Form 1041 QFT U S Income Tax Return for Qualified Funeral Trusts 2023

What is the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

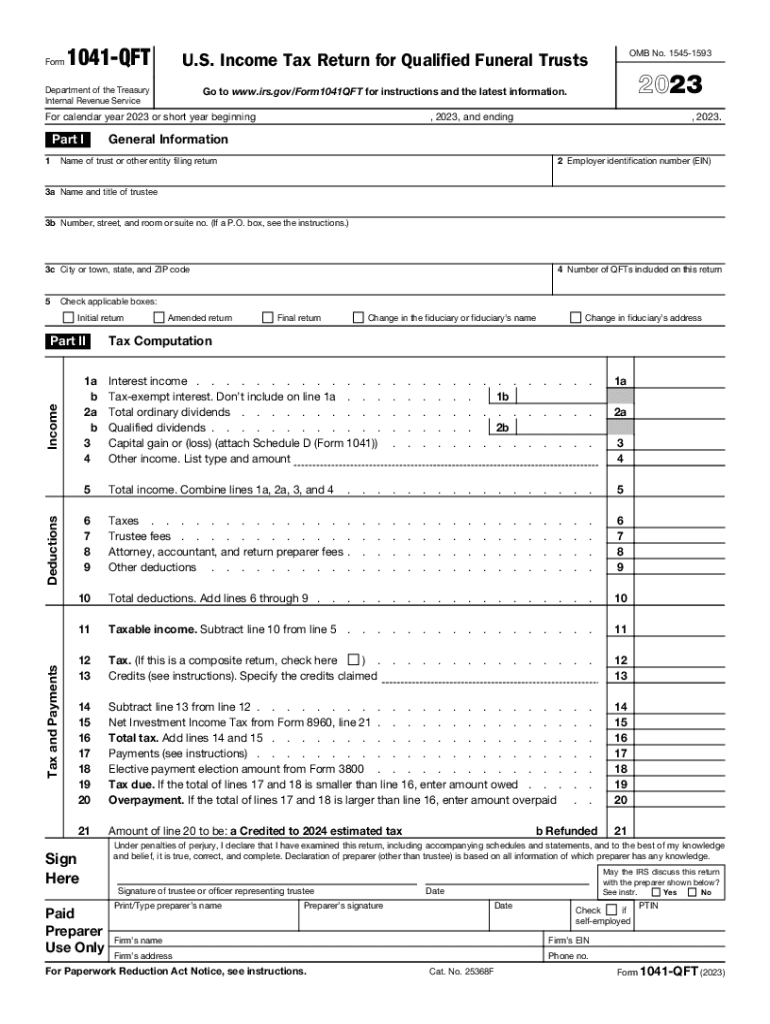

The Form 1041 QFT is specifically designed for reporting income generated by qualified funeral trusts. These trusts allow individuals to prepay funeral expenses, ensuring that funds are available when needed. This form is essential for fiduciaries managing these trusts, as it provides a clear framework for reporting income and deductions associated with the trust. Understanding this form is crucial for those involved in managing funeral trusts to comply with IRS regulations.

How to use the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

Using the Form 1041 QFT involves several steps to ensure accurate reporting. First, gather all necessary financial information related to the trust, including income generated and expenses incurred. Next, complete the form by providing details such as the trust's name, employer identification number, and the income received during the tax year. It is important to follow the IRS guidelines carefully to ensure compliance and avoid penalties. Once completed, the form must be submitted to the IRS by the designated deadline.

Steps to complete the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

Completing the Form 1041 QFT requires careful attention to detail. Start by entering the trust's basic information, including its name and identification number. Then, report the income earned by the trust, which may include interest and dividends. Deduct any allowable expenses related to managing the trust. Finally, calculate the trust's taxable income and determine the tax owed. Review the form for accuracy before submitting it to ensure compliance with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 1041 QFT. These guidelines outline the eligibility criteria for qualified funeral trusts, the types of income that must be reported, and the deductions that can be claimed. It is essential for fiduciaries to familiarize themselves with these guidelines to ensure that they are in compliance with tax laws. Regularly checking for updates from the IRS can help maintain compliance and avoid potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 QFT are crucial for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For trusts operating on a calendar year, this typically falls on April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Fiduciaries should mark these dates on their calendars to ensure timely submission and avoid penalties.

Required Documents

To complete the Form 1041 QFT, certain documents are necessary. These include financial statements reflecting the trust's income and expenses, documentation of any deductions claimed, and the trust's formation documents. Keeping organized records will facilitate the completion of the form and ensure that all required information is accurately reported. It is advisable to maintain these records for at least three years in case of an audit.

Quick guide on how to complete form 1041 qft u s income tax return for qualified funeral trusts

Complete Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a wonderful eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts with ease

- Locate Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 qft u s income tax return for qualified funeral trusts

Create this form in 5 minutes!

How to create an eSignature for the form 1041 qft u s income tax return for qualified funeral trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Can funeral expenses be deducted for tax purposes?

Yes, certain funeral expenses can be deducted under specific circumstances. If the deceased was an employee and these expenses were unreimbursed by the employer, you may be able to deduct them on your tax return. However, it’s important to consult with a tax professional to understand the regulations surrounding this deduction.

-

What are the admissible funeral expenses that can be deducted?

Generally, expenses such as the cost of the casket, burial plot, and funeral services may be deducted. However, qualifications apply; typically, these deductions pertain to the estate of the deceased and not personal tax returns. Always seek guidance from a tax advisor to ensure accurate claims.

-

How can airSlate SignNow assist in managing funeral expense documents?

airSlate SignNow enables users to easily send and eSign documents related to funeral expenses, such as contracts and receipts. With an intuitive platform, you can streamline the process, ensuring that necessary documents are organized and accessible. This can help you maintain transparency and make record-keeping more efficient.

-

Are there any features that support funeral expense documentation on airSlate SignNow?

Yes, airSlate SignNow offers features like document templates and collaboration tools that are perfect for handling funeral expense documentation. Users can create, modify, and share necessary documents with family members or legal representatives. These features ensure that all required signatures are obtained promptly.

-

What integrations does airSlate SignNow offer that may benefit funeral service providers?

airSlate SignNow integrates seamlessly with various platforms such as Google Drive and Dropbox, providing funeral service providers with tools to efficiently manage documents. This connectivity allows users to store and access documentation related to funeral expenses directly from their preferred storage solutions.

-

Is airSlate SignNow a cost-effective solution for managing funeral expense documents?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses. With flexible pricing plans, it allows funeral service providers to manage their documentation efficiently without incurring high overhead costs, leading to better management of funeral expenses.

-

Can airSlate SignNow help ensure compliance in funeral expense documentation?

Yes, using airSlate SignNow helps ensure compliance with legal standards for document signing and storage. By providing an auditable trail of all signatures and modifications, it lowers the risk of disputes concerning funeral expenses, enhancing trust with families.

Get more for Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

- Land use verification request form polk county

- Vineland ii manual pdf form

- Forms northplainfield org bh handymanprojecthandyman project application north plainfield

- Borough of midland park purchasing procedures manual form

- New jersey community affairs form

- Etrade com activate form

- Before action breach of contract template form

- Behavior change contract template form

Find out other Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile