Form 941 SS Rev January 2012

What is the Form 941 SS Rev January

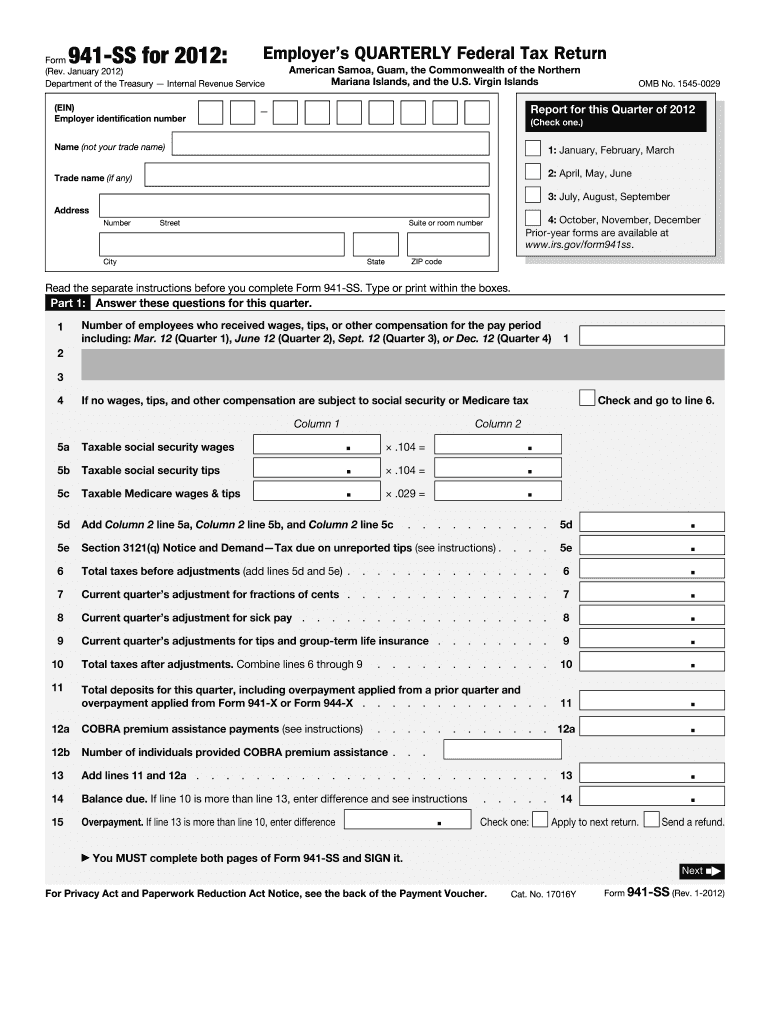

The Form 941 SS Rev January is a tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is specifically designed for employers in U.S. territories, such as Puerto Rico, and is an essential tool for ensuring compliance with federal tax obligations. By accurately filling out this form, employers can provide the Internal Revenue Service (IRS) with necessary information regarding their payroll and tax liabilities.

How to use the Form 941 SS Rev January

Using the Form 941 SS Rev January involves several steps to ensure accurate reporting. Employers must first gather all relevant payroll information, including total wages paid, tips reported, and the amounts of taxes withheld. Once this information is compiled, employers can complete the form by entering the required data in the designated fields. After filling out the form, it should be reviewed for accuracy before submission to the IRS. Utilizing electronic signature tools can streamline this process, making it easier to sign and submit the form securely.

Steps to complete the Form 941 SS Rev January

Completing the Form 941 SS Rev January involves a series of clear steps:

- Gather payroll records, including total wages, tips, and tax withholdings.

- Enter the employer identification number (EIN) and business information at the top of the form.

- Fill in the number of employees and total wages paid during the reporting period.

- Calculate the total taxes owed, including Social Security and Medicare taxes.

- Sign and date the form, confirming that the information is accurate and complete.

After completing these steps, the form can be submitted electronically or via mail to the IRS.

Legal use of the Form 941 SS Rev January

The legal use of the Form 941 SS Rev January is crucial for employers to maintain compliance with federal tax laws. This form serves as an official record of tax withholdings and must be filed quarterly. Failure to file or inaccuracies in reporting can lead to penalties and interest charges. It is important for employers to understand that the information provided on this form is subject to audit by the IRS, making accuracy and honesty essential for legal compliance.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Form 941 SS Rev January. The form is due quarterly, with specific deadlines for each quarter:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

It is essential to adhere to these deadlines to avoid penalties and ensure timely processing of tax information.

Form Submission Methods (Online / Mail / In-Person)

The Form 941 SS Rev January can be submitted through various methods, providing flexibility for employers. Options include:

- Online Submission: Employers can file the form electronically using the IRS e-file system, which is a secure and efficient method.

- Mail Submission: The form can be printed and mailed to the appropriate IRS address based on the employer's location.

- In-Person Submission: Employers may also choose to deliver the form in person at designated IRS offices, although this method is less common.

Choosing the right submission method can help ensure that the form is processed promptly and accurately.

Quick guide on how to complete form 941 ss rev january 2012

Effortlessly Prepare Form 941 SS Rev January on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Form 941 SS Rev January on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related workflow today.

How to modify and eSign Form 941 SS Rev January with ease

- Obtain Form 941 SS Rev January and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents, or conceal sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Modify and eSign Form 941 SS Rev January and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 ss rev january 2012

Create this form in 5 minutes!

How to create an eSignature for the form 941 ss rev january 2012

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is Form 941 SS Rev January and why is it important?

Form 941 SS Rev January is the IRS form used by employers to report income taxes, social security tax, and Medicare tax withheld from employee wages. It's essential for compliance with federal tax regulations and ensures proper reporting of employment taxes.

-

How can airSlate SignNow help with completing Form 941 SS Rev January?

airSlate SignNow allows users to easily create, send, and eSign Form 941 SS Rev January, streamlining the process of tax reporting. With intuitive features, you can fill out the form electronically and gather necessary signatures securely.

-

Is there a specific pricing plan for using airSlate SignNow with Form 941 SS Rev January?

airSlate SignNow offers various pricing plans that accommodate different business needs. While there isn't a specific plan solely for Form 941 SS Rev January, all plans include features that support document management and eSigning.

-

What features does airSlate SignNow offer for handling Form 941 SS Rev January?

Key features of airSlate SignNow for handling Form 941 SS Rev January include customizable templates, audit trails, and secure cloud storage. These features enhance the workflow and ensure compliance and security in managing sensitive tax documents.

-

Can I integrate airSlate SignNow with other software for my Form 941 SS Rev January submissions?

Yes, airSlate SignNow supports various integrations with popular software, making it easy to incorporate Form 941 SS Rev January into your existing workflow. You can connect it with tools like CRM systems, payroll software, and more.

-

What are the benefits of using airSlate SignNow for Form 941 SS Rev January?

Using airSlate SignNow for Form 941 SS Rev January provides businesses with efficiency, accuracy, and enhanced security. The platform automates data entry, reduces the chances of errors, and keeps your sensitive tax information safe.

-

Is it easy to train employees to use airSlate SignNow for Form 941 SS Rev January?

Absolutely! airSlate SignNow is designed to be user-friendly, and with its intuitive interface, employees can quickly learn how to use it for completing and eSigning Form 941 SS Rev January. Comprehensive resources and customer support are also available to assist.

Get more for Form 941 SS Rev January

- Living trust property record district of columbia form

- Financial account transfer to living trust district of columbia form

- Assignment to living trust district of columbia form

- Notice of assignment to living trust district of columbia form

- Revocation of living trust district of columbia form

- Letter to lienholder to notify of trust district of columbia form

- District of columbia timber sale contract district of columbia form

- District of columbia forest products timber sale contract district of columbia form

Find out other Form 941 SS Rev January

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter