Form 1040 Schedule D Capital Gains and Losses Irs 1997

What is the Form 1040 Schedule D Capital Gains And Losses Irs

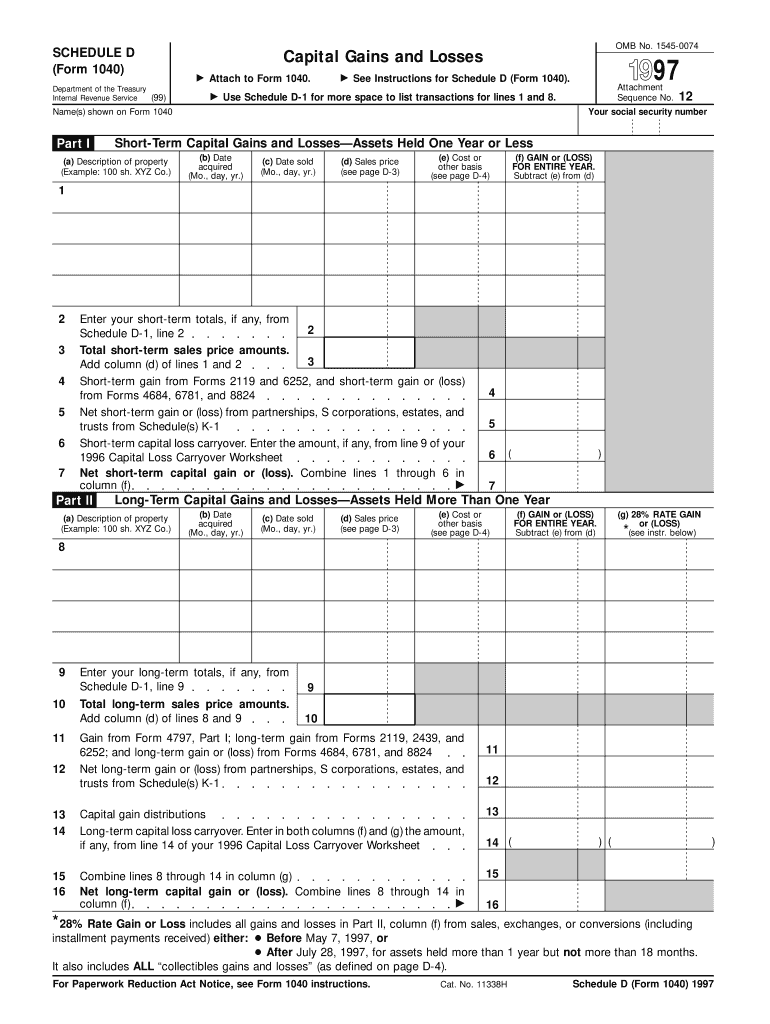

The Form 1040 Schedule D is a crucial document used by U.S. taxpayers to report capital gains and losses from the sale of assets. This form is essential for individuals who have sold stocks, bonds, or real estate, as it helps determine the tax implications of these transactions. The IRS requires taxpayers to detail their capital gains and losses to ensure accurate tax reporting and compliance with federal tax laws.

How to use the Form 1040 Schedule D Capital Gains And Losses Irs

Using the Form 1040 Schedule D involves several steps. Taxpayers must first gather information about their capital transactions, including the purchase price, sale price, and any associated costs. Once this information is compiled, it can be entered into the appropriate sections of the form. The Schedule D allows taxpayers to calculate their total capital gains or losses, which will then be transferred to their main Form 1040 for tax computation.

Steps to complete the Form 1040 Schedule D Capital Gains And Losses Irs

Completing the Form 1040 Schedule D requires careful attention to detail. Here are the steps involved:

- Gather all necessary documents related to asset sales, including purchase and sale records.

- Determine the holding period of each asset to classify gains or losses as short-term or long-term.

- Fill out Part I for short-term capital gains and losses, listing each transaction with its details.

- Complete Part II for long-term capital gains and losses, following the same process.

- Calculate the totals for both short-term and long-term sections.

- Transfer the net capital gain or loss to your Form 1040.

Key elements of the Form 1040 Schedule D Capital Gains And Losses Irs

Several key elements are essential when filling out the Form 1040 Schedule D. These include:

- Transaction details: This includes the date of acquisition, date of sale, and the amounts involved.

- Holding period: Understanding whether the asset was held short-term or long-term is critical for tax rates.

- Net gain or loss: Calculating the total capital gain or loss is necessary for accurate tax reporting.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 Schedule D. Taxpayers should refer to the IRS instructions to ensure compliance with current tax laws. These guidelines cover aspects such as what qualifies as a capital asset, how to report various types of transactions, and the implications of capital gains tax rates. Staying informed about these guidelines helps taxpayers avoid mistakes that could lead to penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule D align with the annual tax return deadlines. Typically, individual taxpayers must submit their returns by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may shift. It is important for taxpayers to stay aware of these dates to ensure timely filing and avoid late fees.

Quick guide on how to complete 1997 form 1040 schedule d capital gains and losses irs

Generate Form 1040 Schedule D Capital Gains And Losses Irs effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form 1040 Schedule D Capital Gains And Losses Irs on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 1040 Schedule D Capital Gains And Losses Irs with ease

- Obtain Form 1040 Schedule D Capital Gains And Losses Irs and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Form 1040 Schedule D Capital Gains And Losses Irs and facilitate effective communication at any juncture of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1997 form 1040 schedule d capital gains and losses irs

Create this form in 5 minutes!

How to create an eSignature for the 1997 form 1040 schedule d capital gains and losses irs

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is Form 1040 Schedule D Capital Gains And Losses IRS?

Form 1040 Schedule D Capital Gains And Losses IRS is a tax form used by individuals to report capital gains and losses from the sale of assets. This form helps taxpayers calculate their overall capital gains or losses, which is crucial for determining tax liability. Accurate completion of this form ensures compliance with IRS regulations.

-

How can airSlate SignNow help with Form 1040 Schedule D Capital Gains And Losses IRS documentation?

airSlate SignNow simplifies the process of eSigning and sending important tax forms, including the Form 1040 Schedule D Capital Gains And Losses IRS. With our easy-to-use platform, users can securely sign and manage documents, reducing paperwork and streamlining tax submissions. This service enhances efficiency during tax season.

-

What features does airSlate SignNow offer for handling Form 1040 Schedule D Capital Gains And Losses IRS?

airSlate SignNow offers essential features such as customizable templates, secure eSigning, automated workflows, and document storage, all of which are beneficial for managing Form 1040 Schedule D Capital Gains And Losses IRS. These features provide users with a user-friendly experience in preparing and signing their tax documents. Additionally, the platform ensures compliance and security of sensitive tax information.

-

Is airSlate SignNow cost-effective for managing Form 1040 Schedule D Capital Gains And Losses IRS?

Yes, airSlate SignNow provides a cost-effective solution for managing Form 1040 Schedule D Capital Gains And Losses IRS. Our competitive pricing plans allow individuals and businesses to access essential eSignature services without breaking the bank. This affordability enables users to focus on their financial goals without worrying about high operational costs.

-

How can I integrate airSlate SignNow with other applications for my Form 1040 Schedule D Capital Gains And Losses IRS?

airSlate SignNow seamlessly integrates with a variety of applications, making it easy to manage Form 1040 Schedule D Capital Gains And Losses IRS alongside your other business tools. By integrating with platforms like Google Drive, Microsoft Office, and CRM systems, users can streamline their workflows and enhance document management efficiencies. These integrations simplify the preparatory steps for tax season.

-

Can airSlate SignNow help ensure compliance with IRS regulations for Form 1040 Schedule D Capital Gains And Losses?

Yes, airSlate SignNow is designed to help users ensure compliance with IRS regulations when handling Form 1040 Schedule D Capital Gains And Losses IRS. Our platform provides security features and audit trails that help maintain the integrity of signed documents, thus satisfying the requirements set forth by the IRS. This commitment to compliance promotes peace of mind for users during tax filing.

-

What are the benefits of using airSlate SignNow for Form 1040 Schedule D Capital Gains And Losses IRS?

Using airSlate SignNow for Form 1040 Schedule D Capital Gains And Losses IRS offers several benefits, including improved efficiency in document handling, reduced turnaround time for signatures, and enhanced security for sensitive information. These advantages not only streamline the tax preparation process but also alleviate the stress associated with managing capital gains and losses documentation.

Get more for Form 1040 Schedule D Capital Gains And Losses Irs

- Demolition contractor package idaho form

- Security contractor package idaho form

- Insulation contractor package idaho form

- Paving contractor package idaho form

- Site work contractor package idaho form

- Siding contractor package idaho form

- Refrigeration contractor package idaho form

- Idaho drainage 497305843 form

Find out other Form 1040 Schedule D Capital Gains And Losses Irs

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT