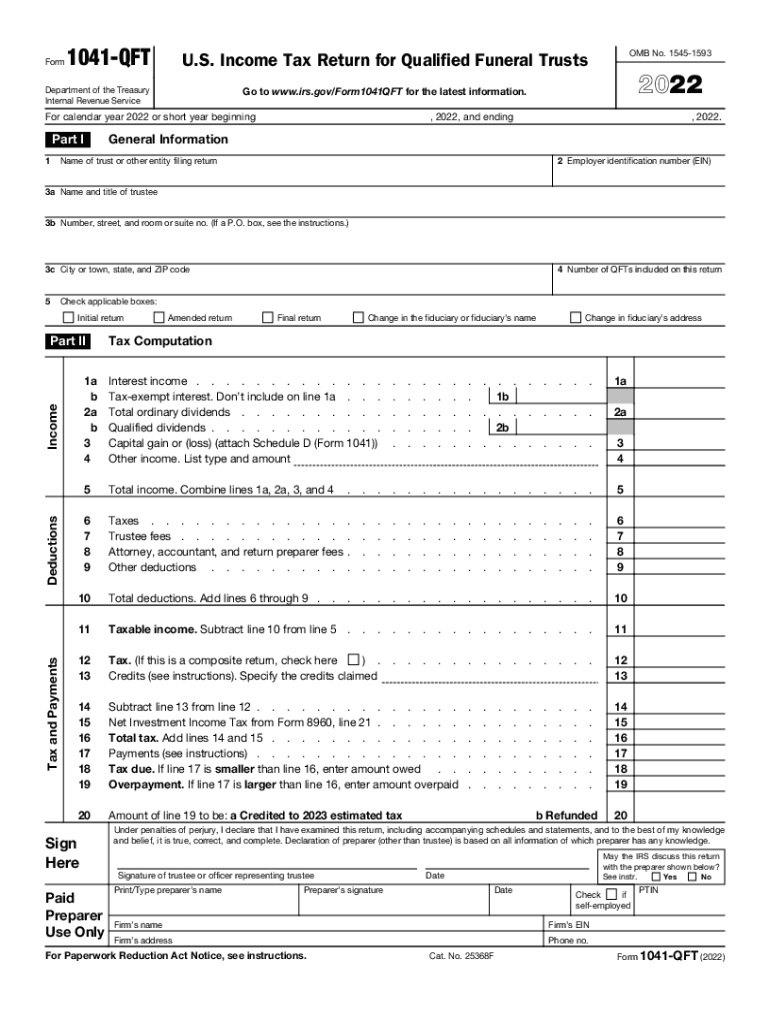

Form 1041 QFT U S Income Tax Return for Qualified Funeral Trusts 2022

What is the Form 1041 QFT U.S. Income Tax Return for Qualified Funeral Trusts

The Form 1041 QFT is specifically designed for reporting income, deductions, and credits related to qualified funeral trusts in the United States. These trusts are established to pre-fund funeral expenses, allowing individuals to set aside money that can be used for their funeral arrangements. The form must be filed by the trustee of the funeral trust to report any income generated by the trust assets. Understanding the purpose of this form is essential for ensuring compliance with IRS regulations and for properly managing the financial aspects of funeral planning.

Steps to Complete the Form 1041 QFT U.S. Income Tax Return for Qualified Funeral Trusts

Completing the Form 1041 QFT involves several important steps:

- Gather necessary information: Collect all relevant financial information related to the trust, including income statements and any deductions.

- Fill out the form: Enter the required information in the appropriate sections of the form, including the trust's name, address, and taxpayer identification number.

- Report income: Detail any income earned by the trust during the tax year, including interest and dividends.

- Claim deductions: Include any allowable deductions, such as administrative expenses associated with managing the trust.

- Review and sign: Ensure all information is accurate, and the form is signed by the trustee.

- File the form: Submit the completed Form 1041 QFT to the IRS by the applicable deadline.

IRS Guidelines for Funeral Expenses Deduction

The IRS has specific guidelines regarding the deductibility of funeral expenses. Generally, funeral expenses are not deductible on personal income tax returns. However, if a qualified funeral trust is established, the income generated by that trust may be subject to different tax treatments. Understanding these guidelines is crucial for individuals considering pre-funding their funeral expenses through a trust. It is advisable to consult IRS publications or a tax professional to navigate these rules effectively.

Eligibility Criteria for Qualified Funeral Trusts

To establish a qualified funeral trust, certain eligibility criteria must be met. These include:

- The trust must be irrevocable, meaning it cannot be altered or revoked once established.

- The funds must be specifically designated for funeral expenses.

- The trust must comply with IRS regulations regarding contributions and distributions.

Meeting these criteria ensures that the trust qualifies for favorable tax treatment under IRS rules, which can provide financial relief for beneficiaries when dealing with funeral costs.

Required Documents for Filing Form 1041 QFT

When filing the Form 1041 QFT, several documents are necessary to support the information provided. These documents include:

- Trust agreement outlining the terms and conditions of the funeral trust.

- Financial statements detailing income generated by the trust.

- Receipts for any expenses incurred in managing the trust.

Having these documents ready can simplify the filing process and help ensure compliance with IRS requirements.

Penalties for Non-Compliance with Form 1041 QFT

Failure to comply with the filing requirements for Form 1041 QFT can result in penalties from the IRS. These may include:

- Late filing penalties, which can accumulate if the form is not submitted by the deadline.

- Failure to pay penalties if any taxes owed are not paid on time.

- Interest on unpaid taxes, which can increase the overall amount owed.

Understanding these penalties emphasizes the importance of timely and accurate filing of the Form 1041 QFT.

Quick guide on how to complete 2022 form 1041 qft us income tax return for qualified funeral trusts

Complete Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the right template and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts with ease

- Obtain Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1041 qft us income tax return for qualified funeral trusts

Create this form in 5 minutes!

People also ask

-

Can funeral expenses be deducted on my taxes?

Yes, in certain circumstances, can funeral expenses be deducted as part of estate expenses. However, it's essential to understand that these deductions typically apply to taxable estates rather than individual taxpayers. Consult a tax professional to determine your eligibility.

-

What features does airSlate SignNow offer for handling funeral expense documents?

airSlate SignNow offers robust features for handling all types of documents, including those related to funeral expenses. You can easily create, send, and eSign important documents such as invoices and reimbursement requests. This streamlined process can help you manage your financial responsibilities efficiently.

-

How can I ensure my funeral expense documentation is legally compliant?

To ensure that your funeral expense documentation is legally compliant, utilize airSlate SignNow’s templates which are designed to adhere to legal standards. By using an eSigning platform, you can guarantee that all documents are signed and stored securely, which can be beneficial if you need to provide proof of expenses for tax deductions.

-

Are there specific integrations that help manage funeral expenses?

Yes, airSlate SignNow integrates with various accounting and financial software, making it easier to manage funeral expenses. With these integrations, users can automatically track and document expenses related to funeral services. This coordination can help streamline the process of determining if funeral expenses can be deducted.

-

What affordable pricing options does airSlate SignNow provide?

airSlate SignNow offers a range of pricing plans to accommodate different business needs, including an affordable option for managing essential documents like funeral expenses. Pricing is accessible and designed to deliver great value, ensuring that even small businesses can make use of effective eSigning solutions for their documentation requirements.

-

Can I use airSlate SignNow to send documents related to funeral expenses quickly?

Absolutely! With airSlate SignNow, you can send documents related to funeral expenses quickly and efficiently. The eSigning process is straightforward, allowing you to manage your paperwork in a timely manner, which is essential for ensuring all expenses are accounted for, especially when considering if can funeral expenses be deducted.

-

Is customer support available for queries about funeral expenses?

Yes, airSlate SignNow provides dedicated customer support that can assist you with questions about managing funeral expense documents. Whether you need help navigating the software or have inquiries about documentation related to can funeral expenses be deducted, our team is here to help.

Get more for Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

- Legal last will and testament form for widow or widower with minor children nevada

- Legal last will form for a widow or widower with no children nevada

- Legal last will and testament form for a widow or widower with adult and minor children nevada

- Legal last will and testament form for divorced and remarried person with mine yours and ours children nevada

- Gregory langadinos form

- Written revocation of will nevada form

- Last will and testament for other persons nevada form

- Notice to beneficiaries of being named in will nevada form

Find out other Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure