Schedule D Form 1040 Capital Gains and Losses 2022-2026

What is the Schedule D Form 1040 Capital Gains And Losses

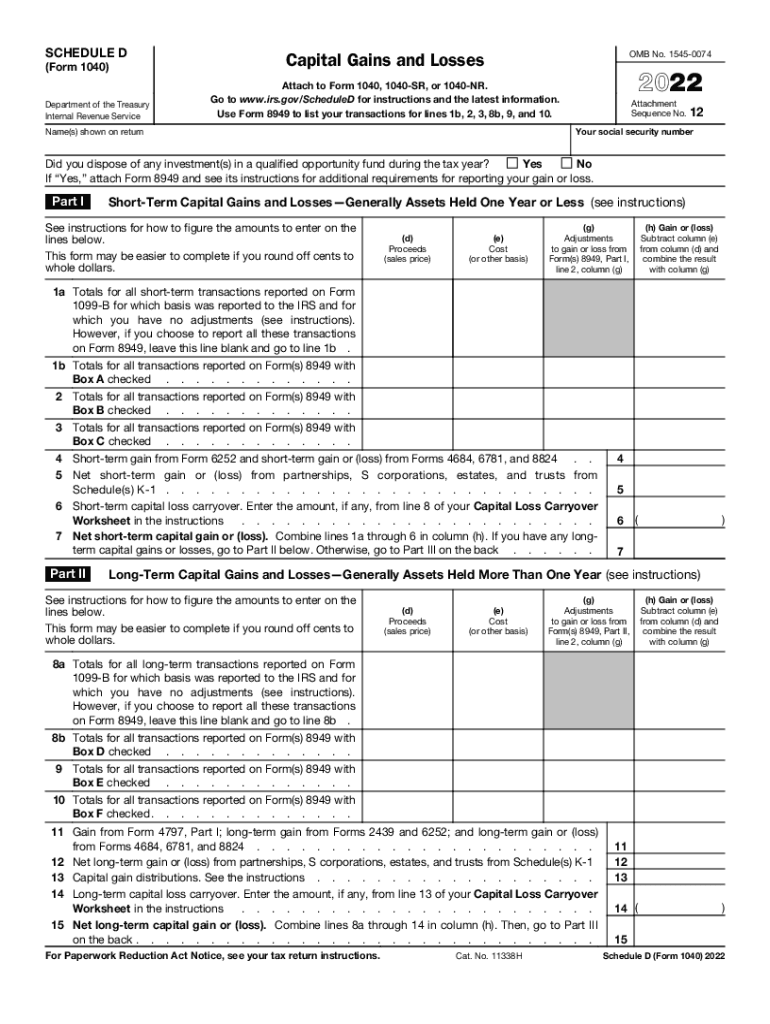

The Schedule D Form 1040 is a crucial document used by taxpayers in the United States to report capital gains and losses from the sale of assets. This form is essential for individuals who have sold stocks, bonds, real estate, or other investments during the tax year. By accurately completing Schedule D, taxpayers can determine their overall capital gain or loss, which directly impacts their taxable income. The form captures both short-term and long-term capital gains, allowing for appropriate tax treatment based on the holding period of the assets sold.

How to use the Schedule D Form 1040 Capital Gains And Losses

Using the Schedule D Form 1040 involves several steps to ensure accurate reporting of capital gains and losses. First, gather all necessary documentation, including records of asset purchases, sales, and any related expenses. Next, complete Part I of the form for short-term capital gains and losses, which includes assets held for one year or less. Then, proceed to Part II for long-term capital gains and losses, focusing on assets held for more than one year. After calculating the totals for both parts, transfer the net gain or loss to Form 1040. It is important to retain all supporting documents in case of an audit.

Steps to complete the Schedule D Form 1040 Capital Gains And Losses

Completing the Schedule D Form 1040 requires careful attention to detail. Follow these steps:

- Gather all relevant documents, including purchase and sale records for each asset.

- Fill out Part I for short-term transactions, listing each asset sold during the year.

- Calculate the total short-term capital gains and losses.

- Complete Part II for long-term transactions, similarly listing each asset sold.

- Calculate the total long-term capital gains and losses.

- Combine the totals from both parts to determine your overall capital gain or loss.

- Transfer the net amount to your Form 1040 and ensure all calculations are accurate.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D Form 1040. Taxpayers should refer to the IRS instructions for Schedule D, which detail how to report various types of capital gains and losses. This includes information on wash sales, which occur when an asset is sold and repurchased within a short timeframe, and how they affect tax calculations. Additionally, the IRS outlines requirements for reporting capital gains distributions from mutual funds and other investment vehicles. Adhering to these guidelines is essential for compliance and to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form 1040 align with the general tax filing deadlines in the United States. Typically, individual taxpayers must file their federal income tax returns, including Schedule D, by April fifteenth of the following year. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers seeking additional time to prepare their returns may file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties and interest.

Required Documents

To complete the Schedule D Form 1040 accurately, taxpayers need to gather several key documents:

- Records of all asset purchases and sales, including transaction dates and amounts.

- Statements from brokerage firms detailing capital gains and losses.

- Documentation for any expenses related to the sale of assets, such as commissions or fees.

- Previous year’s tax returns, if applicable, to assist in reporting carryover losses.

Quick guide on how to complete 2022 schedule d form 1040 capital gains and losses

Easily Prepare Schedule D Form 1040 Capital Gains And Losses on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers all the tools needed to create, edit, and eSign your documents promptly without delays. Manage Schedule D Form 1040 Capital Gains And Losses on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

Effortlessly Edit and eSign Schedule D Form 1040 Capital Gains And Losses

- Find Schedule D Form 1040 Capital Gains And Losses and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as an ink signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule D Form 1040 Capital Gains And Losses and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule d form 1040 capital gains and losses

Create this form in 5 minutes!

People also ask

-

What is the IRS capital loss carryover worksheet 2018?

The IRS capital loss carryover worksheet 2018 is a tax form used to calculate and report capital losses from previous years that can be carried over to offset future capital gains. By accurately completing this worksheet, taxpayers can ensure they maximize their deductions in subsequent tax years.

-

How can airSlate SignNow help with the IRS capital loss carryover worksheet 2018?

airSlate SignNow provides an efficient platform to electronically sign and send the IRS capital loss carryover worksheet 2018. Our easy-to-use solution simplifies document management, allowing you to stay organized and ensure timely submissions to the IRS.

-

What features does airSlate SignNow offer for tax documents?

airSlate SignNow offers several features for tax documents, including customizable templates, secure eSigning, and cloud storage. These features allow users to manage their IRS capital loss carryover worksheet 2018 and other important tax forms seamlessly, enhancing productivity and compliance.

-

Is there a cost to use airSlate SignNow for the IRS capital loss carryover worksheet 2018?

Yes, airSlate SignNow offers different pricing plans that provide access to various features, including those needed for the IRS capital loss carryover worksheet 2018. Our plans are designed to be affordable and provide excellent value for businesses looking to streamline their document processes.

-

Can I integrate airSlate SignNow with other financial software?

Absolutely! airSlate SignNow can integrate seamlessly with many popular financial software solutions. This capability allows you to easily access and share your IRS capital loss carryover worksheet 2018 and other important documents across platforms, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the IRS capital loss carryover worksheet 2018, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage documents from anywhere, ensuring you can handle your tax needs with ease.

-

How secure is airSlate SignNow when handling sensitive tax information?

airSlate SignNow employs state-of-the-art security measures to protect sensitive tax information, including the IRS capital loss carryover worksheet 2018. Our platform is compliant with industry standards, ensuring that your personal and financial documents are secure during the entire signing process.

Get more for Schedule D Form 1040 Capital Gains And Losses

Find out other Schedule D Form 1040 Capital Gains And Losses

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free