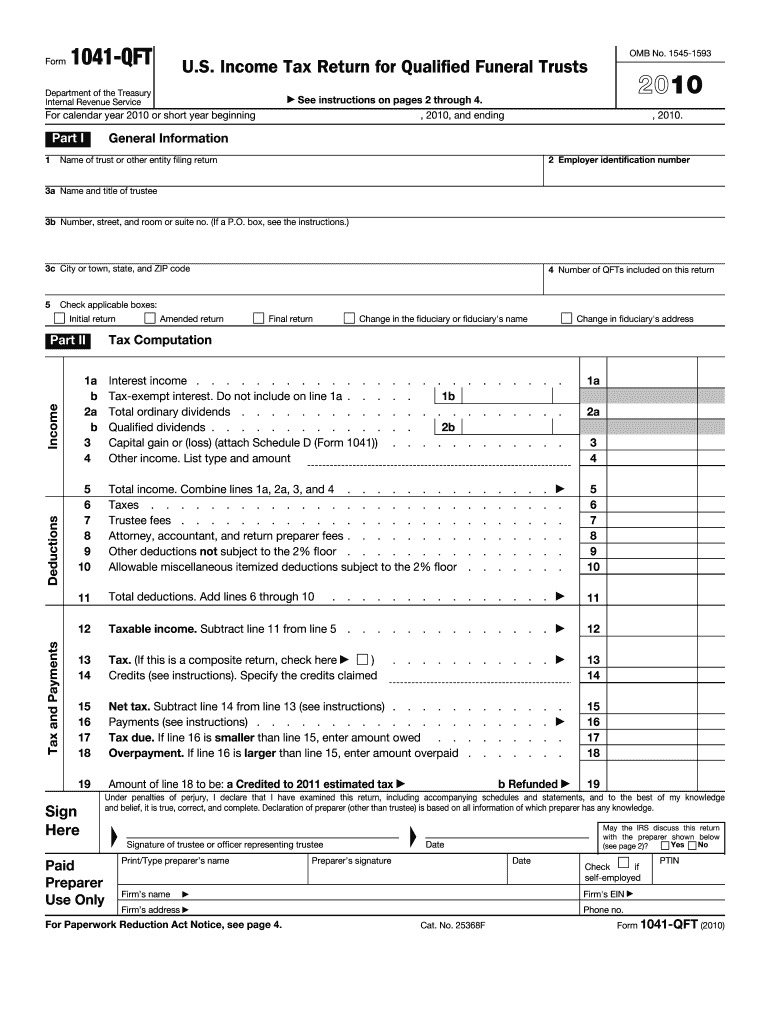

US Individual Income Tax Return Income Adjusted IRS 2010

What is the US Individual Income Tax Return Income Adjusted IRS

The US Individual Income Tax Return Income Adjusted IRS form is a crucial document used by American taxpayers to report their annual income and calculate their tax liability. This form is essential for individuals who need to disclose their adjusted gross income, which includes various types of income such as wages, dividends, capital gains, and other earnings. The adjusted income is significant as it determines eligibility for various tax credits and deductions, impacting the overall tax obligation.

Steps to complete the US Individual Income Tax Return Income Adjusted IRS

Completing the US Individual Income Tax Return Income Adjusted IRS form involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Calculate your total income and determine your adjusted gross income by factoring in deductions and credits.

- Fill out the form accurately, ensuring all sections are completed, including personal information and income details.

- Review the form for accuracy and ensure that all calculations are correct.

- Sign and date the form, either electronically or physically, depending on the submission method.

How to obtain the US Individual Income Tax Return Income Adjusted IRS

Taxpayers can obtain the US Individual Income Tax Return Income Adjusted IRS form through various channels:

- Visit the official IRS website to download the form directly in PDF format.

- Request a paper copy by calling the IRS or visiting a local IRS office.

- Use tax preparation software that often includes the form as part of their filing process.

Legal use of the US Individual Income Tax Return Income Adjusted IRS

The legal use of the US Individual Income Tax Return Income Adjusted IRS form is governed by federal tax laws. It is essential for taxpayers to ensure that the information provided is accurate and complete to avoid penalties. The form must be submitted by the annual filing deadline, and it must reflect the taxpayer's true financial situation. Failure to comply with these legal requirements can result in audits, fines, or other legal repercussions.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the US Individual Income Tax Return Income Adjusted IRS form is crucial for compliance. Typically, the deadline for filing is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file the form, usually until October fifteenth.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the US Individual Income Tax Return Income Adjusted IRS form:

- Online submission through the IRS e-file system, which is a secure and efficient method.

- Mailing a paper copy of the completed form to the appropriate IRS address based on the taxpayer's location.

- In-person submission at local IRS offices, which may provide assistance with the filing process.

Quick guide on how to complete us individual income tax return 2010 income adjusted irs

Effortlessly Prepare US Individual Income Tax Return Income Adjusted IRS on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage US Individual Income Tax Return Income Adjusted IRS on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

Edit and eSign US Individual Income Tax Return Income Adjusted IRS with Ease

- Locate US Individual Income Tax Return Income Adjusted IRS and click Get Form to begin.

- Utilize the tools available to complete your document.

- Select important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require you to print new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign US Individual Income Tax Return Income Adjusted IRS to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct us individual income tax return 2010 income adjusted irs

Create this form in 5 minutes!

How to create an eSignature for the us individual income tax return 2010 income adjusted irs

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the US Individual Income Tax Return Income Adjusted IRS?

The US Individual Income Tax Return Income Adjusted IRS refers to the adjusted gross income reported on your federal tax return, which impacts your tax obligations and eligibility for various tax credits. It's essential to report this income accurately to avoid issues with the IRS. Understanding your adjusted income helps in preparing an effective tax strategy.

-

How can airSlate SignNow help with filing the US Individual Income Tax Return Income Adjusted IRS?

airSlate SignNow allows users to easily send, sign, and manage tax documents, including the US Individual Income Tax Return Income Adjusted IRS forms. With its user-friendly interface, you can enhance your workflow and ensure that all documents are securely signed and stored. This streamlines the filing process and helps maintain compliance with IRS regulations.

-

What are the pricing options for using airSlate SignNow for tax filings?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a free trial to subscription-based pricing. This flexibility ensures that even small businesses can afford to use the platform for managing critical documents like the US Individual Income Tax Return Income Adjusted IRS. Each plan delivers comprehensive features tailored to user demands.

-

What features does airSlate SignNow provide for tax-related documents?

AirSlate SignNow provides robust features such as document templates, real-time tracking, and secure eSigning, specifically useful for tax-related documents like the US Individual Income Tax Return Income Adjusted IRS. These features enhance collaboration and streamline the process of gathering and signing necessary information. Users can also access their documents from any device, ensuring ease of use.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow offers seamless integrations with various accounting software solutions, allowing users to manage their financial documents efficiently. This compatibility ensures that important tax forms, like the US Individual Income Tax Return Income Adjusted IRS, can be easily linked and updated within your existing systems. Integration reduces data entry errors and saves time during tax season.

-

What are the benefits of using airSlate SignNow for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents offers several benefits, including enhanced security, faster signing processes, and reduced paperwork. When dealing with sensitive information like the US Individual Income Tax Return Income Adjusted IRS, the platform ensures that documents are encrypted and securely managed. This boosts trust and efficiency for individuals and businesses alike.

-

Is airSlate SignNow compliant with IRS regulations?

Absolutely, airSlate SignNow is designed to comply with IRS regulations regarding electronic signatures and document management. Using our platform for your US Individual Income Tax Return Income Adjusted IRS submissions ensures that your documents meet necessary legal requirements. This compliance helps mitigate risks associated with electronic record-keeping.

Get more for US Individual Income Tax Return Income Adjusted IRS

- Brick mason contractor package georgia form

- Roofing contractor package georgia form

- Electrical contractor package georgia form

- Sheetrock drywall contractor package georgia form

- Flooring contractor package georgia form

- Trim carpentry contractor package georgia form

- Fencing contractor package georgia form

- Hvac contractor package georgia form

Find out other US Individual Income Tax Return Income Adjusted IRS

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure