IRS Form 941 SS , Employer's Quarterly Federal Tax Return 2023-2026

What is the IRS Form 941 SS, Employer's Quarterly Federal Tax Return

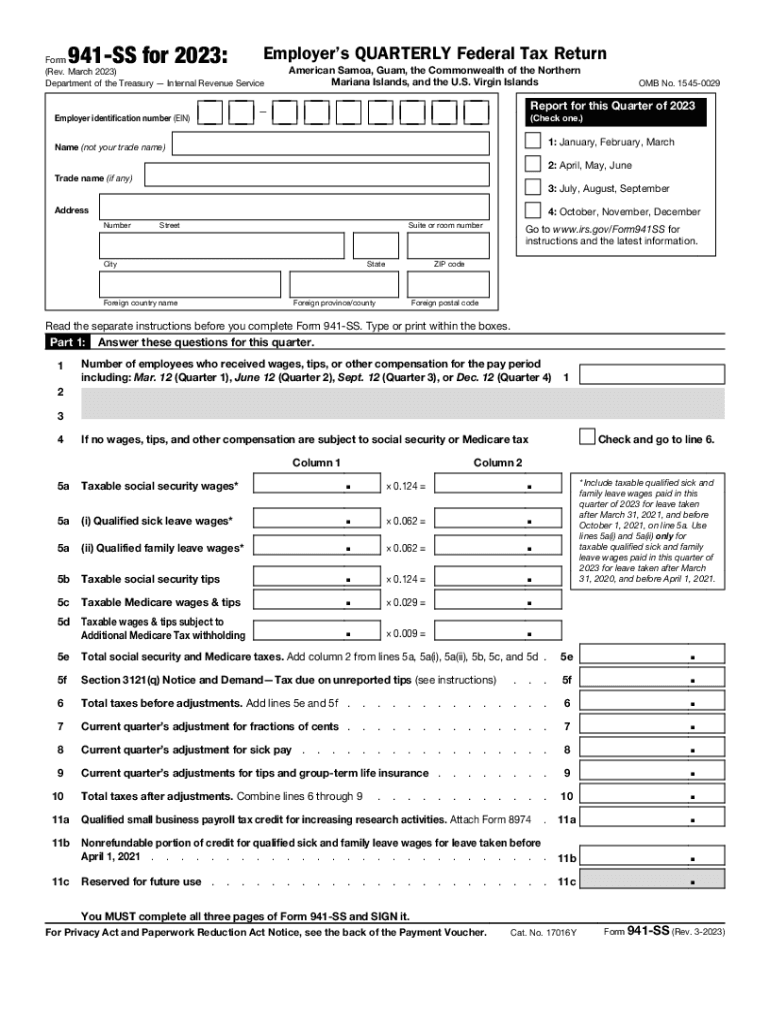

The IRS Form 941 SS, also known as the Employer's Quarterly Federal Tax Return, is a crucial document for employers in the United States. This form is specifically designed for employers in American Samoa, Guam, the Northern Mariana Islands, and the U.S. Virgin Islands. It is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages, as well as the employer's portion of Social Security and Medicare taxes. Understanding this form is essential for compliance with federal tax obligations.

Steps to Complete the IRS Form 941 SS, Employer's Quarterly Federal Tax Return

Completing the IRS Form 941 SS involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll information, including total wages paid, tips reported, and any adjustments for the quarter. Next, fill out the form by entering the required information in each section, including the number of employees and the total tax liability. After completing the form, review it for errors and ensure all calculations are correct. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 941 SS are critical for maintaining compliance. Employers must submit this form quarterly, with deadlines typically falling on the last day of the month following the end of each quarter. For example, the deadlines for 2023 are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 of the following year for the fourth quarter. It is essential to adhere to these deadlines to avoid late fees and penalties.

Legal Use of the IRS Form 941 SS, Employer's Quarterly Federal Tax Return

The legal use of the IRS Form 941 SS is governed by federal tax laws. This form must be completed accurately and submitted on time to fulfill employer tax obligations. Failure to file or inaccuracies in reporting can lead to significant penalties, including fines and interest on unpaid taxes. Additionally, maintaining proper records and documentation related to the information reported on the form is crucial for legal compliance and potential audits.

Key Elements of the IRS Form 941 SS, Employer's Quarterly Federal Tax Return

Key elements of the IRS Form 941 SS include several critical sections that must be completed. These sections cover the employer's identification information, total wages paid, taxes withheld, and adjustments for the quarter. Employers must also report the number of employees and calculate the total tax liability. Understanding these elements is essential for accurate completion and compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the IRS Form 941 SS. The form can be filed electronically through the IRS e-file system, which is a convenient and secure method. Alternatively, employers can mail the completed form to the appropriate IRS address based on their location. In-person submissions are generally not available, making electronic filing or mailing the preferred methods. Choosing the right submission method can help ensure timely processing and compliance.

Quick guide on how to complete irs form 941 ss employers quarterly federal tax return

Complete IRS Form 941 SS , Employer's Quarterly Federal Tax Return effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage IRS Form 941 SS , Employer's Quarterly Federal Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The simplest way to modify and electronically sign IRS Form 941 SS , Employer's Quarterly Federal Tax Return without hassle

- Find IRS Form 941 SS , Employer's Quarterly Federal Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IRS Form 941 SS , Employer's Quarterly Federal Tax Return and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 941 ss employers quarterly federal tax return

Create this form in 5 minutes!

How to create an eSignature for the irs form 941 ss employers quarterly federal tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable 2022 941ss form?

The fillable 2022 941ss form is an IRS payroll tax form designed for employers to report wages, tips, and other compensation paid to employees. Using airSlate SignNow, you can easily create and manage this form digitally, ensuring compliance and accuracy while saving time.

-

How can I obtain a fillable 2022 941ss form?

You can obtain a fillable 2022 941ss form through airSlate SignNow by utilizing our document creation tools. After signing up, simply select the form, customize it to fit your needs, and start filling it out directly within our platform.

-

What are the key features of airSlate SignNow for fillable 2022 941ss forms?

airSlate SignNow offers multiple features for fillable 2022 941ss forms, including electronic signature capabilities, document storage, and easy sharing options. Additionally, our platform supports form completion on various devices, ensuring flexibility and convenience.

-

Is there a cost associated with using airSlate SignNow for fillable 2022 941ss forms?

Yes, airSlate SignNow offers various pricing plans to accommodate your needs when using fillable 2022 941ss forms. We provide a cost-effective solution with different tiers, so you can choose the plan that best fits your usage and budget.

-

Can I integrate airSlate SignNow with other applications while using fillable 2022 941ss forms?

Absolutely! airSlate SignNow provides seamless integrations with popular applications like Google Drive, Salesforce, and Dropbox. This makes it easy to manage your fillable 2022 941ss forms alongside other tools you already use.

-

What are the benefits of using airSlate SignNow for fillable 2022 941ss forms?

Using airSlate SignNow for your fillable 2022 941ss forms streamlines the document signing process, reduces paper usage, and ensures fast processing. Our platform enhances productivity, allowing you to focus on your business while managing necessary paperwork effortlessly.

-

Is airSlate SignNow secure for handling fillable 2022 941ss forms?

Yes, airSlate SignNow prioritizes security and offers industry-standard encryption for all documents, including fillable 2022 941ss forms. You can trust our platform to keep your sensitive information safe while allowing you to send and sign documents electronically.

Get more for IRS Form 941 SS , Employer's Quarterly Federal Tax Return

- Dwc form 045 request to schedule reschedule or cancel

- Employees request for acceleration of impairment income form

- Request to get reimbursed for travel costs form

- Texas department of insurance compact with texans form

- Dwc form 041 employees claim for compensation for a

- For use only by employees not in workers compensation health care networks or certain political subdivision health care plans form

- Texas dwc posts updated forms and notices online

- Request to adjust average weekly wage for seasonal form

Find out other IRS Form 941 SS , Employer's Quarterly Federal Tax Return

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast