Form Irs 941 Fill Online 2020

What is the Form IRS 941 for 2020?

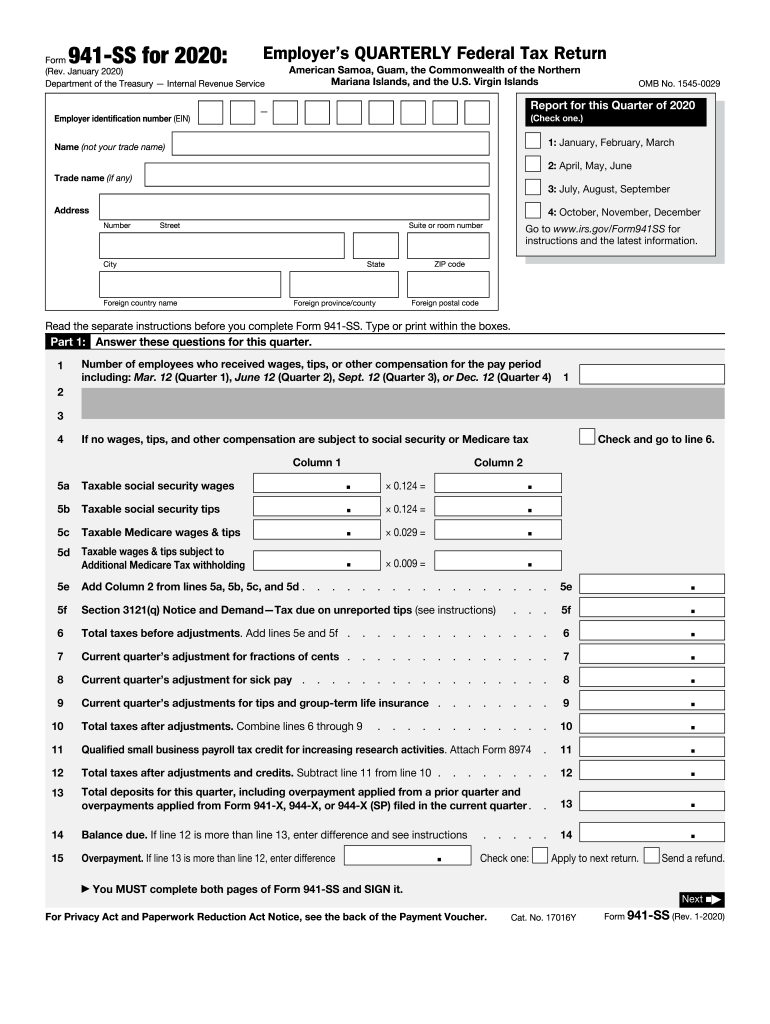

The Form IRS 941 for 2020, also known as the Employer's Quarterly Federal Tax Return, is a crucial document for employers in the United States. It is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Employers must file this form quarterly to ensure compliance with federal tax laws. The form provides the IRS with essential information about the taxes owed and the amounts that have been withheld from employees' paychecks.

Steps to Complete the Form IRS 941 for 2020

Completing the Form IRS 941 for 2020 involves several key steps:

- Gather Employee Information: Collect all necessary data on employee wages, tips, and other compensation.

- Calculate Taxes Withheld: Determine the total amount of federal income tax, Social Security tax, and Medicare tax that has been withheld from employee wages.

- Fill Out the Form: Input the gathered information into the appropriate sections of the form, ensuring accuracy in all calculations.

- Review for Accuracy: Double-check all entries to confirm that there are no errors or omissions.

- Submit the Form: File the completed form with the IRS by the designated deadline, either electronically or via mail.

Filing Deadlines for the Form IRS 941 for 2020

Employers must adhere to specific deadlines when filing the Form IRS 941 for 2020. The deadlines for each quarter are as follows:

- Q1: April 30, 2020

- Q2: July 31, 2020

- Q3: October 31, 2020

- Q4: January 31, 2021

It is essential to file the form on time to avoid penalties and ensure compliance with IRS regulations.

Legal Use of the Form IRS 941 for 2020

The legal use of the Form IRS 941 for 2020 is governed by federal tax laws. Employers are required to file this form to report and pay federal payroll taxes accurately. Failure to file the form or inaccuracies in reporting can lead to penalties, interest on unpaid taxes, and potential legal issues. The form serves as a legal declaration of the taxes owed and the amounts withheld from employees, making it a critical component of an employer's tax responsibilities.

Form Submission Methods for IRS 941 for 2020

Employers have several options for submitting the Form IRS 941 for 2020:

- Electronic Filing: Many employers choose to file electronically through the IRS e-file system, which is secure and efficient.

- Mail: The form can also be printed and mailed to the appropriate IRS address based on the employer's location.

- In-Person: Some employers may opt to deliver the form in person at their local IRS office, although this is less common.

Choosing the right submission method can help ensure timely processing and compliance with IRS requirements.

Key Elements of the Form IRS 941 for 2020

Several key elements must be included in the Form IRS 941 for 2020:

- Employer Identification Number (EIN): This unique number identifies the employer for tax purposes.

- Quarterly Reporting Period: Indicate the specific quarter for which the form is being filed.

- Wages and Tax Withheld: Report total wages paid, tips, and the amounts of federal income tax, Social Security tax, and Medicare tax withheld.

- Signature and Date: The form must be signed by an authorized person, confirming the accuracy of the information provided.

Including all these elements ensures that the form is complete and compliant with IRS regulations.

Quick guide on how to complete form 941 ss rev january 2020 employers quarterly federal tax return american samoa guam the commonwealth of the northern

Effortlessly Prepare Form Irs 941 Fill Online on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow offers all the resources you require to create, edit, and electronically sign your documents swiftly without interruptions. Manage Form Irs 941 Fill Online on any device using the airSlate SignNow applications for Android or iOS, and streamline your document-related processes today.

Tips for Editing and eSigning Form Irs 941 Fill Online with Ease

- Find Form Irs 941 Fill Online and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive details using features that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes merely seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or shared link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form Irs 941 Fill Online and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 ss rev january 2020 employers quarterly federal tax return american samoa guam the commonwealth of the northern

Create this form in 5 minutes!

How to create an eSignature for the form 941 ss rev january 2020 employers quarterly federal tax return american samoa guam the commonwealth of the northern

How to create an electronic signature for your Form 941 Ss Rev January 2020 Employers Quarterly Federal Tax Return American Samoa Guam The Commonwealth Of The Northern online

How to generate an electronic signature for the Form 941 Ss Rev January 2020 Employers Quarterly Federal Tax Return American Samoa Guam The Commonwealth Of The Northern in Google Chrome

How to create an electronic signature for putting it on the Form 941 Ss Rev January 2020 Employers Quarterly Federal Tax Return American Samoa Guam The Commonwealth Of The Northern in Gmail

How to make an electronic signature for the Form 941 Ss Rev January 2020 Employers Quarterly Federal Tax Return American Samoa Guam The Commonwealth Of The Northern right from your smartphone

How to generate an electronic signature for the Form 941 Ss Rev January 2020 Employers Quarterly Federal Tax Return American Samoa Guam The Commonwealth Of The Northern on iOS devices

How to generate an eSignature for the Form 941 Ss Rev January 2020 Employers Quarterly Federal Tax Return American Samoa Guam The Commonwealth Of The Northern on Android OS

People also ask

-

What are 941 forms 2020, and why are they important?

941 forms 2020 are crucial tax documents used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. They help ensure compliance with IRS standards and provide necessary information for tax reporting. Proper handling of these forms is essential to avoid penalties and maintain accurate financial records.

-

How can airSlate SignNow assist with 941 forms 2020?

airSlate SignNow offers a seamless platform for electronically signing and sending 941 forms 2020. This streamlines the uploading and submission process, allowing businesses to save time and reduce paperwork. With an easy-to-use interface, you can ensure your forms are completed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for 941 forms 2020?

Yes, airSlate SignNow provides various pricing plans to meet different business needs. You can choose a plan based on the volume of documents you manage, including 941 forms 2020. Our cost-effective solutions aim to provide great value while ensuring you have all the necessary tools at your disposal.

-

What features does airSlate SignNow offer for handling 941 forms 2020?

airSlate SignNow includes a range of features designed to assist with 941 forms 2020, such as customizable templates, automatic reminders, and robust tracking. These features help ensure that your forms are accurately completed and submitted efficiently. Plus, the platform allows you to access documents from anywhere, ensuring you stay organized.

-

Can I integrate airSlate SignNow with other software for managing 941 forms 2020?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll systems, which can simplify the management of 941 forms 2020. By connecting with your existing tools, you can enhance workflow efficiency and maintain accuracy in tax reporting. This integration ensures all your documents and data are synchronized.

-

How secure is airSlate SignNow when handling 941 forms 2020?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like 941 forms 2020. The platform employs industry-leading encryption and compliance measures to protect your data. You can confidently eSign and send your forms, knowing your information is safe and secure.

-

What are the benefits of using airSlate SignNow for 941 forms 2020?

Using airSlate SignNow for your 941 forms 2020 brings numerous benefits, including time savings, increased accuracy, and enhanced compliance. The platform eliminates the hassles of paper-based processes and allows for quick eSigning from any device. This makes managing your forms more efficient and streamlined.

Get more for Form Irs 941 Fill Online

Find out other Form Irs 941 Fill Online

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile