2290 Form 2016

What is the 2290 Form

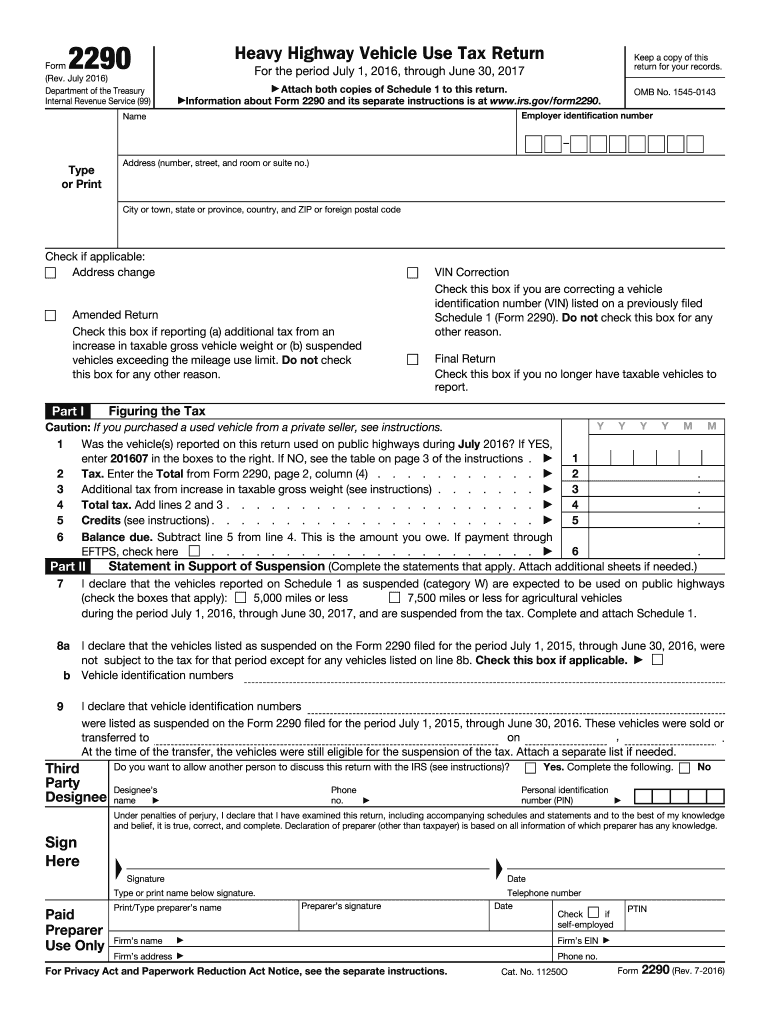

The 2290 Form, officially known as the Heavy Highway Vehicle Use Tax Return, is a tax document required by the Internal Revenue Service (IRS) for individuals and businesses operating heavy vehicles with a gross weight of 55,000 pounds or more. This form is essential for reporting and paying the federal highway use tax, which helps fund the maintenance and construction of public highways. The 2290 Form must be filed annually, and it is particularly relevant for truck owners and operators who use their vehicles on public roads. Understanding this form is crucial for compliance with federal tax regulations.

Steps to complete the 2290 Form

Completing the 2290 Form involves several key steps to ensure accuracy and compliance. First, gather necessary information, including your Employer Identification Number (EIN), vehicle identification numbers (VINs), and gross weight of the vehicles. Next, access the form either through the IRS website or a reliable e-signature platform. Fill out the required sections, including the vehicle details and tax calculations. After completing the form, review it for accuracy before submitting it electronically or via mail. Ensure that you keep a copy for your records, as it may be needed for future reference or audits.

How to obtain the 2290 Form

The 2290 Form can be obtained directly from the IRS website, where it is available for download in PDF format. Alternatively, many tax preparation software programs offer the form as part of their services, allowing for easier completion and submission. For those preferring a digital approach, platforms that support e-signatures can facilitate the process, making it simpler to fill out and submit the form electronically. Ensure that you are using the most current version of the form to comply with IRS requirements.

Filing Deadlines / Important Dates

Filing the 2290 Form has specific deadlines that must be adhered to in order to avoid penalties. The form is typically due on the last day of the month following the month in which the vehicle was first used on public highways. For example, if a vehicle is first used in July, the form must be filed by August 31. Additionally, if you are filing for the first time or if there are any changes to your vehicle fleet, it is essential to be aware of these deadlines to ensure timely compliance with IRS regulations.

Penalties for Non-Compliance

Failing to file the 2290 Form on time can result in significant penalties. The IRS imposes a penalty of up to $50 for each month the form is late, with a maximum penalty of up to five months. Additionally, interest may accrue on any unpaid taxes. It is crucial for vehicle owners and operators to be aware of these penalties and to file the form promptly to avoid unnecessary financial repercussions. Keeping accurate records and setting reminders for filing deadlines can help mitigate the risk of non-compliance.

Legal use of the 2290 Form

The 2290 Form serves a legal purpose by ensuring that heavy vehicle operators contribute to the federal highway fund. The information provided on the form is used by the IRS to determine tax liability based on vehicle use. Proper completion and submission of this form are essential for maintaining compliance with federal tax laws. Additionally, using a reliable e-signature solution can enhance the legal validity of the form, ensuring that it meets all necessary requirements for electronic submission.

Quick guide on how to complete 2290 2016 form

Complete 2290 Form effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Handle 2290 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign 2290 Form seamlessly

- Obtain 2290 Form and select Get Form to begin.

- Leverage the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Alter and eSign 2290 Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2290 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 2290 2016 form

How to make an eSignature for your 2290 2016 Form online

How to make an eSignature for your 2290 2016 Form in Google Chrome

How to generate an eSignature for putting it on the 2290 2016 Form in Gmail

How to generate an electronic signature for the 2290 2016 Form right from your smart phone

How to generate an eSignature for the 2290 2016 Form on iOS

How to generate an electronic signature for the 2290 2016 Form on Android devices

People also ask

-

What is the 2290 Form and why do I need it?

The 2290 Form is a crucial tax document that heavy vehicle owners must file annually with the IRS. It is used to report and pay the Heavy Highway Vehicle Use Tax (HVUT). Filing the 2290 Form accurately helps you avoid penalties and ensures compliance with federal tax regulations.

-

How can airSlate SignNow help me with my 2290 Form?

airSlate SignNow offers a seamless way to electronically sign and submit your 2290 Form. With our user-friendly platform, you can easily fill out the form, eSign it, and send it directly to the IRS, saving you time and reducing errors in the process.

-

Is there a cost associated with using airSlate SignNow for the 2290 Form?

Yes, airSlate SignNow provides various pricing plans tailored to meet your needs. Our plans are cost-effective, ensuring that you can efficiently manage your 2290 Form submissions without breaking the bank. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other tools for filing my 2290 Form?

Absolutely! airSlate SignNow integrates with various applications to streamline your workflow. You can connect it with accounting software or document management systems, making it easier to manage your 2290 Form alongside your other business documentation.

-

What features does airSlate SignNow offer for the 2290 Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for your 2290 Form. These tools help simplify the filing process and ensure that you have a record of all submissions and signatures.

-

Is it safe to use airSlate SignNow for submitting my 2290 Form?

Yes, airSlate SignNow prioritizes the security of your documents. Our platform uses advanced encryption and compliance protocols to ensure that your 2290 Form and sensitive information are protected during transmission and storage.

-

How do I get started with airSlate SignNow for my 2290 Form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you can begin uploading and filling out your 2290 Form. Our intuitive interface guides you through the process, making it accessible for users of all skill levels.

Get more for 2290 Form

Find out other 2290 Form

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure