Form 944 for 2016

What is the Form 944 For

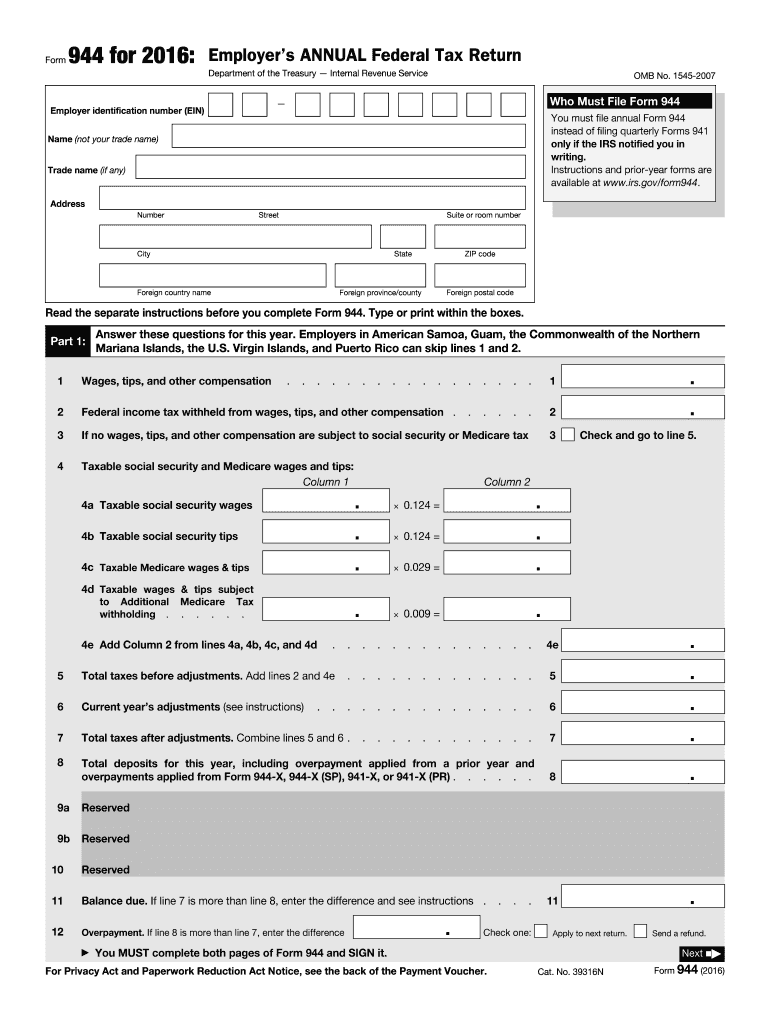

The Form 944 is a tax form used by small businesses in the United States to report and pay federal payroll taxes annually. This form is specifically designed for employers whose annual payroll tax liability is $1,000 or less. By using Form 944, eligible employers can simplify their tax reporting process, as they are not required to file quarterly payroll tax returns. Instead, they submit this single annual form, which covers all payroll taxes owed for the year, including Social Security, Medicare, and federal income tax withholding.

How to use the Form 944 For

To use Form 944 effectively, employers must first determine their eligibility based on their annual payroll tax liability. Once confirmed, they can obtain the form from the IRS website or through tax software. After filling out the required sections, including total wages paid and taxes withheld, employers must ensure that they sign and date the form. It is essential to keep a copy for their records and submit the completed form to the IRS by the designated filing deadline, typically January 31 of the following year.

Steps to complete the Form 944 For

Completing Form 944 involves several key steps:

- Gather necessary information, including total wages paid, taxes withheld, and employer identification number (EIN).

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate it.

- Submit the form to the IRS by the deadline, either electronically or by mail.

Filing Deadlines / Important Dates

For employers using Form 944, the filing deadline is typically January 31 of the year following the tax year being reported. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. Employers should also be aware of any changes to deadlines announced by the IRS, as these can vary from year to year.

Legal use of the Form 944 For

The legal use of Form 944 is governed by IRS regulations. Employers must ensure that the form is completed accurately and submitted on time to avoid penalties. The form serves as a legal document that verifies an employer's compliance with federal payroll tax obligations. Proper use of Form 944 also includes maintaining records of all payroll transactions and tax payments, as these may be requested during an audit.

Penalties for Non-Compliance

Failure to file Form 944 on time or inaccuracies in the form can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, employers who do not pay the taxes owed may face further penalties and interest charges. It is crucial for employers to understand their responsibilities regarding Form 944 to avoid these consequences.

Quick guide on how to complete form 944 for 2016

Complete Form 944 For effortlessly on any device

Web-based document management has become widely adopted by businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form 944 For on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric workflow today.

The easiest way to modify and eSign Form 944 For without hassle

- Obtain Form 944 For and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Form 944 For to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 944 for 2016

Create this form in 5 minutes!

How to create an eSignature for the form 944 for 2016

How to create an electronic signature for your Form 944 For 2016 online

How to make an eSignature for your Form 944 For 2016 in Google Chrome

How to create an electronic signature for signing the Form 944 For 2016 in Gmail

How to make an electronic signature for the Form 944 For 2016 from your smart phone

How to generate an electronic signature for the Form 944 For 2016 on iOS devices

How to create an eSignature for the Form 944 For 2016 on Android devices

People also ask

-

What is Form 944 For and who needs it?

Form 944 For is a tax form used by small employers to report their annual payroll taxes to the IRS. Businesses that expect to owe less than $1,000 in payroll taxes for the year should consider using Form 944 For instead of the more frequent Form 941. This form simplifies the reporting process and is ideal for small businesses.

-

How can airSlate SignNow help with completing Form 944 For?

airSlate SignNow provides an efficient platform for businesses to fill out and eSign Form 944 For quickly and securely. With our easy-to-use interface, you can streamline the process, ensuring that all necessary information is accurately captured and submitted on time. This reduces the likelihood of errors and helps maintain compliance with IRS requirements.

-

What are the benefits of using airSlate SignNow for Form 944 For?

Using airSlate SignNow for Form 944 For offers numerous benefits, including improved efficiency, enhanced security, and reduced paperwork. With our platform, you can easily track document status and gather electronic signatures seamlessly. This ensures that your Form 944 For is processed without unnecessary delays.

-

Is there a cost associated with using airSlate SignNow for Form 944 For?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solution allows you to manage Form 944 For and other documents with a subscription that fits your budget. You can choose from different tiers based on your usage and feature requirements.

-

Can I integrate airSlate SignNow with other software to manage Form 944 For?

Absolutely! airSlate SignNow seamlessly integrates with a range of popular software applications, making it easy to manage Form 944 For alongside your existing tools. Whether you use accounting software or CRM systems, our integrations help streamline your workflow and enhance productivity.

-

What security measures does airSlate SignNow have for Form 944 For?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Form 944 For. We employ advanced encryption protocols and secure cloud storage to protect your data. Additionally, our platform offers features such as access controls and audit trails to ensure your information remains safe.

-

How do I get started with airSlate SignNow for Form 944 For?

Getting started with airSlate SignNow for Form 944 For is simple. You can sign up for a free trial on our website to explore the features and functionalities. Once you're ready, you can easily upload your Form 944 For and start eSigning or sharing it with your team.

Get more for Form 944 For

- Pennsylvania state work study application pheaa pheaa form

- Certification pollution form

- Kentucky approved application for initial funding under the state www2 ed form

- Online 147 visa form

- Steven kracht emro va form

- Form 9423 2010

- Dutchess county sheriffs office employment application dcso form d 60 dutchess county sheriffs office employment application

- Application form for opening demat account syndicate bank

Find out other Form 944 For

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter