Form 944 PDF 2018

What is the Form 944 PDF?

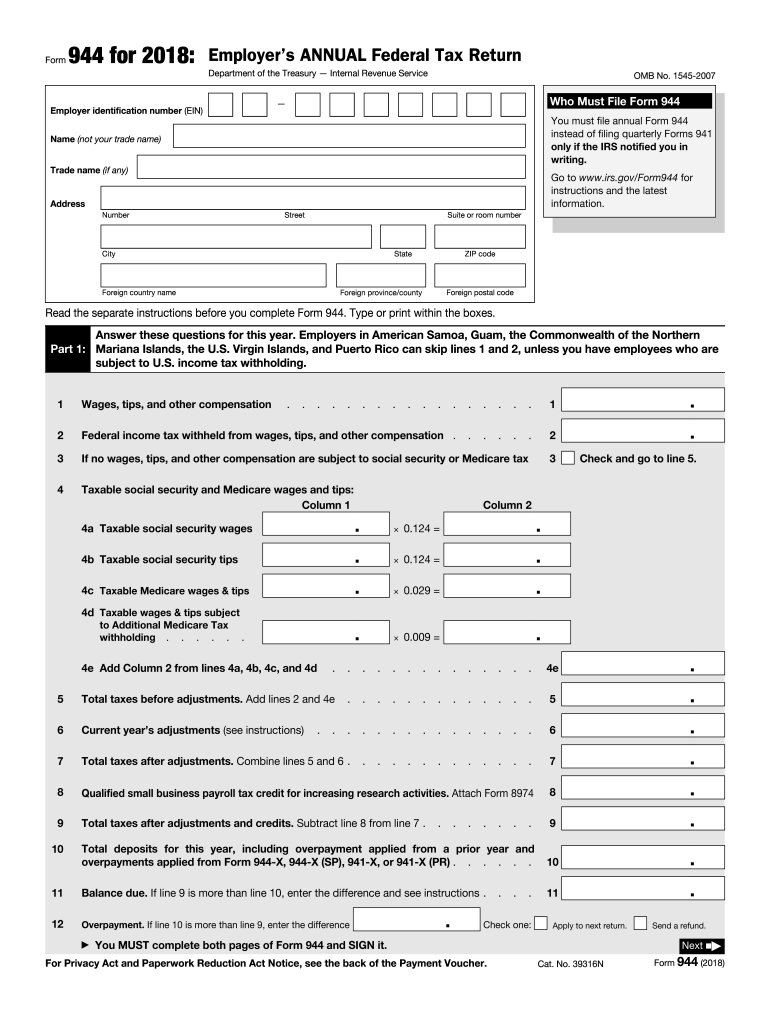

The Form 944 PDF is an Internal Revenue Service (IRS) document used by small businesses to report their annual payroll taxes. This form is specifically designed for employers whose annual payroll tax liability is $1,000 or less. By using Form 944, businesses can simplify their tax reporting process, as they are required to file this form only once a year instead of quarterly. The form includes sections for reporting wages, tips, and other compensation, as well as the taxes withheld from employees' paychecks.

Steps to Complete the Form 944 PDF

Completing the Form 944 PDF involves several key steps. First, gather all necessary information, including your business name, address, and Employer Identification Number (EIN). Next, report the total wages paid to employees during the year, along with any tips and other compensation. You will also need to calculate the total taxes withheld, including Social Security and Medicare taxes. Finally, ensure all sections are filled out accurately before signing and dating the form. Double-check for any errors to avoid delays in processing.

Filing Deadlines / Important Dates

The filing deadline for Form 944 is typically January 31 of the year following the tax year being reported. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to file the form on time to avoid penalties and interest on any unpaid taxes. Additionally, if you are required to make payments, ensure they are submitted by the same deadline to maintain compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

Form 944 can be submitted to the IRS through various methods. You can file the form electronically using IRS-approved e-file software, which is often the fastest and most efficient method. Alternatively, you can print the completed form and mail it to the appropriate IRS address listed in the instructions. In-person submission is generally not an option for Form 944, as the IRS recommends electronic filing for quicker processing. Ensure you retain a copy of the form for your records regardless of the submission method chosen.

Legal Use of the Form 944 PDF

The legal use of Form 944 is governed by IRS regulations, which stipulate that it is intended for small employers with an annual payroll tax liability of $1,000 or less. Businesses must ensure they meet the eligibility criteria to use this form. Filing Form 944 inaccurately or using it when not eligible can result in penalties and complications with tax compliance. It is crucial to understand the legal implications and requirements associated with this form to avoid issues with the IRS.

Key Elements of the Form 944 PDF

Key elements of the Form 944 PDF include sections for reporting employee wages, tips, and other compensation, as well as the total taxes withheld. The form also requires the employer's information, including the business name, address, and EIN. Additionally, there are areas for reporting any adjustments or corrections to previous filings. Understanding these elements is essential for accurate completion and compliance with IRS requirements.

Quick guide on how to complete irs form 944 2018 2019

Uncover the most efficient method to complete and endorse your Form 944 Pdf

Are you still spending unnecessary time crafting your official documents on paper instead of online? airSlate SignNow offers a superior approach to finalize and endorse your Form 944 Pdf and associated forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle paperwork swiftly and in compliance with official standards - robust PDF editing, managing, securing, signing, and sharing tools are all at your fingertips within a user-friendly interface.

Only a handful of steps are needed to complete and endorse your Form 944 Pdf:

- Upload the editable template to the editor using the Get Form button.

- Verify the information you need to include in your Form 944 Pdf.

- Navigate between the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Obscure fields that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finalized Form 944 Pdf in the Documents section of your profile, download it, or export it to your preferred cloud storage. Our service also provides flexible form sharing options. There’s no need to print your templates when you have to submit them to the appropriate public office - you can do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Explore it now!

Create this form in 5 minutes or less

Find and fill out the correct irs form 944 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 944 2018 2019

How to create an eSignature for your Irs Form 944 2018 2019 online

How to generate an electronic signature for your Irs Form 944 2018 2019 in Chrome

How to generate an electronic signature for putting it on the Irs Form 944 2018 2019 in Gmail

How to make an eSignature for the Irs Form 944 2018 2019 from your mobile device

How to create an eSignature for the Irs Form 944 2018 2019 on iOS

How to generate an electronic signature for the Irs Form 944 2018 2019 on Android devices

People also ask

-

What is form 944 2016?

Form 944 2016 is the annual federal payroll tax return used by employers with smaller payrolls. This form allows businesses to report the federal income tax withheld and the taxes due for Social Security and Medicare. Understanding how to properly complete form 944 2016 is essential for compliance and to avoid penalties.

-

How can airSlate SignNow help with submitting form 944 2016?

airSlate SignNow streamlines the process of submitting form 944 2016 by allowing users to easily create, edit, and electronically sign documents. Our platform ensures all forms are completed correctly and securely, enabling users to maintain compliance with IRS requirements while saving time.

-

Is airSlate SignNow cost-effective for businesses needing form 944 2016?

Yes, airSlate SignNow offers a cost-effective solution for businesses that need to manage form 944 2016 and other documents. Our pricing structure is designed to provide value, ensuring that users can access essential features without breaking the bank. This makes it an ideal choice for small to medium-sized businesses.

-

What are the key features of airSlate SignNow for managing form 944 2016?

Key features of airSlate SignNow for managing form 944 2016 include electronic signatures, document templates, and secure storage. These features simplify the process of filling out and signing the form, ensuring that users can complete their submissions efficiently and securely from anywhere.

-

Can I integrate airSlate SignNow with other software when handling form 944 2016?

Absolutely! airSlate SignNow supports integration with various software and applications, making it an excellent choice for businesses that need to handle form 944 2016 alongside other tools. Integrations enhance workflow efficiency by allowing for seamless data transfer and document management.

-

What are the benefits of using airSlate SignNow for form 944 2016 documentation?

The benefits of using airSlate SignNow for form 944 2016 documentation include enhanced efficiency, improved accuracy, and secure storage of important documents. Our platform also facilitates faster turnaround times, ensuring that businesses can meet deadlines with ease.

-

Is airSlate SignNow user-friendly for those unfamiliar with form 944 2016?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible for individuals unfamiliar with form 944 2016. The intuitive interface guides users through the process, allowing them to complete their forms with ease and confidence, regardless of their technical expertise.

Get more for Form 944 Pdf

Find out other Form 944 Pdf

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney