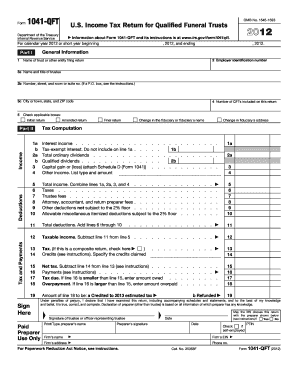

Name of Trust or Other Entity Filing Return 2012

What is the Name Of Trust Or Other Entity Filing Return

The Name Of Trust Or Other Entity Filing Return is a crucial document used for reporting the income, deductions, and credits of a trust or other legal entity. This form ensures that the entity complies with federal tax regulations and provides transparency regarding its financial activities. Typically, trusts and entities such as partnerships, corporations, and limited liability companies (LLCs) must file this return to maintain their legal status and fulfill their tax obligations.

Steps to complete the Name Of Trust Or Other Entity Filing Return

Completing the Name Of Trust Or Other Entity Filing Return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and prior year returns. Next, accurately fill out the form by providing details about the entity, such as its name, address, and taxpayer identification number. Ensure that all income and deductions are reported correctly. After completing the form, review it thoroughly for any errors before submitting it to the appropriate tax authority.

Legal use of the Name Of Trust Or Other Entity Filing Return

The legal use of the Name Of Trust Or Other Entity Filing Return is essential for maintaining compliance with tax laws. Filing this return not only fulfills the entity's legal obligations but also protects the interests of beneficiaries and stakeholders. A properly filed return can help avoid penalties, interest, and potential legal issues. Additionally, it provides a clear record of the entity's financial activities, which can be important in case of audits or disputes.

Required Documents

To successfully complete the Name Of Trust Or Other Entity Filing Return, certain documents are required. These typically include:

- Financial statements detailing income and expenses

- Prior year tax returns for reference

- Records of distributions made to beneficiaries

- Any relevant supporting documentation for deductions claimed

Having these documents organized and accessible will streamline the filing process and help ensure that all information is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Name Of Trust Or Other Entity Filing Return vary depending on the type of entity and its tax year. Generally, trusts must file their returns by the fifteenth day of the fourth month following the end of their tax year. For entities operating on a calendar year, this typically means a deadline of April 15. It is important to be aware of these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Name Of Trust Or Other Entity Filing Return can be submitted through various methods. Entities may choose to file online through authorized e-filing services, which can expedite the process and provide immediate confirmation of receipt. Alternatively, forms can be mailed to the appropriate tax authority, ensuring that they are postmarked by the filing deadline. In some cases, in-person submissions may also be available, depending on local regulations and office hours.

Quick guide on how to complete name of trust or other entity filing return

Effortlessly prepare Name Of Trust Or Other Entity Filing Return on any device

Managing documents online has become increasingly popular among companies and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents efficiently without delays. Manage Name Of Trust Or Other Entity Filing Return on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Name Of Trust Or Other Entity Filing Return with ease

- Obtain Name Of Trust Or Other Entity Filing Return and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the features that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and electronically sign Name Of Trust Or Other Entity Filing Return and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct name of trust or other entity filing return

Create this form in 5 minutes!

How to create an eSignature for the name of trust or other entity filing return

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is the Name Of Trust Or Other Entity Filing Return?

The Name Of Trust Or Other Entity Filing Return is a required document for trusts and entities to report their income and expenses to the IRS. It ensures compliance with tax regulations, providing necessary details that distinguish the entity as a separate tax filer. Submitting this form properly can help prevent potential financial penalties.

-

How does airSlate SignNow facilitate the Name Of Trust Or Other Entity Filing Return process?

airSlate SignNow simplifies the Name Of Trust Or Other Entity Filing Return process by allowing users to easily prepare, sign, and send the required documents electronically. Our user-friendly interface ensures that you can navigate the filing requirements smoothly, making it easier and faster to meet deadlines. You can manage all your document workflows in one place, increasing efficiency.

-

What features does airSlate SignNow offer for managing Name Of Trust Or Other Entity Filing Returns?

airSlate SignNow includes features such as document templates, e-signature capabilities, and secure cloud storage that specifically support the Name Of Trust Or Other Entity Filing Return process. You can create reusable templates for frequent filings and easily gather necessary signatures from stakeholders. These features streamline your workflow while maintaining compliance.

-

Is there a pricing structure for using airSlate SignNow for Name Of Trust Or Other Entity Filing Return?

Yes, airSlate SignNow offers flexible pricing plans designed to cater to different business needs. The plans provide access to essential features that support the Name Of Trust Or Other Entity Filing Return process, such as unlimited document signing and advanced integrations. You can select a plan that aligns with your budget and volume of filings.

-

What are the benefits of using airSlate SignNow for filing returns for trusts or other entities?

By using airSlate SignNow for your Name Of Trust Or Other Entity Filing Return, you ensure faster processing times and enhanced accuracy in your documentation. The platform reduces the chance of human error associated with traditional methods while offering cloud-based accessibility for your files. This empowers your business to stay organized and on track with filing deadlines.

-

Can airSlate SignNow integrate with other software for managing Name Of Trust Or Other Entity Filing Returns?

Absolutely! airSlate SignNow offers various integrations with popular accounting and tax software, allowing for seamless management of the Name Of Trust Or Other Entity Filing Return process. These integrations facilitate data transfer and synchronization, improving the overall workflow and reducing repetitive tasks for your team.

-

Is the airSlate SignNow platform secure for handling sensitive information related to my Name Of Trust Or Other Entity Filing Return?

Yes, airSlate SignNow prioritizes security by implementing robust encryption and data protection measures for all documents, including your Name Of Trust Or Other Entity Filing Return. We comply with industry standards and regulations to protect sensitive information throughout the signing and storage process. You can rest assured that your data is safe with us.

Get more for Name Of Trust Or Other Entity Filing Return

- Revocation of anatomical gift donation iowa form

- Employment or job termination package iowa form

- Newly widowed individuals package iowa form

- Employment interview package iowa form

- Employment employee personnel file package iowa form

- Assignment of mortgage package iowa form

- Assignment of lease package iowa form

- Lease purchase agreements package iowa form

Find out other Name Of Trust Or Other Entity Filing Return

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template