Schedule D Form 2012

What is the Schedule D Form

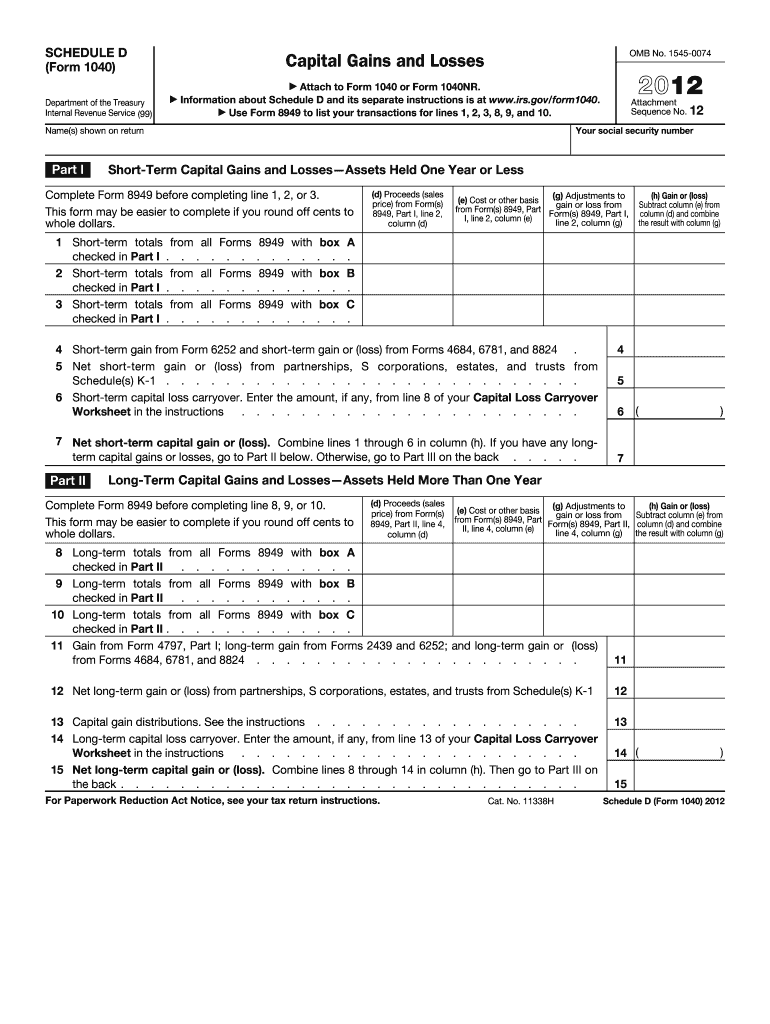

The Schedule D Form is a tax document used by individuals and businesses in the United States to report capital gains and losses from the sale of assets. This form is essential for accurately calculating the tax owed on these transactions, as it helps taxpayers detail their investment activities throughout the year. By reporting gains and losses, taxpayers can determine their overall tax liability and ensure compliance with Internal Revenue Service (IRS) regulations.

How to use the Schedule D Form

Using the Schedule D Form involves several steps to ensure accurate reporting of capital gains and losses. Taxpayers should begin by gathering all relevant documentation, including records of asset purchases, sales, and any associated costs. The form requires detailed information about each transaction, including dates, amounts, and the nature of the assets. After filling out the form, it must be attached to the taxpayer's main tax return, typically Form 1040, before submission to the IRS.

Steps to complete the Schedule D Form

Completing the Schedule D Form involves a systematic approach to ensure accuracy. Follow these steps:

- Gather all necessary documentation related to asset transactions.

- Identify short-term and long-term capital gains and losses.

- Fill out the form by entering transaction details, including dates and amounts.

- Calculate total gains and losses, ensuring to differentiate between short-term and long-term.

- Transfer the net gain or loss to the appropriate section of your tax return.

Legal use of the Schedule D Form

The Schedule D Form is legally binding when completed accurately and submitted in compliance with IRS regulations. Taxpayers must ensure that all provided information is truthful and reflects their actual financial activities. Failing to report capital gains or losses can lead to penalties, including fines or additional taxes owed. It is crucial to keep records of all transactions for at least three years, as the IRS may request documentation to verify the information reported on the form.

Filing Deadlines / Important Dates

Timely filing of the Schedule D Form is essential to avoid penalties. The deadline for submitting the form typically aligns with the annual tax return due date, which is usually April 15 for most taxpayers. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file but do not extend the time to pay any taxes owed.

Examples of using the Schedule D Form

Examples of using the Schedule D Form include reporting gains from the sale of stocks, bonds, real estate, or other investments. For instance, if a taxpayer sells shares of stock for a profit, they must report this gain on Schedule D, detailing the purchase and sale dates, amounts, and any associated costs. Conversely, if an asset is sold at a loss, this information must also be reported, as it can offset gains and reduce overall tax liability.

Quick guide on how to complete schedule d 2012 form

Effortlessly Prepare Schedule D Form on Any Device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly and efficiently. Manage Schedule D Form on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

The easiest way to modify and eSign Schedule D Form effortlessly

- Find Schedule D Form and click on Get Form to begin.

- Utilize the tools available to finalize your form.

- Emphasize key sections of your documents or redact sensitive information with specialized tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether through email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, the hassle of searching for forms, or mistakes that necessitate reprinting document copies. airSlate SignNow meets your document administration needs in just a few clicks from any device. Modify and eSign Schedule D Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule d 2012 form

Create this form in 5 minutes!

How to create an eSignature for the schedule d 2012 form

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a Schedule D Form and why is it important?

The Schedule D Form is a tax document used by taxpayers to report capital gains and losses on their income tax returns. It is important as it helps ensure that you accurately report your investment income, which can affect your overall tax liability. By using the Schedule D Form, you can keep your finances in order and potentially reduce your tax burden.

-

How can airSlate SignNow help with completing a Schedule D Form?

airSlate SignNow offers an intuitive platform that allows users to easily eSign and send documents, including the Schedule D Form. With customizable templates and workflow automation, you can streamline the process of preparing your tax documents. This saves you time and ensures that your Schedule D Form is filled out correctly and efficiently.

-

Is airSlate SignNow cost-effective for managing a Schedule D Form?

Yes, airSlate SignNow provides a cost-effective solution for managing all types of documents, including the Schedule D Form. With flexible pricing plans, you can choose the option that best fits your needs without compromising on features. This makes it an ideal choice for both individuals and businesses looking to manage tax documents economically.

-

Can I integrate airSlate SignNow with my current tax software for the Schedule D Form?

Absolutely! airSlate SignNow offers integrations with various tax software, allowing you to incorporate eSigning features directly into your workflow for the Schedule D Form. This seamless integration enhances productivity and ensures that your documents are handled efficiently from preparation to submission.

-

What features does airSlate SignNow offer for handling documents like Schedule D Form?

airSlate SignNow includes various features designed to simplify document management, including eSigning, document tracking, and customizable templates. These features make it easy to prepare and send your Schedule D Form, ensuring all parties have a smooth experience. Additionally, you will have access to audit trails for enhanced accountability.

-

How secure is my data when using airSlate SignNow for the Schedule D Form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your sensitive information, including that in your Schedule D Form. You can trust that your data is safe throughout the signing process, ensuring compliance with legal standards.

-

Does airSlate SignNow support mobile access for the Schedule D Form?

Yes, airSlate SignNow provides mobile access, enabling you to manage your Schedule D Form on-the-go. Whether you need to eSign or send documents, the mobile app allows for efficient document handling from anywhere. This flexibility supports busy professionals in meeting tax deadlines without being tied to a desk.

Get more for Schedule D Form

- Parking facility credict card authorization form

- Palm beach county school district employee application form

- Trip request form

- Use of facilities agreement pasco county schools form

- Rce field trip request form with lunch info roseland school

- Mis form 162

- State of florida post deductible hra verification form

- Documentation of expenditures broward k12 fl form

Find out other Schedule D Form

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile