Irs Form 944 2007

What is the IRS Form 944

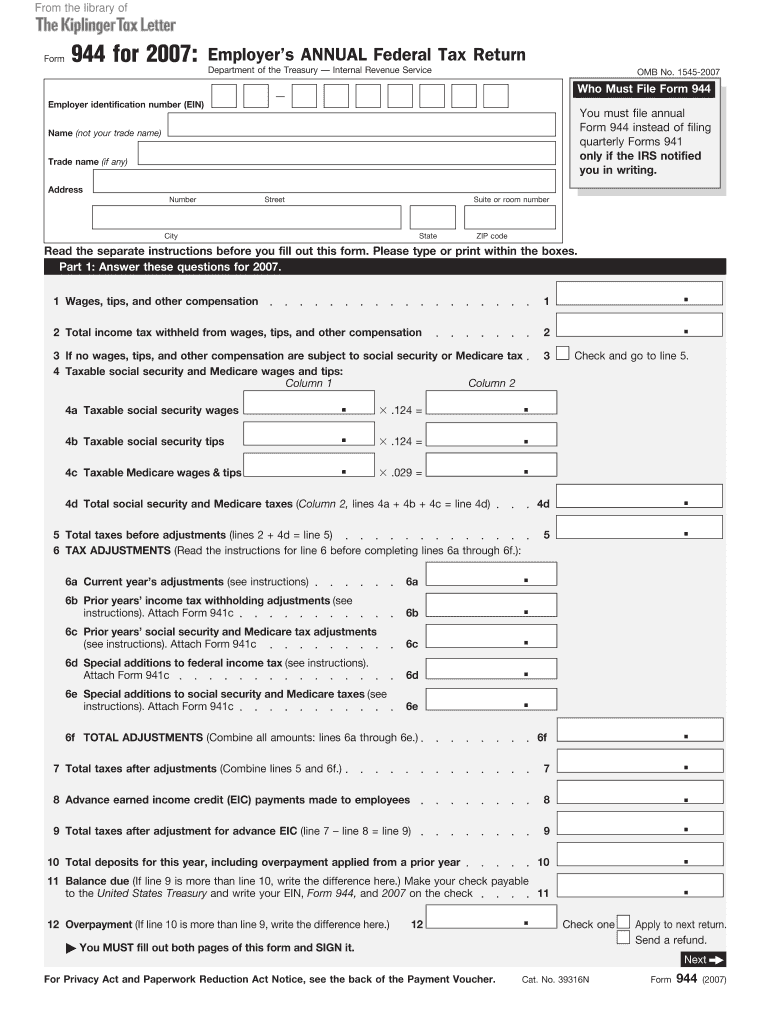

The IRS Form 944 is a tax form designed for smaller employers to report their annual payroll taxes. This form allows eligible businesses to file their employment tax returns once a year instead of quarterly, simplifying the reporting process for those with a lower volume of payroll. It is primarily used by employers who expect to owe less than $1,000 in payroll taxes for the year. Understanding the purpose and requirements of Form 944 is essential for compliance with federal tax laws.

How to use the IRS Form 944

To use the IRS Form 944, employers must first determine their eligibility based on their expected payroll tax liability. Once confirmed, they can complete the form by providing necessary information such as the total wages paid, taxes withheld, and any adjustments. After completing the form, it must be filed with the IRS by the designated deadline. Employers should ensure that all calculations are accurate to avoid potential penalties.

Steps to complete the IRS Form 944

Completing the IRS Form 944 involves several key steps:

- Gather necessary information, including total wages, tips, and other compensation.

- Calculate the total employment taxes owed for the year.

- Complete the form by entering the required information in the designated fields.

- Review the form for accuracy and completeness.

- Submit the form to the IRS by the annual filing deadline.

Filing Deadlines / Important Dates

The IRS Form 944 must be filed annually, with the deadline typically set for January 31 of the following year. However, if the due date falls on a weekend or holiday, the deadline may be adjusted. Employers should stay informed about any changes to filing deadlines to ensure timely submission and avoid penalties.

Penalties for Non-Compliance

Failure to file the IRS Form 944 on time or accurately can result in significant penalties. The IRS may impose fines for late submissions, and incorrect information can lead to additional interest charges on unpaid taxes. It is crucial for employers to comply with all filing requirements to avoid these financial repercussions.

Legal use of the IRS Form 944

The IRS Form 944 is legally binding when completed and submitted according to IRS guidelines. Employers must ensure that the information provided is truthful and accurate. Electronic signatures and submissions are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. Using a reliable eSignature solution can enhance the legitimacy of the document while ensuring compliance with legal standards.

Quick guide on how to complete 2007 2014 irs form 944

Accomplish Irs Form 944 effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and e-sign your documents promptly without delays. Handle Irs Form 944 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to alter and e-sign Irs Form 944 with ease

- Find Irs Form 944 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details using features that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or by downloading it to your PC.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and e-sign Irs Form 944 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2007 2014 irs form 944

Create this form in 5 minutes!

How to create an eSignature for the 2007 2014 irs form 944

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is IRS Form 944?

IRS Form 944 is a federal tax form used by small businesses to report annual payroll taxes to the Internal Revenue Service. By utilizing airSlate SignNow, you can easily eSign and send your IRS Form 944 electronically, ensuring a smooth and efficient filing process.

-

How can airSlate SignNow help with IRS Form 944 filing?

AirSlate SignNow provides a cost-effective solution for preparing and eSigning IRS Form 944, making it easier for businesses to manage their payroll tax documentation. With our user-friendly platform, you can streamline the entire signing process and stay compliant with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for IRS Form 944?

AirSlate SignNow offers competitive pricing plans tailored to suit different business needs. You can choose from monthly or annual subscriptions, making it a budget-friendly option for efficiently managing your IRS Form 944 and other documents.

-

What features does airSlate SignNow offer for IRS Form 944 preparation?

AirSlate SignNow provides robust features including document templates, automatic reminders, and secure cloud storage specifically for IRS Form 944. These tools make it easy to prepare, sign, and store your tax documents securely, enhancing your workflow.

-

Can I integrate airSlate SignNow with my accounting software for IRS Form 944?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, allowing for easy data transfer when preparing IRS Form 944. This integration helps ensure all necessary information is captured accurately, simplifying your tax filing process.

-

What are the benefits of using airSlate SignNow for IRS Form 944?

By using airSlate SignNow for IRS Form 944, businesses can benefit from increased efficiency, reduced paper waste, and enhanced security. Our platform simplifies the eSigning process, allowing you to focus more on your business operations rather than paperwork.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 944?

Absolutely. AirSlate SignNow is designed to comply with IRS regulations, ensuring that your IRS Form 944 submissions meet all legal requirements. Our secure platform provides a legally binding eSignature process, giving you peace of mind.

Get more for Irs Form 944

- Sample transmittal letter for articles of incorporation georgia form

- Sample operating agreement for professional limited liability company pllc georgia form

- Pllc notices and resolutions georgia form

- Sample transmittal letter 497304163 form

- Rehabilitation workers form

- Georgia registered agent form

- New resident guide georgia form

- Corporation ga form

Find out other Irs Form 944

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed