Form 941 Ss 2016

What is the Form 941 Ss

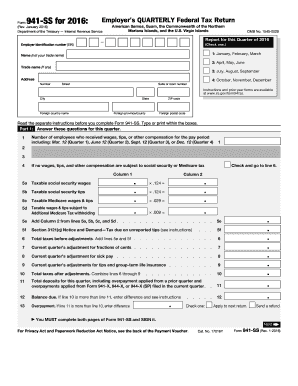

The Form 941 Ss is a tax form used by employers in the United States to report income taxes withheld from employee wages, as well as the employer's share of Social Security and Medicare taxes. This form is specifically designed for employers who operate in the U.S. territories, including American Samoa, Guam, the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands. It is crucial for maintaining compliance with federal tax regulations and ensuring accurate reporting of payroll taxes.

How to use the Form 941 Ss

To use the Form 941 Ss effectively, employers must first gather all necessary payroll information, including total wages paid, tips reported, and any adjustments for prior quarters. The form requires detailed entries for each employee's wages and the corresponding tax withholdings. Employers must also calculate the total taxes owed and ensure that the form is submitted by the appropriate deadline to avoid penalties. Utilizing electronic filing options can streamline this process and enhance accuracy.

Steps to complete the Form 941 Ss

Completing the Form 941 Ss involves several key steps:

- Gather employee payroll records for the reporting period.

- Calculate total wages, tips, and other compensation paid to employees.

- Determine the amount of federal income tax withheld, along with Social Security and Medicare taxes.

- Complete each section of the form, ensuring accuracy in all calculations.

- Review the form for any errors or omissions before submission.

- File the completed form electronically or via mail by the due date.

Legal use of the Form 941 Ss

The legal use of the Form 941 Ss is governed by the Internal Revenue Service (IRS) regulations. Employers must ensure that the information reported is accurate and submitted on time to avoid penalties. Electronic signatures can be utilized for filing, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Maintaining records of submitted forms is essential for legal compliance and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941 Ss are typically set on a quarterly basis. Employers must submit the form by the last day of the month following the end of each quarter. For example, the due dates for the 2023 tax year are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

It is essential for employers to adhere to these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 941 Ss can be submitted through various methods to accommodate different employer preferences. Employers may choose to file the form electronically using IRS-approved software, which often simplifies the process and provides immediate confirmation of submission. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. In-person submissions are generally not available for this form, making electronic and mail options the most viable methods.

Quick guide on how to complete form 941 ss 2016

Effortlessly Prepare Form 941 Ss on Any Device

Managing documents online has gained signNow traction among organizations and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily access the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents rapidly without delays. Manage Form 941 Ss on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The easiest way to modify and eSign Form 941 Ss seamlessly

- Obtain Form 941 Ss and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or corrections that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 941 Ss while ensuring excellent communication throughout the document preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 ss 2016

Create this form in 5 minutes!

How to create an eSignature for the form 941 ss 2016

How to create an eSignature for your Form 941 Ss 2016 in the online mode

How to generate an electronic signature for the Form 941 Ss 2016 in Chrome

How to create an eSignature for putting it on the Form 941 Ss 2016 in Gmail

How to generate an electronic signature for the Form 941 Ss 2016 right from your smart phone

How to make an eSignature for the Form 941 Ss 2016 on iOS devices

How to create an electronic signature for the Form 941 Ss 2016 on Android

People also ask

-

What is Form 941 Ss and why do I need it?

Form 941 Ss is a crucial tax form used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Understanding how to properly fill out Form 941 Ss is essential for compliance with IRS regulations. Using airSlate SignNow can simplify the process of signing and sending this form securely.

-

How does airSlate SignNow help with Form 941 Ss?

airSlate SignNow streamlines the process of completing and eSigning Form 941 Ss, enabling you to manage your tax documentation efficiently. With our easy-to-use interface, you can fill out the form online, collect signatures, and send it directly to the IRS without hassle. This ensures timely submissions and helps you avoid penalties.

-

Is airSlate SignNow affordable for small businesses needing to file Form 941 Ss?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses that need to file Form 941 Ss and other documents. Our plans are designed to provide essential features without breaking the bank, allowing businesses of all sizes to access professional eSigning capabilities.

-

What features does airSlate SignNow provide for managing Form 941 Ss?

airSlate SignNow offers a variety of features for managing Form 941 Ss, including customizable templates, real-time tracking, and automated reminders for signing. Our platform ensures that you have all the tools needed to complete the form accurately and efficiently, enhancing your document workflow.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 941 Ss?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, making it easy to manage your Form 941 Ss within your existing workflows. This integration helps streamline your document management process and keeps your financial records organized.

-

What security measures does airSlate SignNow implement for Form 941 Ss?

Security is a top priority at airSlate SignNow. When handling Form 941 Ss, we use advanced encryption technologies and secure storage solutions to protect your sensitive information. Our platform complies with industry standards to ensure that your documents remain confidential and secure.

-

How can I track the status of my Form 941 Ss using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Form 941 Ss in real time. Our dashboard provides updates on who has signed the document and when it was completed, allowing you to stay informed throughout the signing process.

Get more for Form 941 Ss

- Form au 960 2011

- Pennsylvania form waiver

- Ownertenant change form rentonwa

- North carolina form av 13 pdffiller

- Subpoena form

- Form gs 12 california state university los angeles calstatela

- Laverne noyes scholarship university of minnesota policy library policy umn form

- Star search snare drum guidelines form

Find out other Form 941 Ss

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form