Form 941 2011

What is the Form 941

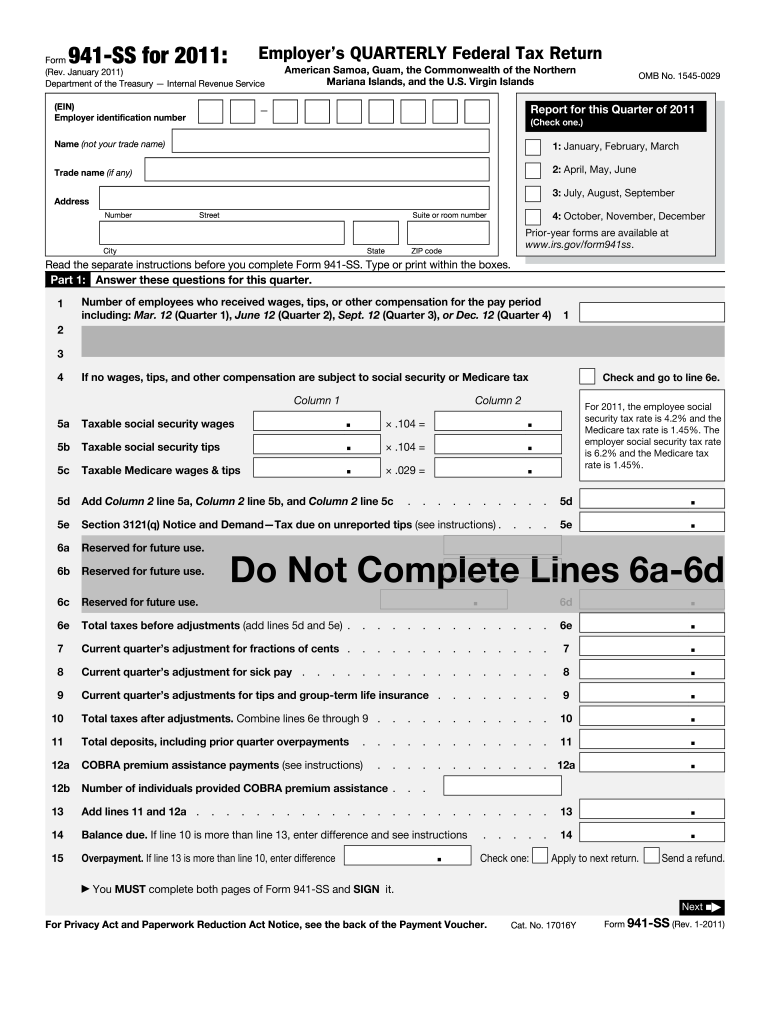

The Form 941, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document for businesses in the United States. It is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Employers must file this form quarterly to ensure compliance with federal tax regulations. The information provided on Form 941 helps the IRS track tax liabilities and ensure that employers are meeting their withholding obligations.

How to use the Form 941

Using Form 941 involves several steps to accurately report your business's payroll taxes. Employers should first gather necessary information, including total wages paid, tips received, and the federal income tax withheld. After compiling this data, you can fill out the form, ensuring that all sections are completed correctly. Once the form is filled out, it can be submitted electronically or by mail, depending on your preference. Utilizing digital tools can simplify this process, making it easier to track and manage your tax obligations.

Steps to complete the Form 941

Completing Form 941 requires careful attention to detail. Here are the steps to follow:

- Gather employee wage information and tax withholding details for the quarter.

- Fill out the basic information section, including your business name, address, and Employer Identification Number (EIN).

- Report total wages, tips, and other compensation in the appropriate sections.

- Calculate the total taxes owed, including Social Security and Medicare taxes.

- Determine any adjustments for the current quarter, if applicable.

- Sign and date the form before submission.

Legal use of the Form 941

The legal use of Form 941 is governed by IRS guidelines, which stipulate that employers must file the form accurately and on time to avoid penalties. Electronic signatures are accepted, provided they meet the requirements set forth by the IRS. Compliance with eSignature laws ensures that the form is considered legally binding. It is essential for employers to maintain accurate records of submitted forms for future reference and audits.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing Form 941. The form is due on the last day of the month following the end of each quarter. This means that for the first quarter (January to March), the deadline is April 30; for the second quarter (April to June), it is July 31; for the third quarter (July to September), it is October 31; and for the fourth quarter (October to December), it is January 31 of the following year. Timely filing helps avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Form 941 can be submitted through various methods, providing flexibility for employers. The form can be filed electronically using the IRS e-file system, which is often the fastest and most efficient method. Alternatively, employers can mail a paper version of the form to the appropriate IRS address based on their location. In-person submission is generally not available for Form 941, making electronic and mail options the primary methods for filing.

Quick guide on how to complete form 941 2011

Complete Form 941 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Form 941 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 941 without hassle

- Obtain Form 941 and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Illuminate pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or corrections that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Alter and eSign Form 941 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 2011

Create this form in 5 minutes!

How to create an eSignature for the form 941 2011

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is Form 941 and how can airSlate SignNow help with it?

Form 941 is the Employer's Quarterly Federal Tax Return, used to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. With airSlate SignNow, you can easily create, send, and eSign Form 941, ensuring compliance and accuracy in your tax reporting.

-

Is there a cost to use airSlate SignNow for filling out Form 941?

airSlate SignNow offers a variety of pricing plans to fit different business needs. You can access features for managing Form 941 and other documents at a competitive price, and we even provide a free trial to explore our services before committing.

-

Can I integrate airSlate SignNow with other software for Form 941 management?

Yes, airSlate SignNow seamlessly integrates with various popular software applications to streamline your workflow. This means you can easily connect your existing tools to manage Form 941 and other documents efficiently.

-

What features does airSlate SignNow offer for managing Form 941?

airSlate SignNow provides a range of features specifically designed for managing Form 941, including customizable templates, eSignature capabilities, and automated workflows. These features help you save time and reduce errors when preparing and submitting your tax forms.

-

How does airSlate SignNow ensure the security of my Form 941 documents?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your Form 941 documents, ensuring that your sensitive information remains safe and confidential.

-

Can I access Form 941 on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage and eSign Form 941 documents on the go. Our mobile app ensures that you can stay productive no matter where you are.

-

What benefits does airSlate SignNow provide for businesses filing Form 941?

Using airSlate SignNow for your Form 941 filing can signNowly reduce the time spent on paperwork, enhance collaboration among team members, and improve overall compliance. Our user-friendly platform makes it easy to manage your tax documentation efficiently.

Get more for Form 941

- Mission vision ampamp values florida state college at jacksonville form

- Family education rights and privacy act ferpaschool form

- Troy university access your trojanpass profile form

- Satisfactory academic progress us department of education form

- Ps vendor setup form 2doc

- Declaration of major form university college

- Graduate certificate in government contracting troy university form

- Fillable online case agreement form charlotte county

Find out other Form 941

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online