Schedule D Form 1040 Capital Gains and Losses 2020

What is the Schedule D Form 1040 Capital Gains And Losses

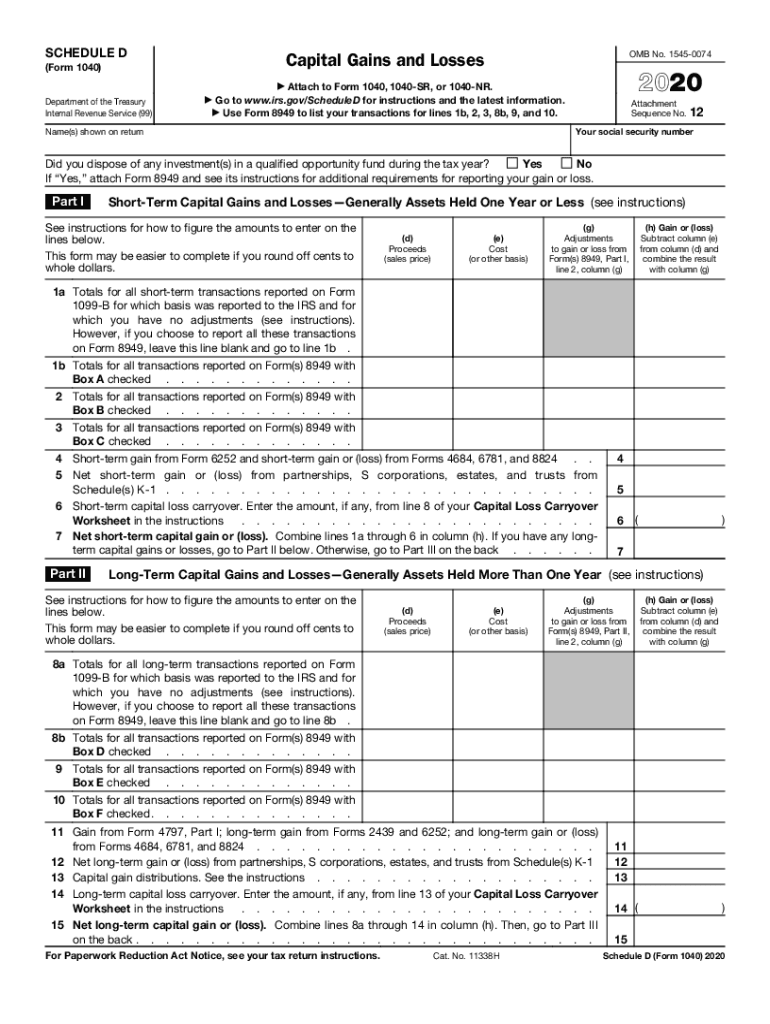

The Schedule D Form 1040 is a crucial document used by U.S. taxpayers to report capital gains and losses from the sale of assets. This form helps individuals calculate their overall capital gain or loss for the tax year, which ultimately affects their taxable income. Taxpayers must report various transactions, including the sale of stocks, bonds, real estate, and other investments. Understanding the Schedule D is essential for accurate tax filing and compliance with IRS regulations.

Steps to complete the Schedule D Form 1040 Capital Gains And Losses

Completing the Schedule D Form 1040 involves several key steps:

- Gather necessary documents: Collect records of all asset transactions, including purchase and sale dates, amounts, and any associated costs.

- Determine your capital gains or losses: Calculate the difference between the selling price and the purchase price for each asset.

- Fill out the form: Enter your total capital gains and losses on the appropriate lines of the Schedule D.

- Transfer totals to Form 1040: After completing Schedule D, transfer the calculated amounts to your main tax return, Form 1040.

How to obtain the Schedule D Form 1040 Capital Gains And Losses

Taxpayers can obtain the Schedule D Form 1040 through several methods:

- IRS website: Download the form directly from the official IRS website, where it is available in PDF format.

- Tax preparation software: Many tax software programs include the Schedule D, allowing users to complete their taxes electronically.

- Local IRS offices: Visit a local IRS office to request a physical copy of the form.

Legal use of the Schedule D Form 1040 Capital Gains And Losses

The Schedule D Form 1040 is legally binding when completed accurately and submitted to the IRS. It is essential for taxpayers to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or audits. The form must be filed alongside the main tax return, and it is subject to IRS review. Compliance with tax laws is crucial to avoid legal issues and ensure that taxpayers fulfill their obligations.

Filing Deadlines / Important Dates

Taxpayers should be aware of the following important dates related to the Schedule D Form 1040:

- Tax filing deadline: Typically, the deadline for filing individual tax returns, including Schedule D, is April 15 of the following year.

- Extended filing deadline: If an extension is filed, the deadline may be extended to October 15.

- Estimated tax payments: If applicable, estimated tax payments for capital gains may be due quarterly throughout the year.

Examples of using the Schedule D Form 1040 Capital Gains And Losses

Examples of transactions that require reporting on the Schedule D include:

- Sale of stocks: If a taxpayer sells shares of stock for a profit, the gain must be reported on Schedule D.

- Real estate transactions: Selling a home or investment property may result in capital gains or losses that need to be documented.

- Cryptocurrency sales: Profits from the sale of cryptocurrencies are also subject to capital gains reporting on Schedule D.

Quick guide on how to complete 2020 schedule d form 1040 capital gains and losses

Complete Schedule D Form 1040 Capital Gains And Losses effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Manage Schedule D Form 1040 Capital Gains And Losses on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest method to alter and electronically sign Schedule D Form 1040 Capital Gains And Losses seamlessly

- Obtain Schedule D Form 1040 Capital Gains And Losses and then select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Schedule D Form 1040 Capital Gains And Losses to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule d form 1040 capital gains and losses

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule d form 1040 capital gains and losses

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is a Schedule D 2020 form?

The Schedule D 2020 form is used to report capital gains and losses from the sale of securities. It is an essential part of completing your income tax return, particularly for individuals who have engaged in transactions involving stocks and bonds during the tax year. Understanding how to fill out Schedule D 2020 accurately can help you maximize your tax benefits.

-

How can airSlate SignNow assist with Schedule D 2020 documentation?

airSlate SignNow provides businesses with the ability to easily send and eSign important documents, including those related to Schedule D 2020. This streamlines the process of collecting electronic signatures, ensuring that all paperwork is securely stored and easily accessible. With airSlate SignNow, you can manage your Schedule D 2020 submissions efficiently.

-

What features of airSlate SignNow can help with tax document management?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking to help manage tax documents like Schedule D 2020. These features facilitate a seamless workflow, allowing you to prepare and send tax-related documents quickly. You can track the status of each document, ensuring that you meet all deadlines for your Schedule D 2020 submissions.

-

Is airSlate SignNow cost-effective for small businesses handling Schedule D 2020?

Yes, airSlate SignNow provides a cost-effective solution for small businesses managing their Schedule D 2020 forms. With scalable pricing plans, businesses can choose services that best fit their needs without overspending. This affordability means that even small businesses can access the tools required for efficient tax documentation.

-

Are there integrations available with airSlate SignNow for Schedule D 2020?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software like QuickBooks, making it easier to manage Schedule D 2020 and other tax-related documents. These integrations help streamline data entry and ensure accuracy in reporting, minimizing the risk of errors in your financial statements.

-

Can I store my Schedule D 2020 documents securely with airSlate SignNow?

Yes, airSlate SignNow prioritizes document security, providing a safe environment for storing your Schedule D 2020 forms. All documents are encrypted, ensuring that sensitive information is protected against unauthorized access. With airSlate SignNow, you can have peace of mind knowing your data is secure.

-

What benefits does airSlate SignNow offer for eSigning my Schedule D 2020?

Using airSlate SignNow for eSigning your Schedule D 2020 offers numerous benefits, including faster turnaround times and improved efficiency. This eliminates the need for printing and mailing, allowing for immediate processing and submission of your tax documents. Additionally, electronic signatures are legally binding, giving you confidence in the validity of your Schedule D 2020 submissions.

Get more for Schedule D Form 1040 Capital Gains And Losses

- Wwwidealweightlosscliniccomblogideal proteinideal protein phase 1 food and shopping lists form

- Printable decisional balance worksheet form

- Secret sister questionnaire name birthday phone number email address these are a few of my favorite things hlbconline form

- Facility use request form calvary bible church cbcderry

- Factualized trust form

- Awana registration form template 374928955

- Zanaco corporate account pdf forms download

- Canvas form

Find out other Schedule D Form 1040 Capital Gains And Losses

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document