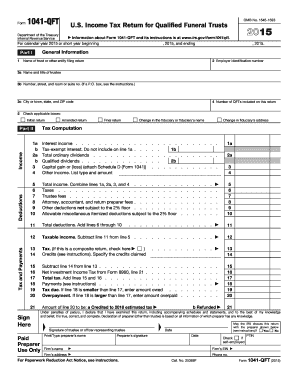

Form 1041 Qft 2015

What is the Form 1041 Qft

The Form 1041 QFT, or Qualified Funeral Trust, is a tax form used by estates to report income earned by funeral trusts. This form is specifically designed for trusts that provide for the funeral expenses of the beneficiaries. It ensures that the income generated by the trust is reported accurately to the Internal Revenue Service (IRS). By using this form, trustees can manage the tax obligations of the trust while fulfilling their fiduciary duties to the beneficiaries.

How to use the Form 1041 Qft

Using the Form 1041 QFT involves several steps. First, trustees must gather all necessary financial information related to the trust, including income, expenses, and distributions made during the tax year. Next, the form must be filled out with accurate details about the trust and its beneficiaries. After completing the form, it should be submitted to the IRS along with any required schedules and attachments. It is important to ensure that all information is correct to avoid penalties or delays in processing.

Steps to complete the Form 1041 Qft

Completing the Form 1041 QFT requires careful attention to detail. Here are the key steps:

- Gather financial records related to the trust, including income statements and expense receipts.

- Fill out the identification section, providing the trust's name, address, and Employer Identification Number (EIN).

- Report the income earned by the trust in the appropriate sections of the form.

- Detail any deductions or expenses that can be claimed against the income.

- Complete the section regarding distributions made to beneficiaries, if applicable.

- Review the form for accuracy before signing and dating it.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the Form 1041 Qft

The legal use of the Form 1041 QFT is critical for compliance with federal tax laws. This form must be filed correctly to ensure that the trust meets its tax obligations. Failure to file the form or inaccuracies in reporting can lead to penalties and interest charges. The form also serves as a legal document that verifies the trust's income and expenses, which can be important in case of audits or disputes. Adhering to IRS guidelines is essential to maintain the trust's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 QFT are crucial for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the deadline is April fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is advisable to keep track of these dates to avoid late filing penalties.

Required Documents

To complete the Form 1041 QFT, several documents are required:

- Financial statements for the trust, including income and expense reports.

- Details of any distributions made to beneficiaries.

- Trust agreement or governing documents that outline the terms of the trust.

- Any previous tax returns filed for the trust, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete form 1041 qft 2015

Prepare Form 1041 Qft effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-conscious solution to conventional printed and signed documents, allowing you to access the correct form and safely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without interruptions. Handle Form 1041 Qft on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign Form 1041 Qft without any hassle

- Locate Form 1041 Qft and click Get Form to begin.

- Make use of the features we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 1041 Qft to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 qft 2015

Create this form in 5 minutes!

How to create an eSignature for the form 1041 qft 2015

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a Form 1041 Qft?

Form 1041 Qft is a tax form used by fiduciaries to report income, deductions, and credits for qualified funeral trusts. This form ensures that the trust adheres to IRS regulations and accurately reflects its financial standing. Understanding how to properly complete Form 1041 Qft is crucial for both compliance and potential tax benefits.

-

How can airSlate SignNow help with Form 1041 Qft?

AirSlate SignNow offers an efficient platform for preparing, signing, and sending Form 1041 Qft documents securely. With its intuitive interface, users can easily manage their documents and obtain necessary signatures without the hassle of printing. This saves time and ensures compliance in your fiduciary obligations.

-

What features does airSlate SignNow provide for Form 1041 Qft preparation?

AirSlate SignNow includes features such as template creation, secure cloud storage, and real-time document tracking specifically for Form 1041 Qft. Users can also collaborate with others seamlessly and customize the signing workflow to meet their needs. These features enhance efficiency and ensure a smooth document management process.

-

Is airSlate SignNow compatible with other software for Form 1041 Qft?

Yes, airSlate SignNow integrates with various applications to streamline the process for Form 1041 Qft. This includes popular accounting software, making it easy to sync data and generate documents without manual entry. Integrating SignNow with your existing tools ensures a more productive workflow for trust administration.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers a variety of pricing plans tailored to suit different needs when working with Form 1041 Qft. Whether you’re an individual or a business, there are flexible subscription options available. Additionally, the cost-effectiveness of airSlate SignNow makes it a viable choice for managing essential documents like Form 1041 Qft.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Form 1041 Qft, provides several benefits, such as enhanced security and ease of use. The platform ensures your documents are encrypted and compliant with regulations. Additionally, the ability to manage everything online simplifies the overall process, helping you avoid common pitfalls.

-

Can airSlate SignNow assist in tracking the status of Form 1041 Qft submissions?

Absolutely! AirSlate SignNow offers features that allow users to track the status of Form 1041 Qft submissions in real time. You’ll receive notifications when documents are viewed, signed, or completed, giving you peace of mind that everything is processed smoothly. This level of transparency is invaluable when dealing with important tax submissions.

Get more for Form 1041 Qft

- Commercial contract for contractor district of columbia form

- Excavator contract for contractor district of columbia form

- Renovation contract for contractor district of columbia form

- Concrete mason contract for contractor district of columbia form

- Demolition contract for contractor district of columbia form

- Framing contract for contractor district of columbia form

- District of columbia security form

- Insulation contract for contractor district of columbia form

Find out other Form 1041 Qft

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy