944 2020

What is the IRS 944?

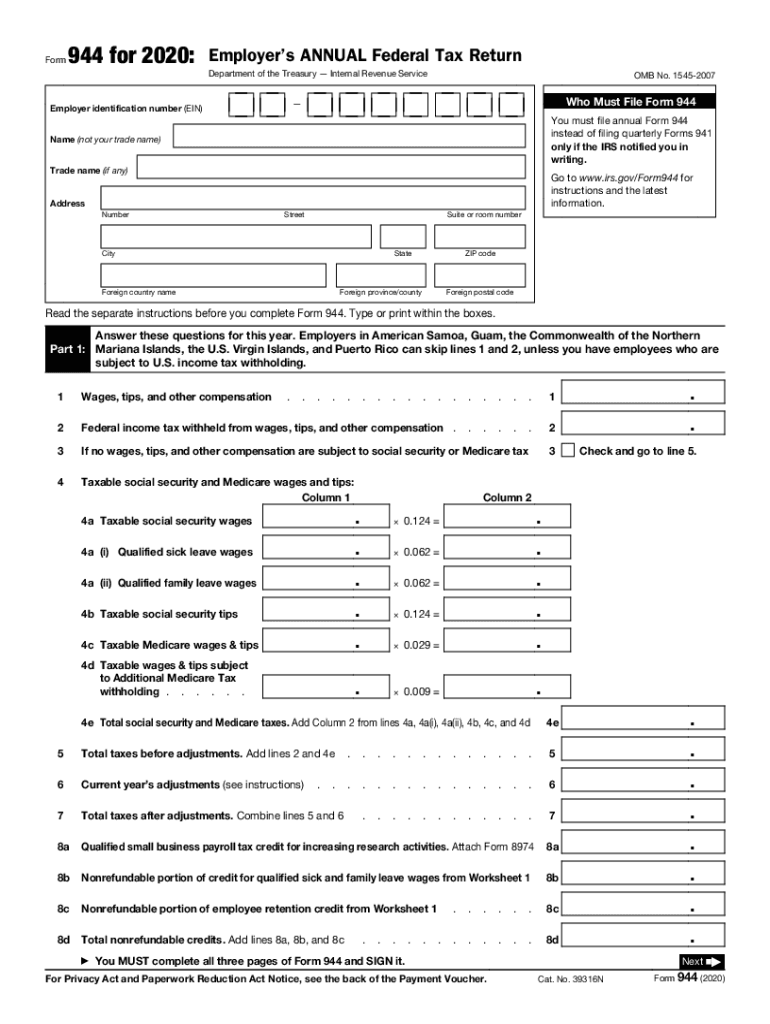

The IRS 944 form, officially known as the Employer's Annual Federal Tax Return, is designed for small employers who have a low payroll tax liability. This form allows eligible employers to report their annual payroll taxes instead of filing quarterly returns. Specifically, businesses that expect to owe less than one thousand dollars in payroll taxes for the year can utilize this form. By using the 944, employers simplify their tax reporting process and reduce the frequency of filing, making it a practical choice for small businesses.

Steps to Complete the IRS 944

Completing the IRS 944 form involves several key steps to ensure accurate reporting of payroll taxes. Begin by gathering necessary information, including your Employer Identification Number (EIN) and total wages paid during the year. Next, follow these steps:

- Fill out the employer information section, including your name, address, and EIN.

- Report total wages, tips, and other compensation in the appropriate fields.

- Calculate the total taxes owed, including Social Security, Medicare, and any additional taxes.

- Sign and date the form to certify the information provided is accurate.

It is crucial to double-check all entries for accuracy to avoid delays or penalties.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the IRS 944 form to avoid penalties. Typically, the IRS requires the form to be filed by January thirty-first of the year following the tax year being reported. For example, if you are filing for the 2020 tax year, the form is due by January thirty-first, 2021. Additionally, any payments owed should be submitted by the same deadline to ensure compliance and avoid interest or penalties.

Legal Use of the IRS 944

The IRS 944 form is legally binding when completed accurately and submitted on time. Employers must ensure they meet the eligibility criteria, which includes having a payroll tax liability of less than one thousand dollars. Compliance with IRS regulations is essential, as failure to file or inaccuracies can lead to penalties. Using a reliable eSignature solution can help ensure that the form is signed and submitted securely, meeting legal standards for electronic documents.

How to Obtain the IRS 944

Employers can obtain the IRS 944 form directly from the IRS website or through tax preparation software that includes IRS forms. The form is available in a printable format, allowing employers to fill it out manually if preferred. Additionally, many tax professionals can assist in obtaining and completing the form, ensuring that all information is accurate and compliant with IRS guidelines.

Form Submission Methods

The IRS 944 form can be submitted in various ways, including:

- By mail: Employers can print the completed form and send it to the appropriate IRS address based on their location.

- Electronically: Many tax preparation software options allow for electronic filing of the IRS 944, which can streamline the process and reduce the risk of errors.

Employers should choose the method that best fits their needs, keeping in mind the importance of timely submission.

Quick guide on how to complete 2011 944

Effortlessly Prepare 944 on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers a flawless eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without inconvenience. Manage 944 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign 944 with minimal effort

- Obtain 944 and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text (SMS), invite link, or download it to your computer.

Eliminate issues related to lost or disorganized documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign 944 and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 944

Create this form in 5 minutes!

How to create an eSignature for the 2011 944

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is IRS 944 and who should use it?

IRS 944 is a tax form used by small employers to report annual payroll taxes. This form is specifically designed for employers whose annual payroll tax liability is $1,000 or less. If your business qualifies, using IRS 944 simplifies your tax reporting process, allowing you more time to focus on other important tasks.

-

How can airSlate SignNow help with IRS 944 forms?

AirSlate SignNow streamlines the process of completing and signing IRS 944 forms electronically. With our user-friendly platform, you can easily collaborate with your team and ensure that all necessary paperwork is accurately completed and submitted on time. This helps you avoid potential penalties associated with late or incorrect filings.

-

Is airSlate SignNow affordable for small businesses filing IRS 944?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to meet the needs of small businesses. By providing an efficient solution for managing IRS 944 forms and other documents, airSlate SignNow helps you save money and reduce the costs associated with paper-based workflows. Invest in our platform to simplify your tax filing process without breaking the bank.

-

What features does airSlate SignNow offer for IRS 944 form signing?

AirSlate SignNow includes features such as document templates, in-app signing, and real-time tracking for IRS 944 forms. These features simplify the signing process, ensuring your documents are executed quickly and efficiently. Additionally, our platform allows you to manage your documents securely, providing peace of mind for sensitive information.

-

Can airSlate SignNow integrate with accounting software for IRS 944?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions that facilitate IRS 944 filing. This integration allows you to pull data directly into your forms, reducing manual entry errors and streamlining your payroll reporting process. By using airSlate SignNow, you can easily connect your documents with your financial systems.

-

How secure is airSlate SignNow for handling IRS 944 documents?

AirSlate SignNow takes document security seriously, implementing robust encryption methods to protect your IRS 944 forms and sensitive data. Our platform adheres to industry-standard security protocols to ensure your information remains confidential. You can confidently manage your documents knowing they're being handled with the utmost care and security.

-

What are the benefits of using airSlate SignNow for IRS 944?

Using airSlate SignNow for IRS 944 offers numerous benefits, such as increased efficiency, improved accuracy, and enhanced collaboration. Our platform simplifies the entire process of preparing and signing tax forms, saving you time and reducing stress. Experience the benefits of a streamlined workflow that allows you to focus on growing your business.

Get more for 944

- Real life sociology a canadian approach 2nd edition pdf download form

- Emis form 2021

- Annexure 6 form for medical

- Cbse name correction form pdf 2022

- Annexure 8 application form

- Launch x431 pro software download cracked form

- Urine dipstick form b1 normal quality control record sheet

- 2036 can an individual through the hipaa right hhs gov form

Find out other 944

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now