Form CT 1040ES Form CT 1040ES 2022

What is the CT 1040ES?

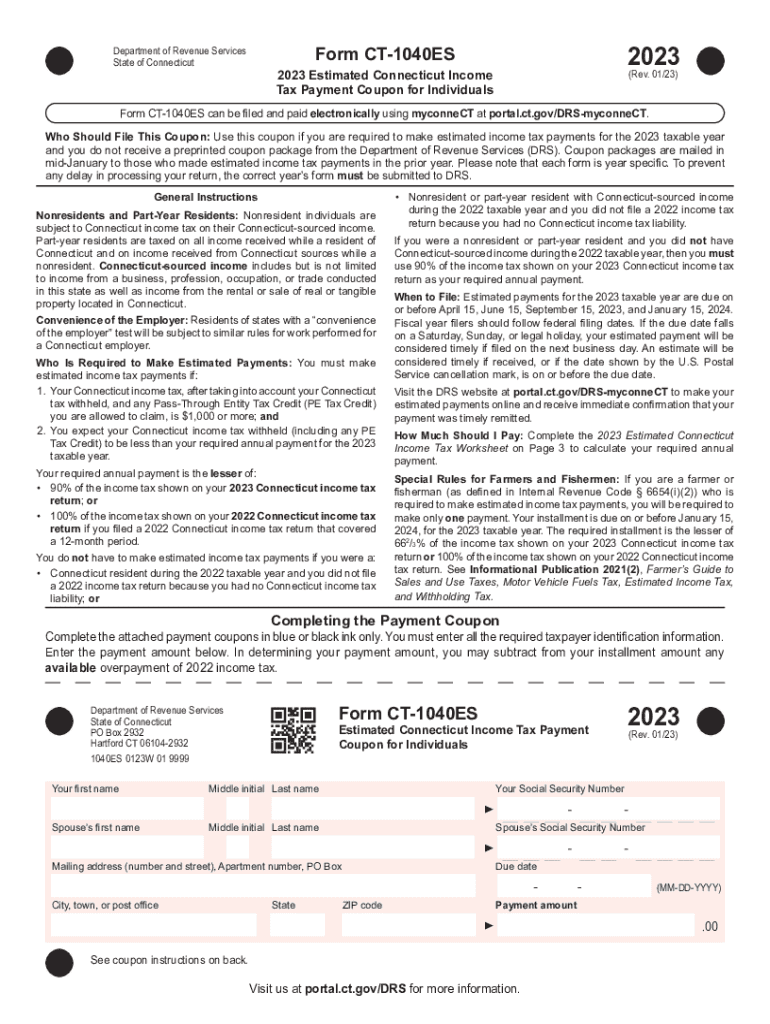

The CT 1040ES is the estimated income tax payment form for residents of Connecticut. This form is specifically designed for individuals who expect to owe income tax of $1,000 or more when they file their annual tax return. By submitting the CT 1040ES, taxpayers can make quarterly estimated payments to the state, helping to manage their tax liabilities throughout the year. This proactive approach can prevent underpayment penalties and ensure that individuals stay compliant with Connecticut tax regulations.

Steps to Complete the CT 1040ES

Completing the CT 1040ES involves several straightforward steps:

- Gather your financial information, including income sources and deductions.

- Estimate your total income for the year to determine your expected tax liability.

- Calculate your estimated tax payments, which are typically due in four installments.

- Fill out the CT 1040ES form with your estimated payment amounts for each quarter.

- Review the form for accuracy before submission.

Each payment should be made by the due dates specified by the Connecticut Department of Revenue Services to avoid penalties.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the CT 1040ES to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should ensure that payments are made by these dates to remain compliant with state tax laws.

How to Obtain the CT 1040ES

The CT 1040ES form can be obtained through the Connecticut Department of Revenue Services website. Taxpayers can download a printable version of the form or access it through digital tax preparation software that supports Connecticut tax forms. Additionally, physical copies may be available at local tax offices or public libraries.

Key Elements of the CT 1040ES

The CT 1040ES includes several key elements that taxpayers need to complete:

- Your name, address, and Social Security number

- Estimated income for the year

- Calculated estimated tax liability

- Payment amounts for each quarter

Accurate completion of these elements ensures that your estimated payments are correctly processed and credited to your account.

Penalties for Non-Compliance

Failing to submit the CT 1040ES or underpaying estimated taxes can result in penalties. Connecticut imposes a penalty for underpayment if the total estimated tax owed is not paid by the due dates. Taxpayers may also face interest charges on any unpaid tax amounts. It is crucial to calculate estimated payments accurately and submit them on time to avoid these financial repercussions.

Quick guide on how to complete form ct 1040es form ct 1040es

Easily Prepare Form CT 1040ES Form CT 1040ES on Any Device

The management of online documents has become increasingly favored among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents since you can easily find the right template and securely archive it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Form CT 1040ES Form CT 1040ES from any device using the airSlate SignNow apps available for Android or iOS and streamline any paperwork process today.

Steps to Edit and Electronically Sign Form CT 1040ES Form CT 1040ES Effortlessly

- Obtain Form CT 1040ES Form CT 1040ES and click Get Form to initiate the process.

- Utilize our provided tools to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the specific tools that airSlate SignNow offers.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from the device of your choice. Modify and electronically sign Form CT 1040ES Form CT 1040ES and ensure excellent communication throughout your form processing journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1040es form ct 1040es

Create this form in 5 minutes!

How to create an eSignature for the form ct 1040es form ct 1040es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing for handling ct income tax documents?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes that deal with ct income tax documents. Our plans include features tailored for document signing, storage, and compliance, ensuring you get the best value for your investment. You can choose a plan that fits your needs, whether you're a small business or a larger enterprise.

-

How does airSlate SignNow simplify the eSigning process for ct income tax forms?

AirSlate SignNow streamlines the eSigning process for ct income tax forms by providing an intuitive interface that allows users to send, sign, and manage documents seamlessly. Our solution ensures that the signing process is quick and compliant with legal standards, which is essential for ct income tax documentation. You can also automate reminders to keep everything on track.

-

What features does airSlate SignNow offer specifically for ct income tax compliance?

To meet ct income tax compliance, airSlate SignNow offers features such as secure storage, audit trails, and advanced encryption. These tools help ensure that all your documents are legally binding and secure, maintaining the integrity of sensitive tax information. Our platform also enables easy access to archived documents when needed.

-

Can I integrate airSlate SignNow with other accounting tools for ct income tax preparation?

Absolutely! airSlate SignNow can integrate with a variety of accounting and tax preparation tools to facilitate your ct income tax preparation. This integration ensures seamless data flow and helps reduce manual entry errors, making the entire process more efficient and accurate for your business.

-

Is airSlate SignNow suitable for individual taxpayers handling ct income tax?

Yes, airSlate SignNow is an ideal solution for individual taxpayers managing their ct income tax forms. With our easy-to-use interface, individuals can send and eSign necessary documents quickly while ensuring the security of their personal information. Whether you are a freelancer or a professional, our platform simplifies the tax filing process.

-

How secure is airSlate SignNow for handling sensitive ct income tax information?

AirSlate SignNow prioritizes security and employs industry-leading encryption methods to protect sensitive ct income tax information. Our platform complies with legal regulations ensuring that all data is handled with the highest standards of security. With our audit trails and secure access features, you can be confident that your documents are safe.

-

What benefits does airSlate SignNow provide for businesses dealing with ct income tax?

For businesses dealing with ct income tax, airSlate SignNow offers numerous benefits, including time savings, cost-effectiveness, and enhanced document management. By digitizing the signing process, businesses can reduce paperwork and streamline communication. Furthermore, electronic signatures improve the turnaround time for document approvals.

Get more for Form CT 1040ES Form CT 1040ES

- A raisin in the sun act 1 scene 1 pdf form

- Demande de slection permanente catgorie du regroupement form

- Form rml 001 incidentaccident report

- Rcmp grc 2180e vision examination of applicant rcmp grc gc form

- Emergency supplies checklist be prepared form

- Vision form claimsecure

- Commercial proforma 1 invoice number and date 2 dpd

- Citi announces agreement to sell its consumer form

Find out other Form CT 1040ES Form CT 1040ES

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy