Form 2290 2015

What is the Form 2290

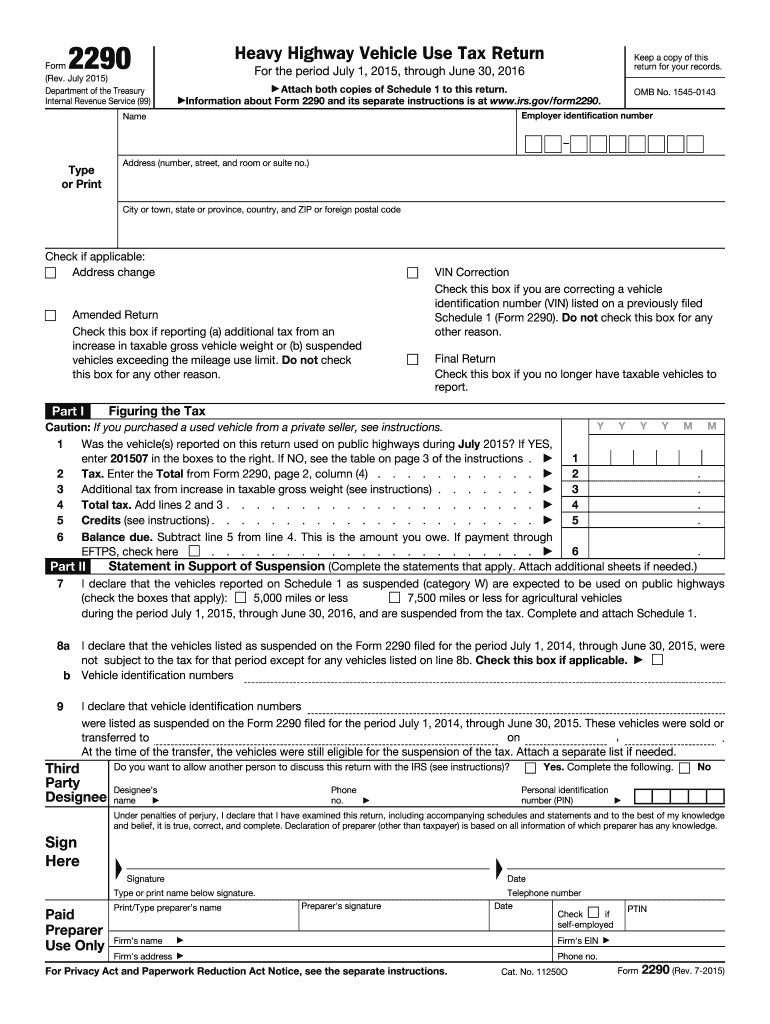

The Form 2290, officially known as the Heavy Highway Vehicle Use Tax Return, is a tax form used by individuals and businesses that operate heavy vehicles on public highways in the United States. This form is primarily used to report and pay the federal highway use tax on vehicles with a gross weight of 55,000 pounds or more. The tax helps fund the construction and maintenance of highways. Filing the Form 2290 is a requirement for anyone who operates qualifying vehicles, and it must be submitted annually to the Internal Revenue Service (IRS).

Steps to complete the Form 2290

Completing the Form 2290 involves several important steps to ensure accuracy and compliance with IRS regulations. First, gather necessary information, including your Employer Identification Number (EIN), vehicle identification numbers (VINs), and gross weight classifications. Next, download the form from the IRS website or use an online platform for convenience. Fill out the form by providing details about your vehicles, including the number of vehicles and their weight categories. After completing the form, calculate the total tax owed based on the number of vehicles and their weight. Finally, submit the form electronically or by mail, ensuring you keep a copy for your records.

How to obtain the Form 2290

The Form 2290 can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, many online tax preparation services offer electronic versions of the form, allowing for easier completion and submission. It is essential to ensure that you are using the most current version of the form, as tax regulations can change annually. For those who prefer a paper version, you can also request a copy from the IRS by contacting their office directly.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2290 are crucial for compliance with IRS regulations. The form must be filed by the last day of the month following the month in which the vehicle is first used on public highways. For example, if a vehicle is first used in July, the Form 2290 must be filed by August 31. Additionally, the tax payment is due at the time of filing. It is important to keep track of these deadlines to avoid penalties and interest charges for late submissions.

Legal use of the Form 2290

The legal use of the Form 2290 is governed by IRS regulations, which outline the requirements for filing and paying the heavy highway vehicle use tax. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Additionally, electronic signatures are accepted if filed through an authorized e-filing service, ensuring compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN). Keeping a copy of the filed form and any payment confirmations is essential for record-keeping and potential audits.

Penalties for Non-Compliance

Failing to file the Form 2290 or pay the associated tax on time can result in significant penalties. The IRS imposes a penalty of up to five percent of the total tax due for each month the return is late, with a maximum penalty of 25 percent. Additionally, interest may accrue on any unpaid tax amounts. In severe cases, failure to comply can lead to legal action or the inability to register vehicles. It is crucial for taxpayers to understand these penalties and take timely action to avoid them.

Quick guide on how to complete form 2290 2015

Complete Form 2290 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and without delays. Manage Form 2290 on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and electronically sign Form 2290 without hassle

- Obtain Form 2290 and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details carefully and then click the Done button to save your alterations.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form 2290 while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2290 2015

Create this form in 5 minutes!

How to create an eSignature for the form 2290 2015

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is Form 2290 and why is it important?

Form 2290 is a vital tax document used by truck owners and operators to report and pay federal highway use tax. Filing this form is mandatory for those operating heavy vehicles, and it's essential for compliance with IRS regulations.

-

How can airSlate SignNow help with filing Form 2290?

airSlate SignNow streamlines the process of completing and eSigning Form 2290. Our user-friendly platform allows you to fill out the form electronically, ensuring accuracy and expediting your submissions to the IRS.

-

What is the cost of using airSlate SignNow for Form 2290?

airSlate SignNow offers competitive pricing plans that are budget-friendly, especially for businesses needing to file Form 2290. Our transparent cost structure ensures you know exactly what you’re paying for without hidden fees.

-

What features does airSlate SignNow offer for Form 2290 management?

With airSlate SignNow, you gain access to features such as customizable templates, advanced eSigning options, and secure document storage for your Form 2290. These tools enhance efficiency and simplify the filing process.

-

Is airSlate SignNow compliant with IRS requirements for Form 2290?

Yes, airSlate SignNow is fully compliant with IRS standards for eFiling Form 2290. We ensure that your submissions meet all regulatory guidelines, providing peace of mind during the tax filing process.

-

Can I integrate airSlate SignNow with other accounting software for Form 2290?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software solutions, making it easier for you to manage your Form 2290 alongside your financial data. This connectivity streamlines your overall workflow.

-

What are the benefits of using airSlate SignNow for Form 2290?

Using airSlate SignNow for Form 2290 offers numerous benefits, including time savings, increased accuracy, and reduced paper clutter. Our platform simplifies the entire process, making it quicker to file and easier to stay organized.

Get more for Form 2290

Find out other Form 2290

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement