944 Form 2011

What is the 944 Form

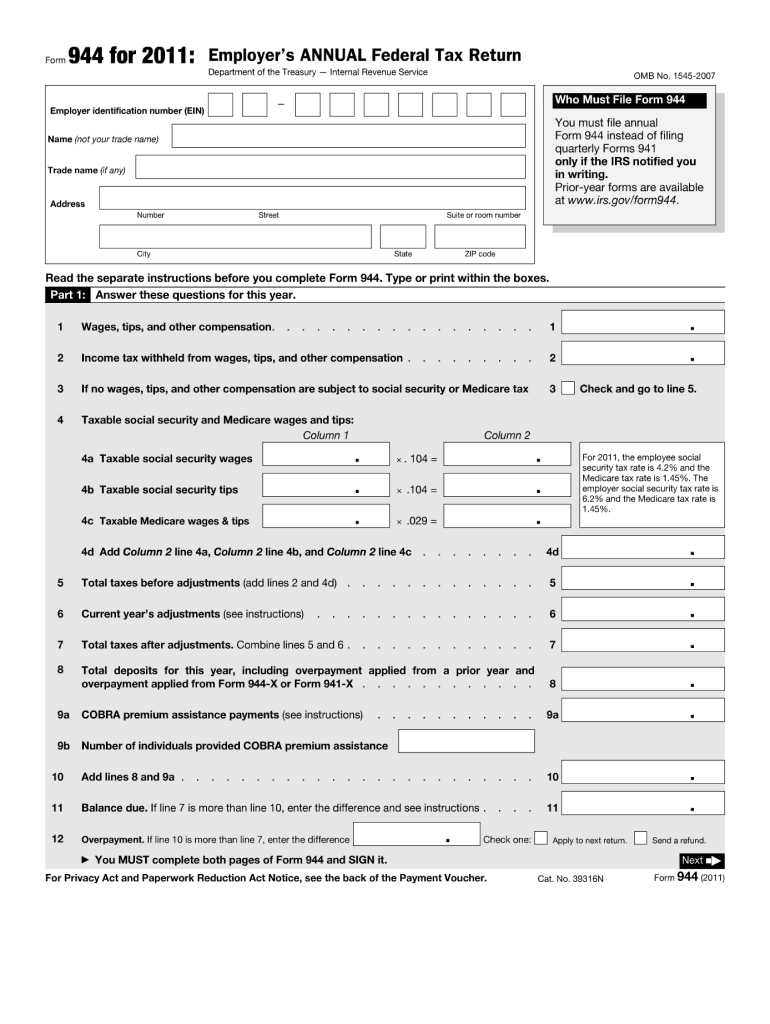

The 944 Form is a tax document used by small employers in the United States to report annual payroll taxes to the Internal Revenue Service (IRS). This form is specifically designed for businesses that have a low annual payroll, allowing them to file their employment tax returns on a yearly basis instead of quarterly. The 944 Form simplifies the reporting process for eligible employers, helping them manage their tax obligations more efficiently.

How to use the 944 Form

Using the 944 Form involves several steps to ensure accurate reporting of payroll taxes. Employers must first determine their eligibility to file this form, which is generally based on the total payroll amount for the previous year. Once eligibility is confirmed, the employer completes the form by providing relevant information, including total wages paid, taxes withheld, and any adjustments. After filling out the form, it must be submitted to the IRS by the designated deadline, ensuring compliance with federal tax regulations.

Steps to complete the 944 Form

Completing the 944 Form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including employee wages, tax withheld, and any adjustments.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check calculations to avoid errors in reported amounts.

- Sign and date the form to validate the submission.

- Submit the completed form to the IRS by the deadline.

Legal use of the 944 Form

The 944 Form is legally binding when completed and submitted in accordance with IRS regulations. Employers must ensure that all information provided is accurate and truthful to avoid penalties. The form must be filed annually, and failure to do so can result in fines or other legal repercussions. Adhering to the guidelines set forth by the IRS ensures that the form is used correctly and maintains its legal standing.

Filing Deadlines / Important Dates

Timely filing of the 944 Form is crucial to avoid penalties. The form is typically due by January thirty-first of the year following the tax year being reported. Employers should also be aware of any changes to deadlines that may arise due to federal regulations or specific circumstances. Keeping a calendar with important dates can help ensure compliance and timely submissions.

Who Issues the Form

The 944 Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. Employers can obtain the form directly from the IRS website or through tax professionals who assist with payroll tax reporting. It is essential to use the most current version of the form to ensure compliance with tax laws.

Penalties for Non-Compliance

Failure to file the 944 Form on time or submitting inaccurate information can lead to significant penalties. The IRS imposes fines for late filings, which can increase the longer the form remains unfiled. Additionally, providing incorrect information may result in further penalties, including interest on unpaid taxes. Employers should prioritize accurate and timely submissions to avoid these consequences.

Quick guide on how to complete 2011 944 form

Effortlessly Prepare 944 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle 944 Form on any platform using the airSlate SignNow Android or iOS applications, and enhance any document-focused process today.

Steps to Modify and Electronically Sign 944 Form with Ease

- Obtain 944 Form and click Get Form to initiate the process.

- Use the tools at your disposal to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your updates.

- Select your preferred method for submitting your form, whether it be via email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and electronically sign 944 Form to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 944 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 944 form

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is a 944 Form and why is it important?

The 944 Form is a tax document used by eligible small employers to report their annual payroll taxes to the IRS. Understanding the 944 Form is crucial for businesses to ensure compliance with tax regulations and avoid penalties. Using airSlate SignNow, you can easily eSign and submit your 944 Form electronically, streamlining the process.

-

How can airSlate SignNow help me with my 944 Form?

airSlate SignNow simplifies the process of preparing and signing the 944 Form by providing an intuitive platform for document management. With airSlate SignNow, you can easily fill out, eSign, and securely share your 944 Form with your accountant or the IRS. Our solution ensures that your documents are handled efficiently and safely.

-

Is airSlate SignNow cost-effective for filing the 944 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing your 944 Form and other documents. Our flexible pricing plans cater to businesses of all sizes, allowing you to choose the best option for your needs. With airSlate SignNow, you can save money on printing and mailing costs while ensuring timely submission of your 944 Form.

-

What features does airSlate SignNow offer for the 944 Form?

airSlate SignNow provides a range of features for handling the 944 Form, including eSignature capabilities, document templates, and secure cloud storage. You can track the status of your 944 Form in real-time and receive notifications when it has been signed. These features enhance the efficiency and security of your document management process.

-

Can I integrate airSlate SignNow with other tools to manage my 944 Form?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, allowing you to streamline the management of your 944 Form. By connecting with tools you already use, you can automate data entry and ensure that your 944 Form is completed accurately and efficiently.

-

How secure is airSlate SignNow for submitting the 944 Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive information, including the details on your 944 Form. You can trust that your documents are safe with us, ensuring compliance and confidentiality.

-

What are the benefits of using airSlate SignNow for the 944 Form?

Using airSlate SignNow for your 944 Form allows you to benefit from increased efficiency, reduced costs, and improved compliance. Our platform simplifies document signing and management, making it easier to handle your tax filings. Plus, you can access your signed documents anytime, anywhere, enhancing your workflow.

Get more for 944 Form

- Staff classified advertising form staff classified advertising request form

- New mexico highlands university s its nmhu form

- Internship learning contract iwuedu form

- Academic support career services academic kaplan form

- Tel 866 522 7747 form

- Troy publication 384 326 form

- Activity club long waiverdocx form

- Time amp effort report instructions towson university towson form

Find out other 944 Form

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship