Schedule D Form 1040 Capital Gains and Losses 2021

What is the Schedule D Form 1040 Capital Gains And Losses

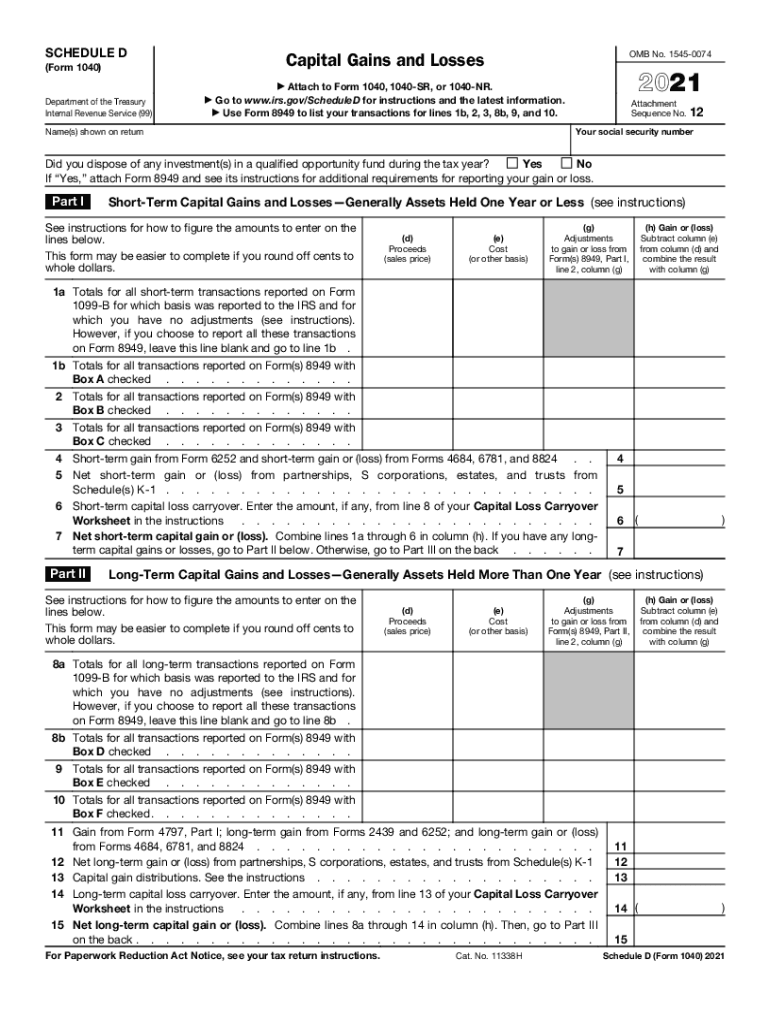

The Schedule D form is a crucial document used by taxpayers in the United States to report capital gains and losses from the sale of assets. This form is part of the IRS Form 1040 and helps individuals calculate their overall capital gains tax liability. Capital gains refer to the profit made from selling an asset, such as stocks, bonds, or real estate, while capital losses occur when an asset is sold for less than its purchase price. Understanding how to fill out the Schedule D form accurately is essential for ensuring compliance with tax regulations and optimizing tax outcomes.

Steps to complete the Schedule D Form 1040 Capital Gains And Losses

Completing the Schedule D form involves several key steps:

- Gather necessary documents, including records of all asset sales, purchase dates, and amounts.

- Determine the type of gain or loss for each transaction, categorizing them as short-term or long-term based on the holding period.

- Calculate the total capital gains and losses, ensuring to offset gains with losses where applicable.

- Fill out the Schedule D form, entering the calculated figures in the appropriate sections.

- Transfer the totals to your Form 1040 to complete your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D form, which are essential for accurate reporting. Taxpayers must follow the instructions outlined in the IRS Schedule D instructions document. These guidelines include details on how to classify gains and losses, the importance of maintaining accurate records, and the implications of different types of transactions. Adhering to these guidelines helps prevent errors and potential audits from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D form align with the overall tax return deadlines. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file for additional time. Keeping track of these important dates ensures timely submission and avoids penalties.

Penalties for Non-Compliance

Failure to accurately complete and file the Schedule D form can result in various penalties from the IRS. These may include fines for late filing, interest on unpaid taxes, and potential audits. Additionally, underreporting capital gains can lead to further scrutiny and additional tax liabilities. It is crucial for taxpayers to ensure that their Schedule D form is completed correctly to avoid these consequences.

Examples of using the Schedule D Form 1040 Capital Gains And Losses

Understanding practical examples can clarify how to use the Schedule D form effectively. For instance, if a taxpayer sells stocks purchased for $2,000 for $5,000, they have a capital gain of $3,000. If they also sold another asset for a $1,000 loss, they can report a net capital gain of $2,000 on Schedule D. These examples illustrate how to calculate and report gains and losses accurately, ensuring compliance with IRS regulations.

Digital vs. Paper Version

Taxpayers can choose between filing the Schedule D form digitally or on paper. The digital version, often completed through tax software, offers advantages such as automatic calculations and error checks. Conversely, the paper version allows for traditional filing methods but may require more manual effort. Understanding the pros and cons of each method can help taxpayers decide which approach best suits their needs.

Quick guide on how to complete 2021 schedule d form 1040 capital gains and losses

Effortlessly Complete Schedule D Form 1040 Capital Gains And Losses on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Schedule D Form 1040 Capital Gains And Losses on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

How to Modify and eSign Schedule D Form 1040 Capital Gains And Losses with Ease

- Find Schedule D Form 1040 Capital Gains And Losses and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Schedule D Form 1040 Capital Gains And Losses and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule d form 1040 capital gains and losses

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule d form 1040 capital gains and losses

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

What is a schedule d in the context of airSlate SignNow?

A schedule d refers to a specific layout or template used for document signing within airSlate SignNow. It enables businesses to easily structure their documents for eSigning, ensuring all necessary fields are included. This helps streamline the signing process and keeps everything organized for both senders and signers.

-

How can I create and manage a schedule d with airSlate SignNow?

Creating a schedule d with airSlate SignNow is simple. You can use our intuitive interface to design your document, adding signature fields, dates, and any other necessary elements. Once designed, you can manage it through our dashboard, making modifications as needed, and send it out for eSigning.

-

Does airSlate SignNow offer integrations for schedule d templates?

Yes, airSlate SignNow provides integrations with various applications that can enhance the functionality of your schedule d templates. You can connect with CRM systems, project management tools, and more, allowing for seamless workflows. This ensures that your document processes are efficient and connected with your existing tools.

-

What are the benefits of using airSlate SignNow for my schedule d needs?

Using airSlate SignNow for your schedule d offers several benefits, including a user-friendly design interface and comprehensive eSigning capabilities. It signNowly speeds up the signing process and improves document accuracy. Additionally, you can track your document's status in real-time, providing peace of mind during urgent transactions.

-

Is there a free trial available for airSlate SignNow to test schedule d functionalities?

Yes, airSlate SignNow offers a free trial for prospective users to explore its schedule d functionalities. This allows you to test the ease of use, integrate it with your current processes, and see how it can enhance your document signing experience. Sign up for the trial to experience its benefits without any commitments.

-

What pricing plans does airSlate SignNow offer for schedule d usage?

airSlate SignNow provides several pricing plans that cater to different business needs for schedule d usage. Plans vary based on features, the number of users, and anticipated signing volume. It's designed to be cost-effective, allowing businesses of all sizes to afford the services they require.

-

Can airSlate SignNow handle multiple schedule d documents simultaneously?

Absolutely! AirSlate SignNow is designed to manage multiple schedule d documents at the same time. This functionality allows businesses to send out numerous documents for signing concurrently, signNowly improving operational efficiency. You can easily track each document's progress to ensure nothing falls through the cracks.

Get more for Schedule D Form 1040 Capital Gains And Losses

- Sellers disclosure of forfeiture rights for contract for deed hawaii form

- Hawaii contract 497304252 form

- Hawaii annual form

- Notice of default for past due payments in connection with contract for deed hawaii form

- Final notice of default for past due payments in connection with contract for deed hawaii form

- Hi deed form

- Notice of assignment of contract for deed hawaii form

- Hi contract form

Find out other Schedule D Form 1040 Capital Gains And Losses

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online