Schedule D Form 2016

What is the Schedule D Form

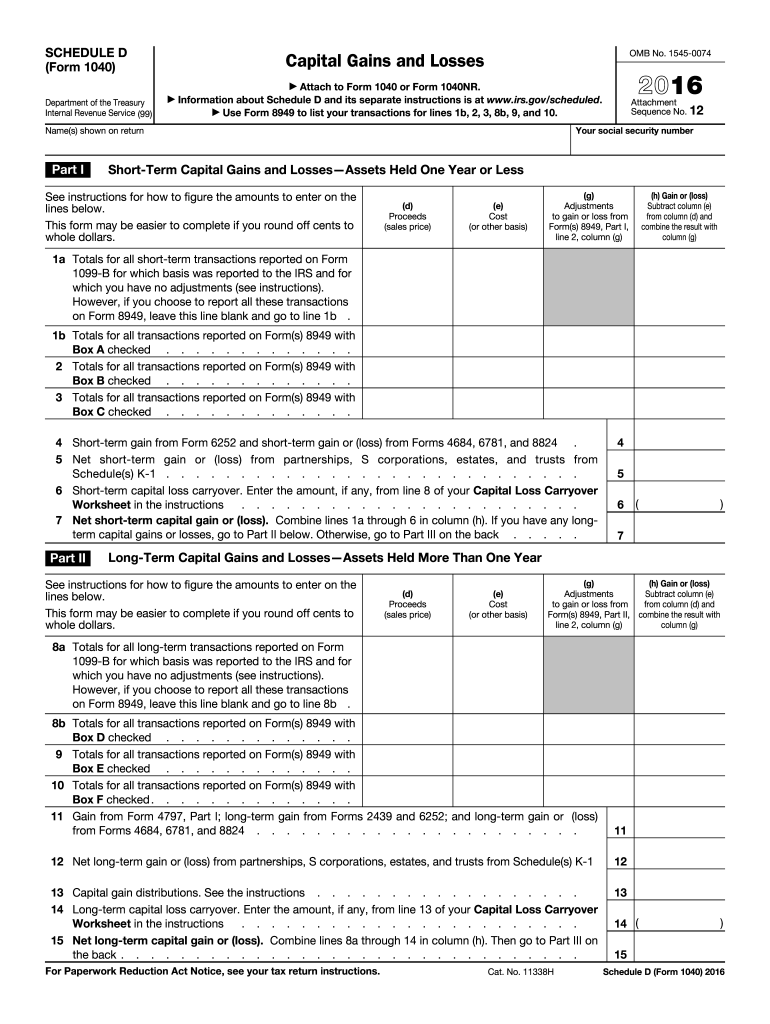

The Schedule D Form is a tax form used by individuals and businesses in the United States to report capital gains and losses from the sale of securities and other assets. It is an essential component of the federal income tax return, specifically for those who need to detail their investment transactions. This form helps taxpayers calculate their overall capital gain or loss, which is crucial for determining their tax liability. Understanding the Schedule D Form is vital for anyone involved in buying or selling investments, as it directly impacts their financial reporting and tax obligations.

How to use the Schedule D Form

Using the Schedule D Form involves several steps to ensure accurate reporting of capital gains and losses. Taxpayers must first gather all relevant documentation, including records of asset purchases and sales. The next step is to categorize each transaction as either a short-term or long-term capital gain or loss, depending on the holding period of the asset. After categorization, taxpayers will report the totals on the Schedule D Form, which then flows into their main tax return. It is important to follow IRS guidelines closely to avoid errors that could lead to penalties.

Steps to complete the Schedule D Form

Completing the Schedule D Form requires careful attention to detail. Here are the key steps:

- Gather all transaction records, including purchase and sale dates, amounts, and costs associated with each asset.

- Determine whether each transaction is a short-term or long-term capital gain or loss based on the holding period.

- Calculate total short-term and long-term gains and losses separately.

- Transfer the totals to the appropriate sections of the Schedule D Form.

- Include any carryover losses from previous years, if applicable.

- Review the completed form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D Form, which are crucial for compliance. Taxpayers should refer to the IRS instructions for the Schedule D Form, which outline how to report various types of transactions, including sales of stocks, bonds, and real estate. These guidelines also explain how to calculate capital gains and losses, including adjustments for various factors such as depreciation and improvements. Staying informed about these guidelines helps ensure that taxpayers meet their reporting obligations accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form align with the overall tax return deadlines. Typically, individual taxpayers must file their federal income tax returns, including the Schedule D Form, by April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, allowing them to file by October 15. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Schedule D Form accurately, taxpayers need several key documents. These include:

- Brokerage statements detailing all transactions, including dates, amounts, and types of securities sold.

- Records of purchase prices and any associated costs, such as commissions or fees.

- Documents related to any previous capital losses that may be carried over to the current tax year.

- Any relevant tax forms that may provide additional information, such as Form 8949 for reporting sales and exchanges of capital assets.

Quick guide on how to complete schedule d 2016 form

Complete Schedule D Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without interruptions. Manage Schedule D Form on any device with airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The simplest method to modify and eSign Schedule D Form effortlessly

- Obtain Schedule D Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious searches for forms, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Schedule D Form and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule d 2016 form

Create this form in 5 minutes!

How to create an eSignature for the schedule d 2016 form

How to create an eSignature for your Schedule D 2016 Form online

How to make an eSignature for the Schedule D 2016 Form in Google Chrome

How to create an electronic signature for signing the Schedule D 2016 Form in Gmail

How to generate an electronic signature for the Schedule D 2016 Form right from your mobile device

How to make an electronic signature for the Schedule D 2016 Form on iOS

How to generate an electronic signature for the Schedule D 2016 Form on Android devices

People also ask

-

What is the Schedule D Form used for?

The Schedule D Form is used to report capital gains and losses from the sale of securities and other assets. By accurately completing the Schedule D Form, taxpayers can determine their tax liability from these transactions. It's essential for anyone involved in trading or investing to understand how to fill out this form correctly.

-

How does airSlate SignNow help with the Schedule D Form?

airSlate SignNow provides an efficient platform for electronically signing and sending your Schedule D Form. Our solution simplifies the eSignature process, ensuring that you can securely sign and share your tax documents without any hassle. This streamlines your tax filing process, allowing you to focus on what matters most.

-

Is there a cost associated with using airSlate SignNow for the Schedule D Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions include features specifically designed for managing documents, such as the Schedule D Form. Explore our pricing options to find the best fit for your requirements.

-

Can I integrate airSlate SignNow with other software for my Schedule D Form?

Absolutely! airSlate SignNow integrates seamlessly with numerous other software applications that can help you manage your Schedule D Form more effectively. By connecting it with your accounting or tax software, you can streamline your workflow and enhance productivity.

-

What features does airSlate SignNow offer for managing the Schedule D Form?

airSlate SignNow offers a range of features for managing your Schedule D Form, including eSignatures, document templates, and secure cloud storage. These features ensure that you can easily create, sign, and store your tax documents while maintaining compliance and security.

-

How secure is airSlate SignNow when handling the Schedule D Form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the Schedule D Form. We utilize advanced encryption technologies and compliance with industry standards to protect your data, ensuring that your information remains secure throughout the signing process.

-

Can I track the status of my Schedule D Form using airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Schedule D Form in real-time. You can easily see when the document has been viewed, signed, or completed, providing you with complete visibility and control over your tax documents.

Get more for Schedule D Form

- Nfirs 50 field data collection form

- Grape crush and purchase inquiry form

- Ottawa county dob license by mailxls georgetown mi form

- Ielts form

- Hacienda fillable forms 2010

- Rule 4a 100 domestic relations forms instructions and

- Subject declaration form teaching council

- Citizens charter pag ibig fund form

Find out other Schedule D Form

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template