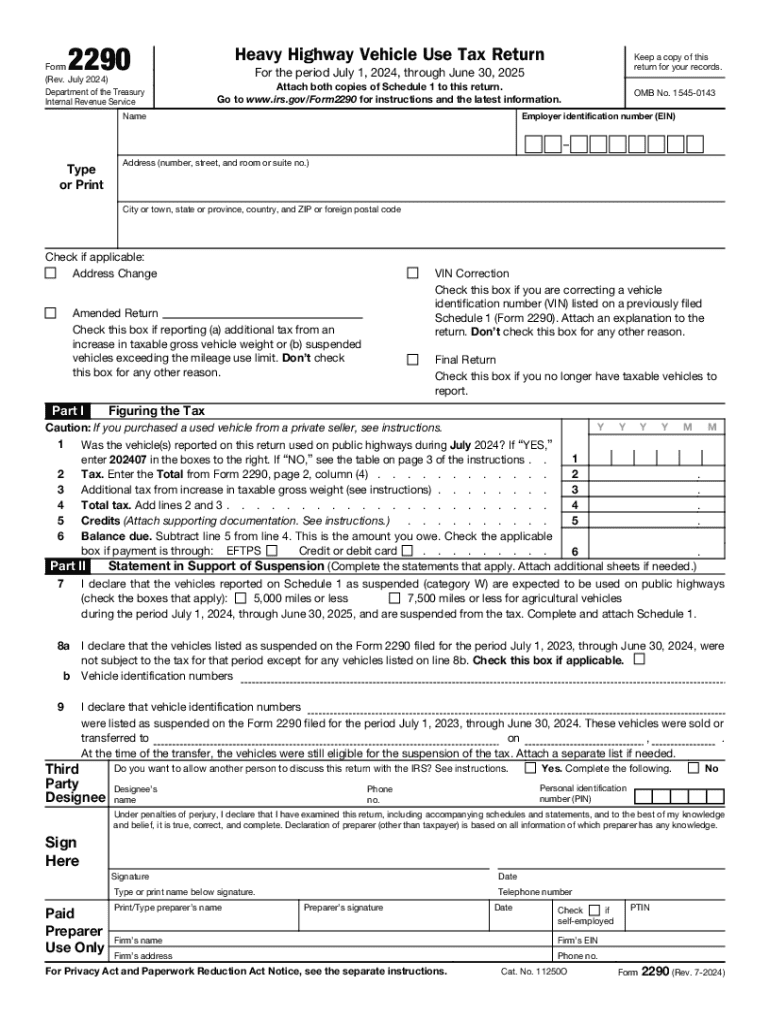

The Form 2290, officially known as the Heavy Highway Vehicle Use Tax Return, is a federal tax form required by the Internal Revenue Service (IRS) for owners of heavy vehicles that operate on public highways. This form is primarily used to report and pay the Highway Use Tax, which is a tax imposed on vehicles with a gross weight of 55,000 pounds or more. The revenue generated from this tax is used to fund the construction and maintenance of highways. It is essential for vehicle owners to understand their obligations under this tax to ensure compliance with federal regulations.

Steps to Complete the Form 2290 Heavy Highway Vehicle Use Tax Return

Completing the Form 2290 involves several key steps to ensure accurate filing. First, gather necessary information, including the vehicle identification number (VIN), gross weight, and the date the vehicle was first used on public highways. Next, calculate the tax amount based on the vehicle's weight and the tax rate applicable for the current tax year. After filling out the form, review it for accuracy and completeness. Finally, submit the form electronically or by mail to the IRS, ensuring that you keep a copy for your records. Filing online is often faster and may provide immediate confirmation of receipt.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with Form 2290. The tax year for this form runs from July first to June thirtieth of the following year. The deadline for filing the Form 2290 is typically August 31 of each year. If you acquire a new vehicle during the tax year, you must file Form 2290 within 30 days of its first use. Failure to file by these deadlines can result in penalties and interest on any unpaid taxes.

Form Submission Methods

Form 2290 can be submitted through various methods, including electronic filing and traditional mail. E-filing is often the preferred method as it is faster and allows for immediate confirmation of submission. Several IRS-approved e-filing providers offer user-friendly platforms for completing and submitting the form online. Alternatively, you can print the completed form and mail it to the appropriate IRS address, but this method may result in longer processing times.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 2290 can lead to significant penalties. If the form is not filed by the deadline, the IRS may impose a penalty of up to 4.5 percent of the total tax due for each month the return is late, capped at 22.5 percent. Additionally, interest may accrue on any unpaid taxes. It is essential to stay informed about filing requirements to avoid these financial consequences.

Eligibility Criteria

To be eligible for filing Form 2290, the vehicle must meet specific criteria. Primarily, the form applies to heavy vehicles with a gross weight of 55,000 pounds or more that are used on public highways. Additionally, vehicles that are exempt from the Highway Use Tax include those used exclusively for agricultural purposes and vehicles that are not driven on public highways. Understanding these criteria helps ensure that the correct vehicles are reported, maintaining compliance with IRS regulations.

Handy tips for filling out Form 2290 Rev July Heavy Highway Vehicle Use Tax Return online

Quick steps to complete and e-sign Form 2290 Rev July Heavy Highway Vehicle Use Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant service for maximum simpleness. Use signNow to electronically sign and send Form 2290 Rev July Heavy Highway Vehicle Use Tax Return for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 2290 rev july heavy highway vehicle use tax return

Create this form in 5 minutes!

How to create an eSignature for the form 2290 rev july heavy highway vehicle use tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 2290 tax filing and who needs to file it?

2290 tax filing refers to the IRS Form 2290, which is used by heavy vehicle owners to report and pay the Heavy Highway Vehicle Use Tax. Businesses that operate vehicles with a gross weight of 55,000 pounds or more are required to file this form annually. Understanding the requirements for 2290 tax filing is crucial to avoid penalties and ensure compliance.

-

How can airSlate SignNow assist with 2290 tax filing?

airSlate SignNow simplifies the 2290 tax filing process by allowing users to eSign and send necessary documents securely and efficiently. Our platform provides templates and tools that streamline the preparation and submission of Form 2290, making it easier for businesses to manage their tax obligations. With airSlate SignNow, you can focus on your business while we handle the paperwork.

-

What are the pricing options for using airSlate SignNow for 2290 tax filing?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solutions ensure that you can manage your 2290 tax filing without breaking the bank. You can choose from monthly or annual subscriptions, allowing you to select the plan that best fits your needs.

-

Are there any features specifically designed for 2290 tax filing?

Yes, airSlate SignNow includes features tailored for 2290 tax filing, such as customizable templates, secure eSigning, and document tracking. These tools help ensure that your filings are accurate and submitted on time. Additionally, our user-friendly interface makes it easy to navigate the 2290 tax filing process.

-

What are the benefits of using airSlate SignNow for 2290 tax filing?

Using airSlate SignNow for 2290 tax filing offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform reduces the risk of errors and ensures that your documents are securely stored and easily accessible. This allows you to focus on your core business activities while we take care of your tax filing needs.

-

Can I integrate airSlate SignNow with other software for 2290 tax filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your 2290 tax filing experience. This integration allows for easy data transfer and ensures that all your financial information is synchronized, making the filing process more efficient and less prone to errors.

-

Is there customer support available for 2290 tax filing with airSlate SignNow?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions or issues related to 2290 tax filing. Our knowledgeable support team is available via chat, email, or phone to ensure you have the help you need. We are committed to making your experience as smooth as possible.

Get more for Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

Find out other Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement