941 Ss Form 2013

What is the 941 Ss Form

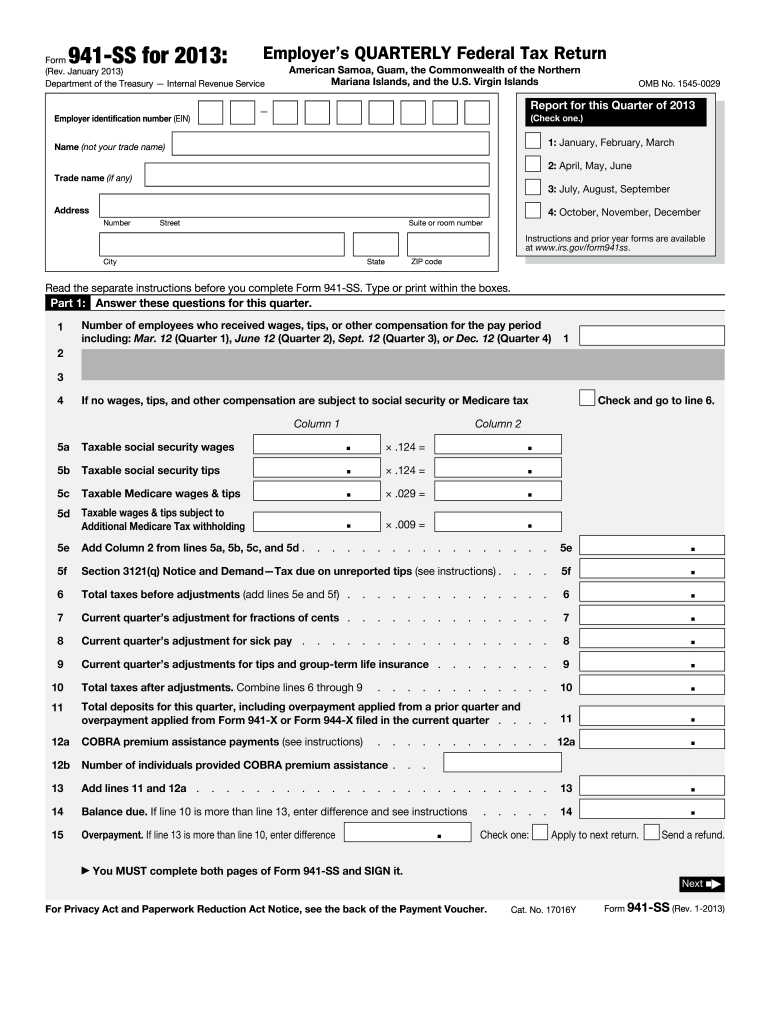

The 941 Ss Form is a tax document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is specifically designed for employers who pay wages to employees in the U.S. Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands. It serves as a means for these employers to report their tax liabilities to the Internal Revenue Service (IRS) and ensures compliance with federal tax regulations.

How to use the 941 Ss Form

To effectively use the 941 Ss Form, employers must first gather relevant payroll information, including total wages paid, taxes withheld, and any adjustments for the quarter. The form is divided into several sections where employers must input specific data, including the number of employees, total compensation, and the amounts withheld for federal income tax, Social Security, and Medicare. Accurate completion of this form is essential to avoid penalties and ensure proper tax reporting.

Steps to complete the 941 Ss Form

Completing the 941 Ss Form involves several key steps:

- Gather necessary payroll records, including employee wages and tax withholdings.

- Fill out the employer information section, including your business name, address, and EIN.

- Report the total number of employees and the total wages paid during the reporting period.

- Calculate and enter the amounts withheld for federal income tax, Social Security, and Medicare.

- Complete any adjustments necessary for the quarter, if applicable.

- Review the form for accuracy and sign it before submission.

Legal use of the 941 Ss Form

The legal use of the 941 Ss Form is governed by IRS regulations. Employers must file this form quarterly to remain compliant with federal tax laws. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is crucial for employers to understand their obligations under the law and ensure timely and accurate submissions to avoid legal repercussions.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the 941 Ss Form. The form is due on the last day of the month following the end of each quarter. The deadlines are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The 941 Ss Form can be submitted to the IRS through various methods. Employers have the option to file electronically using IRS e-file services, which provides a faster and more efficient way to submit the form. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. In-person submissions are generally not available for this form, as the IRS encourages electronic filing for quicker processing.

Quick guide on how to complete 2013 941 ss form

Complete 941 Ss Form easily on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Handle 941 Ss Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to modify and eSign 941 Ss Form effortlessly

- Retrieve 941 Ss Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and eSign 941 Ss Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 941 ss form

Create this form in 5 minutes!

How to create an eSignature for the 2013 941 ss form

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 941 Ss Form and who needs to file it?

The 941 Ss Form is a tax form used by employers to report wages, tips, and other compensation, along with the corresponding tax withholdings. Businesses with employees that are subject to Social Security and Medicare taxes must file this form. It's crucial for accurate tax reporting and compliance with federal regulations.

-

How does airSlate SignNow facilitate the completion of the 941 Ss Form?

With airSlate SignNow, users can easily create, send, and eSign their 941 Ss Form, streamlining the filing process. The platform allows for quick edits and securely stores documents, ensuring that every form is completed accurately and on time. This efficiency helps in avoiding delays and penalties associated with late filings.

-

Are there any costs associated with using airSlate SignNow for the 941 Ss Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, allowing you to manage your documents, including the 941 Ss Form, at a reasonable cost. Each plan is designed to provide comprehensive features for document management and eSigning. It's a cost-effective solution that enhances productivity without breaking the bank.

-

What features does airSlate SignNow offer for managing the 941 Ss Form?

airSlate SignNow provides intuitive features such as document templates, electronic signatures, and secure cloud storage specifically for your 941 Ss Form. Users can also track document status and access real-time updates, which ensures seamless collaboration among team members. These features signNowly simplify the filing and management processes.

-

Can I integrate airSlate SignNow with other software for 941 Ss Form management?

Absolutely! airSlate SignNow offers integration capabilities with various CRM systems, accounting software, and productivity tools. This allows users to seamlessly manage their 941 Ss Form and other documents within their existing workflows. Such integrations enhance efficiency and simplify the overall document handling process.

-

How does eSigning the 941 Ss Form with airSlate SignNow work?

eSigning the 941 Ss Form with airSlate SignNow is straightforward and secure. Users can sign documents digitally from any device, ensuring that the process is quick and accessible. The platform also provides audit trails to track when and where signatures were added, enhancing document integrity.

-

Is airSlate SignNow mobile-friendly for filing the 941 Ss Form?

Yes, airSlate SignNow is fully optimized for mobile use, allowing users to access and manage their 941 Ss Form on the go. This mobile compatibility ensures that you can eSign and manage documents anytime, anywhere. The user-friendly interface makes it easy to navigate even from a smartphone or tablet.

Get more for 941 Ss Form

- Indiana notice suit form

- Indiana quitclaim deed 497306824 form

- Warranty deed from two individuals to llc indiana 497306825 form

- Quitclaim deed business entity grantor by attorney in fact to individual grantee indiana form

- Business entity 497306827 form

- Indiana affidavit form 497306828

- Indiana lien in form

- Indiana husband wife 497306831 form

Find out other 941 Ss Form

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure