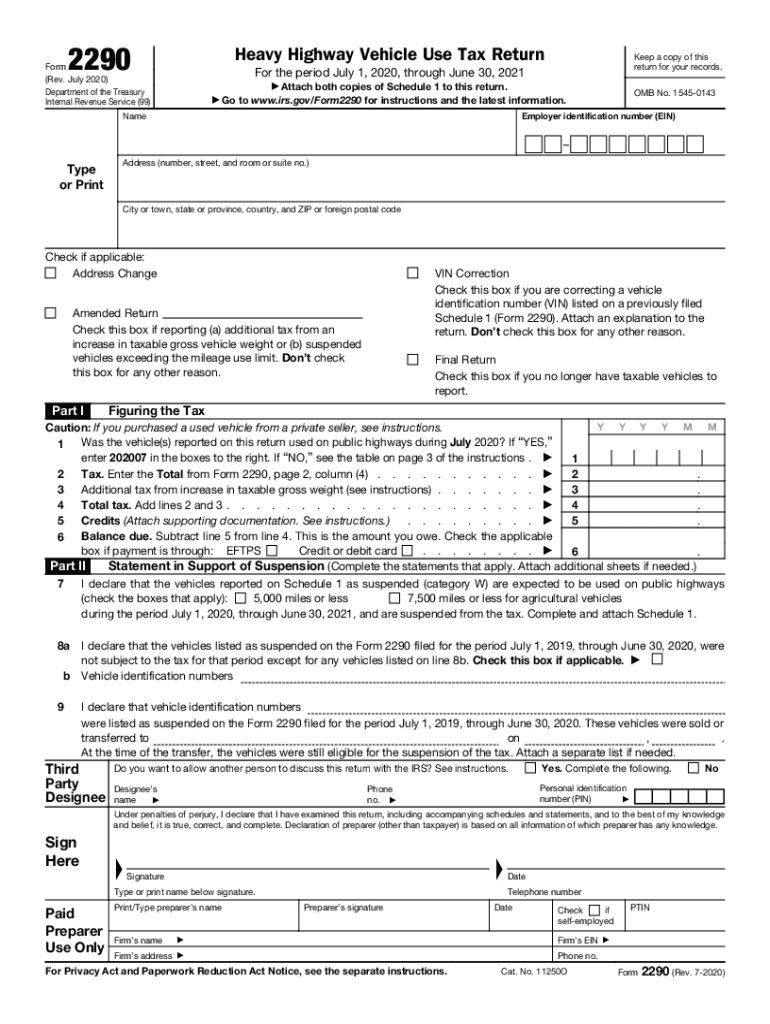

Form 2290 Rev July Heavy Highway Vehicle Use Tax Return 2020

What is the federal heavy use tax 2290 form?

The federal heavy use tax 2290 form, officially known as the Heavy Highway Vehicle Use Tax Return, is a tax document required by the Internal Revenue Service (IRS) for individuals and businesses that operate heavy vehicles on public highways. This form is specifically designed for vehicles with a gross weight of 55,000 pounds or more. It helps the IRS assess the tax owed based on the weight and usage of these vehicles. The tax is typically calculated annually and is due by the end of the month following the month of first use of the vehicle during the tax year.

Steps to complete the federal heavy use tax 2290 form

Completing the federal heavy use tax 2290 form involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information about the vehicle, including its Vehicle Identification Number (VIN) and the date it was first used on public highways. Next, calculate the tax owed based on the weight of the vehicle and any applicable credits. Once the calculations are complete, fill out the form accurately, ensuring that all sections are completed. After reviewing the form for errors, submit it to the IRS either electronically or via mail, depending on your preference.

How to obtain the federal heavy use tax 2290 form

The federal heavy use tax 2290 form can be obtained directly from the IRS website or through authorized e-filing providers. For those who prefer a paper version, the form can be printed from the IRS site. It is important to ensure that you are using the most current version of the form, as updates may occur. Additionally, many tax preparation software programs include the form, allowing for easier completion and submission.

Filing deadlines for the federal heavy use tax 2290 form

Filing deadlines for the federal heavy use tax 2290 form are crucial for compliance. The form must be filed by the last day of the month following the month in which the vehicle was first used. For example, if a vehicle is first used in July, the form is due by August 31. If the deadline falls on a weekend or holiday, it is extended to the next business day. Additionally, annual renewals must be filed by August 31 each year for the upcoming tax year.

Legal use of the federal heavy use tax 2290 form

The legal use of the federal heavy use tax 2290 form is governed by IRS regulations. Proper completion and timely submission of the form are essential to avoid penalties. The information provided on the form must be accurate, as any discrepancies may lead to audits or fines. It is also important to retain a copy of the submitted form and any payment receipts for your records, as these may be required for future reference or audits.

Form submission methods for the federal heavy use tax 2290 form

The federal heavy use tax 2290 form can be submitted in several ways. Taxpayers have the option to file electronically through authorized e-filing services, which is often faster and more efficient. Alternatively, the form can be mailed to the IRS at the address specified in the form instructions. For those who prefer in-person submissions, visiting a local IRS office may also be an option, although this method is less common.

Quick guide on how to complete form 2290 rev july 2020 heavy highway vehicle use tax return

Effortlessly Prepare Form 2290 Rev July Heavy Highway Vehicle Use Tax Return on Any Device

Digital document management has gained popularity among companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Form 2290 Rev July Heavy Highway Vehicle Use Tax Return on any platform with the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

The Simplest Way to Modify and eSign Form 2290 Rev July Heavy Highway Vehicle Use Tax Return Without Stress

- Locate Form 2290 Rev July Heavy Highway Vehicle Use Tax Return and click Get Form to begin.

- Use the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and hit the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Form 2290 Rev July Heavy Highway Vehicle Use Tax Return and guarantee seamless communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2290 rev july 2020 heavy highway vehicle use tax return

Create this form in 5 minutes!

How to create an eSignature for the form 2290 rev july 2020 heavy highway vehicle use tax return

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the federal heavy use tax 2290 form?

The federal heavy use tax 2290 form is a tax document required for individuals and businesses that operate heavy vehicles with a gross weight of 55,000 pounds or more. This form helps the IRS track the use of heavy vehicles on public highways and ensures compliance with tax regulations. It's crucial for vehicle owners to file this form on time to avoid penalties.

-

How can airSlate SignNow help with the federal heavy use tax 2290 form?

airSlate SignNow streamlines the process of completing and eSigning the federal heavy use tax 2290 form. Our easy-to-use platform simplifies document management and allows users to fill out necessary information quickly. With secure eSignature capabilities, you can ensure your forms are signed and submitted with ease.

-

Is there a cost associated with filing the federal heavy use tax 2290 form through airSlate SignNow?

Yes, there is a nominal fee for using airSlate SignNow to file the federal heavy use tax 2290 form. This cost is offset by the time and effort you save in managing and signing your documents online. Our pricing plans are designed to be affordable and efficient for all users.

-

What features does airSlate SignNow offer for managing the federal heavy use tax 2290 form?

airSlate SignNow offers features like custom templates, secure cloud storage, and easy collaboration to manage the federal heavy use tax 2290 form effectively. Users can create and save templates for future use, share documents securely, and ensure all necessary fields are completed before submission. These features enhance the overall filing experience.

-

Can I integrate airSlate SignNow with other applications for filing the federal heavy use tax 2290 form?

Yes, airSlate SignNow offers integrations with various applications to facilitate the filing of the federal heavy use tax 2290 form. You can connect our platform with your existing tools such as CRM systems, accounting software, and more, streamlining your workflow and ensuring a seamless process.

-

What are the benefits of electronic filing of the federal heavy use tax 2290 form with airSlate SignNow?

Using airSlate SignNow for electronic filing of the federal heavy use tax 2290 form brings numerous benefits. You'll enjoy faster processing times, reduced paperwork, and the convenience of managing documents from anywhere. Additionally, eSignature ensures your forms are legally binding and secure.

-

How do I ensure my federal heavy use tax 2290 form is filed correctly?

To ensure your federal heavy use tax 2290 form is filed correctly, utilize the built-in validation features of airSlate SignNow. Our platform prompts you to complete all necessary fields and provides guidance throughout the process. If you have further questions, our support team is available to assist.

Get more for Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

- Complaint for injunctive relief and damages form

- This agreement for purchase and sale of real secgov form

- This roommate agreement agreement is made by the following roommates form

- Leave benefitsus department of labor form

- Revised escrow agreement georgia attorney general form

- Acpa advisor manual cal state fullerton form

- Sample agency agreement modify as necessary non real estate generally for talent matters form

- This agreement made by and between amp hereinafter collectively form

Find out other Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors