Form 2290 Rev July Heavy Highway Vehicle Use Tax Return 2021

What is the Form 2290 Heavy Highway Vehicle Use Tax Return

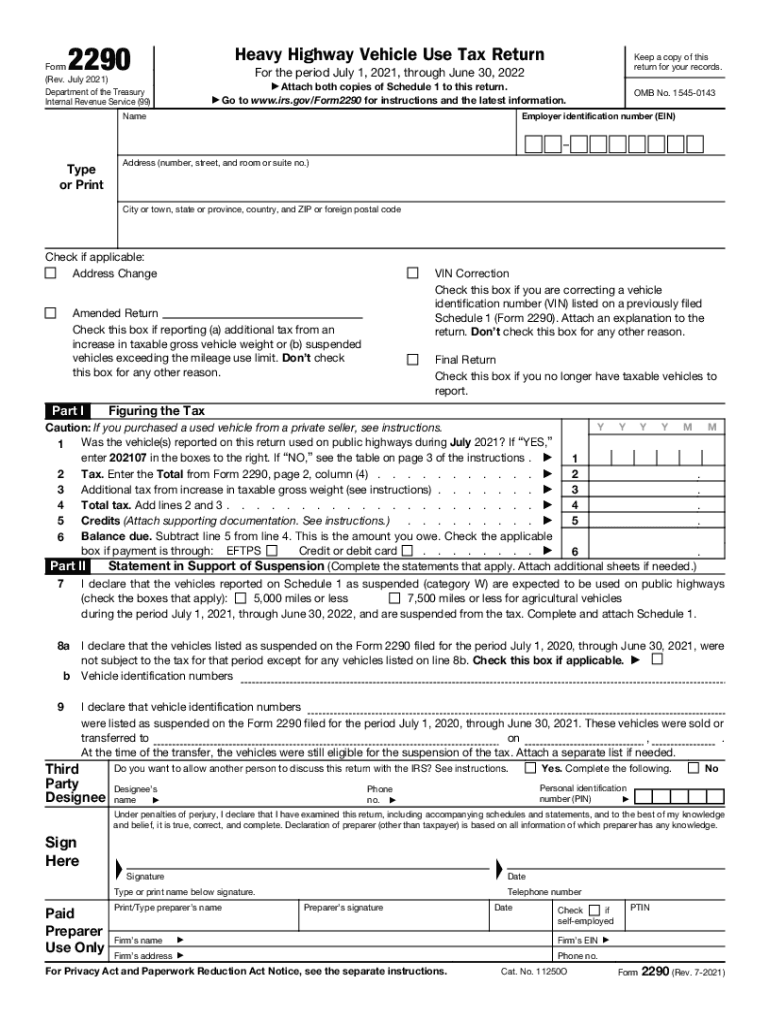

The Form 2290, officially known as the Heavy Highway Vehicle Use Tax Return, is a tax form used by owners of heavy vehicles to report and pay the Heavy Vehicle Use Tax (HVUT) to the Internal Revenue Service (IRS). This form is specifically designed for vehicles that have a gross weight of 55,000 pounds or more and are used on public highways. The tax is calculated based on the weight of the vehicle and is due annually. Understanding the purpose and requirements of the Form 2290 is crucial for compliance with federal tax laws.

Steps to Complete the Form 2290

Completing the Form 2290 involves several key steps to ensure accurate reporting and compliance. First, gather the necessary information, including your vehicle details, Employer Identification Number (EIN), and payment method. Next, fill out the form by providing information about each vehicle subject to the tax. Calculate the tax amount based on the weight of the vehicle, and ensure you include any applicable credits. After completing the form, review it for accuracy before submitting it to the IRS. It's important to retain a copy for your records.

Filing Deadlines / Important Dates

Timely filing of the Form 2290 is essential to avoid penalties. The IRS requires that the form be filed by the last day of the month following the month in which the vehicle was first used on public highways. For example, if a vehicle is first used in July, the Form 2290 must be filed by August 31. Additionally, if you are filing for the first time or are renewing your submission, be aware of the deadlines to ensure compliance and avoid late fees.

Required Documents

To complete the Form 2290, certain documents are necessary. These include your Employer Identification Number (EIN), vehicle identification numbers (VINs) for each vehicle, and any previous Form 2290s if applicable. Additionally, having your payment information ready, whether for electronic payment or check, will facilitate a smoother filing process. Ensuring you have all required documents at hand will help avoid delays in processing your return.

Form Submission Methods

The Form 2290 can be submitted through various methods, allowing for flexibility based on your preferences. You can file the form online through the IRS e-file system, which is often the quickest and most efficient method. Alternatively, you can submit a paper form by mailing it to the appropriate IRS address. In-person submission is generally not available for this form. Choosing the right submission method can streamline the filing process and ensure timely compliance.

Penalties for Non-Compliance

Failure to file the Form 2290 on time or underreporting the tax owed can result in significant penalties. The IRS imposes a penalty for late filing, which can be a percentage of the tax due, along with interest on unpaid amounts. Understanding these penalties is crucial for vehicle owners to ensure compliance and avoid unexpected financial burdens. Staying informed about filing requirements and deadlines can help mitigate these risks.

Quick guide on how to complete form 2290 rev july 2021 heavy highway vehicle use tax return

Effortlessly Prepare Form 2290 Rev July Heavy Highway Vehicle Use Tax Return on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents swiftly without any delays. Manage Form 2290 Rev July Heavy Highway Vehicle Use Tax Return on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Form 2290 Rev July Heavy Highway Vehicle Use Tax Return Stress-Free

- Find Form 2290 Rev July Heavy Highway Vehicle Use Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark essential sections of your documents or obscure sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 2290 Rev July Heavy Highway Vehicle Use Tax Return and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2290 rev july 2021 heavy highway vehicle use tax return

Create this form in 5 minutes!

How to create an eSignature for the form 2290 rev july 2021 heavy highway vehicle use tax return

The way to generate an e-signature for your PDF document in the online mode

The way to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is form 2290 and why do I need it?

Form 2290 is a Vehicle Use Tax Return used by heavy vehicle owners to report and pay their taxes to the IRS. If you operate a truck with a gross weight of 55,000 pounds or more, you are required to file this form annually. Understanding and filing form 2290 correctly is essential to avoid penalties and keep your vehicle in compliance.

-

How can airSlate SignNow help with form 2290?

airSlate SignNow offers an easy-to-use platform to electronically sign and manage documents, including your form 2290. You can send, sign, and store your tax documents securely, streamlining the filing process and ensuring you never miss a deadline. This can save you time and give you peace of mind.

-

Is airSlate SignNow affordable for filing form 2290?

Yes, airSlate SignNow is a cost-effective solution for managing your form 2290 and other documentation needs. With competitive pricing plans, you can choose an option that best fits your budget while getting robust features for electronic signatures and document management. It’s an investment that can simplify your tax filing process.

-

What features does airSlate SignNow offer for form 2290 processing?

airSlate SignNow provides various features such as templates for form 2290, collaboration tools, and automated reminders for filing deadlines. You can also track your documents in real time, ensuring you know the status of your submissions. These features enhance efficiency in managing your tax-related paperwork.

-

Can I integrate airSlate SignNow with other software for form 2290?

Yes, airSlate SignNow seamlessly integrates with various software applications, including accounting and tax software. This allows you to synchronize your data effortlessly, ensuring that your form 2290 and other financial records are easily managed in one place. Integration enhances productivity and reduces manual errors.

-

How secure is the information I provide on form 2290 using airSlate SignNow?

airSlate SignNow prioritizes the security of your information with top-grade encryption and compliance with industry standards. When you file form 2290 through our platform, your sensitive data is protected to ensure confidentiality. You can trust us to keep your tax information safe and secure.

-

What are the benefits of using airSlate SignNow for form 2290 filings?

Using airSlate SignNow for your form 2290 filings simplifies the entire process with its user-friendly interface and robust features. You can easily prepare, send, and sign documents, which saves time and minimizes stress during tax season. Additionally, the ability to access your forms remotely makes it convenient for busy professionals.

Get more for Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

Find out other Form 2290 Rev July Heavy Highway Vehicle Use Tax Return

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast