1041 Qft Form 2014

What is the 1041 Qft Form

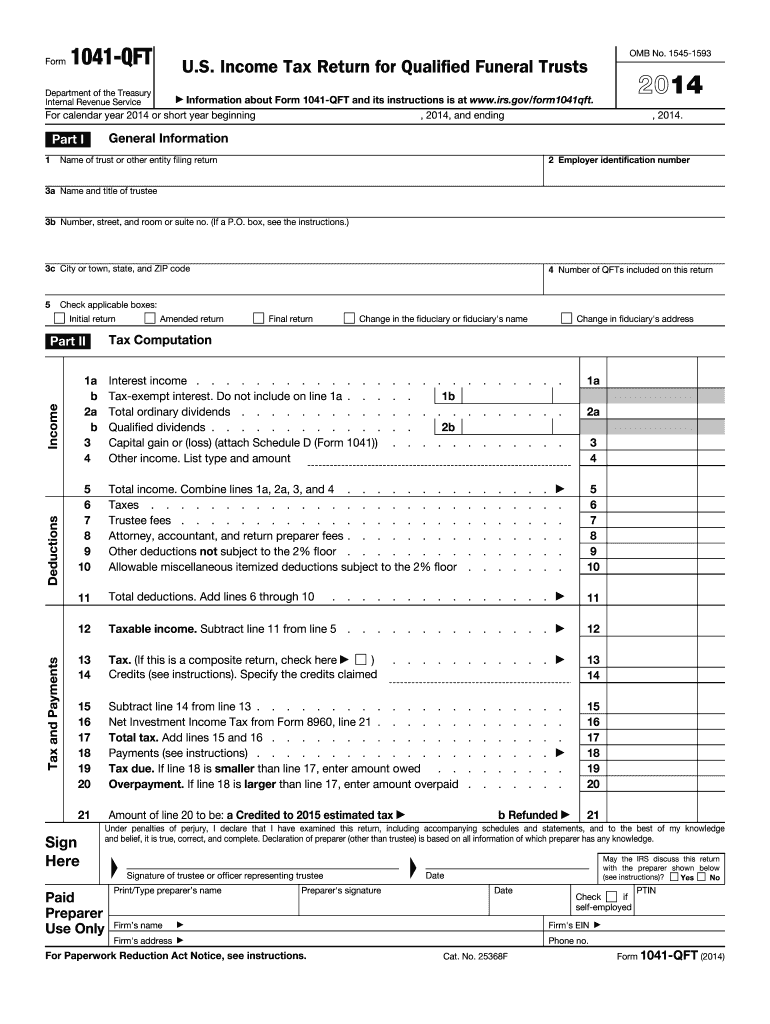

The 1041 Qft Form is a tax document utilized by estates and trusts in the United States to report income, deductions, and credits. This form is essential for fiduciaries who manage the financial affairs of deceased individuals or those who have placed their assets in a trust. The information provided on the 1041 Qft Form helps the Internal Revenue Service (IRS) assess the tax obligations of the estate or trust, ensuring compliance with federal tax laws.

How to use the 1041 Qft Form

Using the 1041 Qft Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents related to the estate or trust, including income statements, expense receipts, and previous tax returns. Next, fill out the form with precise information regarding the income earned and deductions claimed. After completing the form, review it for accuracy before filing it with the IRS, either electronically or by mail. It is crucial to adhere to the specific guidelines provided by the IRS to avoid any potential issues.

Steps to complete the 1041 Qft Form

Completing the 1041 Qft Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income sources and expenses.

- Fill out the identification section, including the name and taxpayer identification number of the estate or trust.

- Report all income received during the tax year, including interest, dividends, and capital gains.

- Claim any deductions available, such as administrative expenses and distributions to beneficiaries.

- Calculate the taxable income and determine the tax liability using the appropriate tax rates.

- Sign and date the form, ensuring that it is submitted by the deadline.

Legal use of the 1041 Qft Form

The legal use of the 1041 Qft Form is governed by federal tax regulations. It is essential for fiduciaries to understand that the form must be completed accurately to reflect the financial activities of the estate or trust. Failure to comply with IRS guidelines can result in penalties or audits. The form serves as a legal declaration of the estate’s or trust’s income and expenses, making it vital for maintaining transparency and accountability in financial reporting.

Filing Deadlines / Important Dates

Filing deadlines for the 1041 Qft Form are critical for compliance. Typically, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the form is generally due by April fifteenth. It is important to keep track of these dates and file on time to avoid penalties. Extensions may be available, but they must be requested in advance.

Required Documents

To complete the 1041 Qft Form, several documents are necessary. These include:

- Financial statements detailing income and expenses for the estate or trust.

- Previous tax returns for the decedent or trust.

- Documentation of distributions made to beneficiaries.

- Receipts for any deductible expenses incurred during the tax year.

Having these documents prepared in advance can streamline the completion of the form and ensure accurate reporting.

Quick guide on how to complete 1041 qft 2014 form

Complete 1041 Qft Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as it allows you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without any delays. Handle 1041 Qft Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign 1041 Qft Form without any hassle

- Find 1041 Qft Form and click on Get Form to proceed.

- Utilize the tools available to complete your form.

- Highlight relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it directly to your computer.

Forget about misplaced or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign 1041 Qft Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1041 qft 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 1041 qft 2014 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is the 1041 Qft Form and why is it important?

The 1041 Qft Form is a tax document used by estates and trusts to report income and deductions. It's important because it ensures compliance with IRS regulations and assists in the proper calculation of tax liabilities. Properly filing the 1041 Qft Form can help reduce the risk of audits and penalties.

-

How can airSlate SignNow help with filling out the 1041 Qft Form?

airSlate SignNow offers an intuitive platform for easily creating and signing the 1041 Qft Form. With our user-friendly interface, you can fill in the necessary fields quickly, ensuring all required information is accurate. This streamlines the documentation process, allowing you to focus on what matters most.

-

What is the pricing for using airSlate SignNow for the 1041 Qft Form?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. You can choose from monthly or annual subscriptions that are cost-effective for sending and eSigning the 1041 Qft Form. Numerous features are included, ensuring you get the best value for your investment.

-

Are there any integrations available for managing the 1041 Qft Form?

Yes, airSlate SignNow seamlessly integrates with popular software solutions to enhance your workflow. You can connect with cloud storage services, CRMs, and accounting tools to manage the 1041 Qft Form efficiently. This allows for centralized document management and easy access to all your important files.

-

Is my data secure when using airSlate SignNow for the 1041 Qft Form?

Absolutely. airSlate SignNow prioritizes your data security with robust encryption and compliance with industry standards. Your information is securely stored, and access is controlled, ensuring your 1041 Qft Form and other documents remain confidential and protected.

-

Can I track the status of the 1041 Qft Form after sending it?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your sent 1041 Qft Form. You'll receive notifications when the document is viewed and signed, giving you peace of mind and keeping you informed throughout the process. This feature is essential for timely tax management.

-

Is it possible to customize the 1041 Qft Form using airSlate SignNow?

Yes, you can customize the 1041 Qft Form within airSlate SignNow to meet your specific needs. Our platform allows you to add fields, logos, and any additional information required to tailor the form appropriately. This customization ensures the form reflects your branding and fulfills all necessary legal requirements.

Get more for 1041 Qft Form

- Quitclaim deed from corporation to individual georgia form

- Warranty deed from corporation to individual georgia form

- Quitclaim deed from corporation to llc georgia form

- Quitclaim deed from corporation to corporation georgia form

- Warranty deed from corporation to corporation georgia form

- Divorce maiden name form

- Georgia decree divorce form

- Quitclaim deed from corporation to two individuals georgia form

Find out other 1041 Qft Form

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation