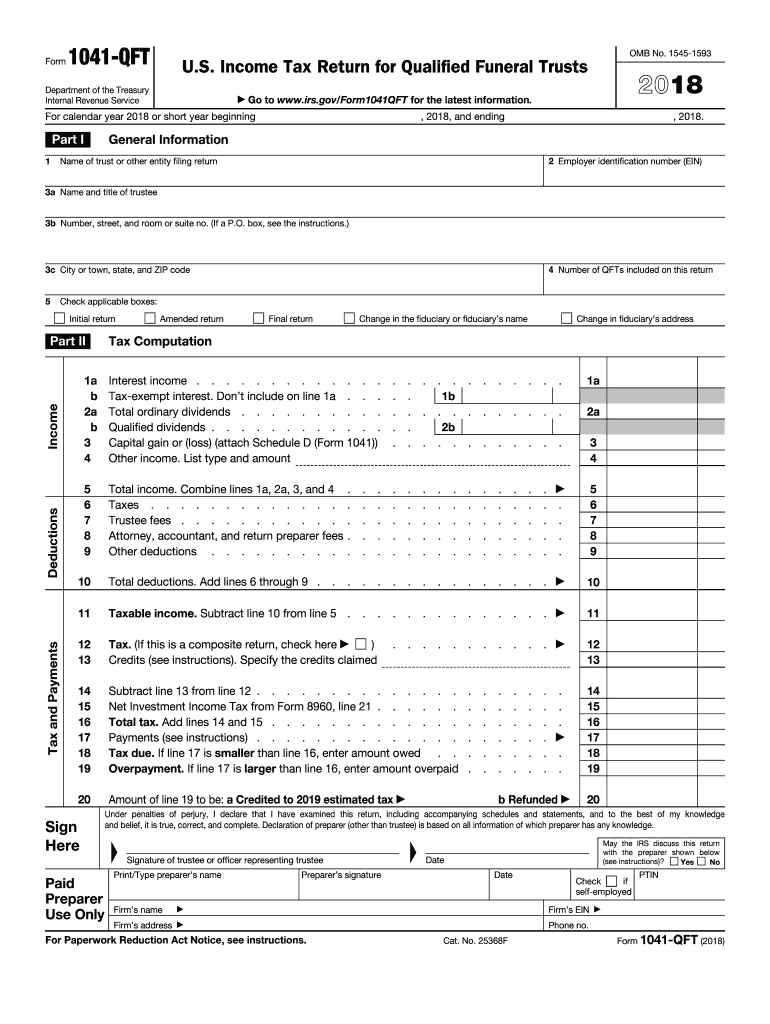

1041 Qft 2018

What is the 1041 QFT?

The 1041 QFT, or Form 1041 Qualified Funeral Trust, is a tax form used in the United States for reporting income generated by a qualified funeral trust. This form is essential for trusts established to manage funds for funeral expenses, ensuring that the income is reported correctly to the IRS. The 1041 QFT allows trustees to report income, deductions, and credits associated with the trust, making it a crucial document for compliance with federal tax regulations.

Steps to complete the 1041 QFT

Completing the 1041 QFT involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents related to the trust, including income statements and expense records. Next, fill out the form with the required information, paying close attention to the income and deductions sections. It is important to ensure that all information is accurate and complete to avoid any issues with the IRS. After filling out the form, review it thoroughly for errors before submitting it.

How to obtain the 1041 QFT

The 1041 QFT can be obtained directly from the IRS website or through tax preparation software that includes the form. It is important to ensure that you are using the most current version of the form, as outdated forms may not be accepted by the IRS. Additionally, some tax professionals may have access to the form and can assist in obtaining it if needed.

Legal use of the 1041 QFT

The legal use of the 1041 QFT is governed by IRS regulations regarding qualified funeral trusts. These trusts must meet specific criteria to qualify for tax benefits, including being established for the purpose of paying for funeral expenses. Proper use of the form ensures that the income generated by the trust is reported accurately, which is essential for maintaining compliance with tax laws. Failure to use the form correctly can result in penalties or disqualification of the trust's tax status.

Filing Deadlines / Important Dates

Filing deadlines for the 1041 QFT typically align with the tax year of the trust. Generally, the form must be filed by the 15th day of the fourth month following the end of the trust's tax year. For most trusts operating on a calendar year, this means the form is due by April 15. It is crucial to keep track of these deadlines to avoid late filing penalties and ensure that the trust remains in good standing with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The 1041 QFT can be submitted to the IRS through various methods. While electronic filing is available through approved tax software, some trustees may prefer to file by mail. When submitting by mail, ensure that the form is sent to the correct IRS address based on the trust's location. In-person submission is generally not an option for this form, as the IRS typically requires forms to be filed electronically or via mail.

Quick guide on how to complete form 1041 qft 2018 2019

Discover the easiest method to complete and endorse your 1041 Qft

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow presents a superior solution for completing and endorsing your 1041 Qft and related forms for public services. Our advanced electronic signature tool equips you with everything necessary to handle documents swiftly and in compliance with formal standards - comprehensive PDF editing, management, protection, signing, and sharing functionalities are all accessible through a user-friendly interface.

Only a few steps are needed to complete your 1041 Qft:

- Upload the editable template to the editor using the Get Form button.

- Review the information required in your 1041 Qft.

- Move between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the blanks with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Blackout sections that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your work with the Done button.

Store your finalized 1041 Qft in the Documents folder in your profile, download it, or send it to your chosen cloud storage. Our service also features versatile form sharing options. There’s no necessity to print your templates when sending them to the designated public office - accomplish it through email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct form 1041 qft 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the form 1041 qft 2018 2019

How to create an eSignature for your Form 1041 Qft 2018 2019 in the online mode

How to create an electronic signature for your Form 1041 Qft 2018 2019 in Chrome

How to generate an eSignature for signing the Form 1041 Qft 2018 2019 in Gmail

How to generate an electronic signature for the Form 1041 Qft 2018 2019 straight from your smartphone

How to create an eSignature for the Form 1041 Qft 2018 2019 on iOS devices

How to make an eSignature for the Form 1041 Qft 2018 2019 on Android OS

People also ask

-

What are 1041 qft forms and why are they important?

1041 qft forms are tax documents used for reporting income and deductions for estates and trusts. They are important because they ensure compliance with IRS regulations and help in accurate tax reporting.

-

How can airSlate SignNow assist with completing 1041 qft forms?

airSlate SignNow provides an easy-to-use platform for filling out and signing 1041 qft forms digitally. This minimizes errors and streamlines the filing process, allowing you to focus on managing your estate or trust more effectively.

-

Is there a cost associated with using airSlate SignNow for 1041 qft forms?

Yes, airSlate SignNow offers various pricing plans, including options specifically aimed at users needing to handle documents like 1041 qft forms. Our cost-effective solutions are designed to fit different budgets while providing powerful features for document management.

-

Can I integrate airSlate SignNow with other software for managing 1041 qft forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to sync your data and manage 1041 qft forms alongside other financial and accounting tools. This enhances productivity and ensures all your documents are in one place.

-

What security features does airSlate SignNow offer for 1041 qft forms?

airSlate SignNow prioritizes security and offers robust encryption, secure cloud storage, and compliance with industry standards for handling 1041 qft forms. Your sensitive information is protected throughout the signing and storing process.

-

Are there templates available for 1041 qft forms on airSlate SignNow?

Yes, airSlate SignNow offers templates for 1041 qft forms that simplify the completion process. You can customize these templates to fit your specific needs, making it easier to manage multiple estates or trusts efficiently.

-

How long does it take to complete and eSign 1041 qft forms using airSlate SignNow?

Completing and eSigning 1041 qft forms using airSlate SignNow can take as little as a few minutes. The intuitive interface and streamlined workflow facilitate quick document management without unnecessary delays.

Get more for 1041 Qft

- Use objectid in input form help meteor forums

- Allianz professional indemnity proposal form

- Wv medicaid dme prior authorization request form aps healthcare

- Privacy release form u s senator dan coats u s senate

- Coal book pdf form

- In the matter of sharon losee and u dol form

- 99 0659 doc dol form

- Please select the program to which you are applying form

Find out other 1041 Qft

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document